Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 19, 2015

Investors flee emerging markets

The Chinese slowdown and commodities slump has seen investors flee equity and fixed income ETFs at the fastest pace in 18 months.

- Emerging market combined PMI data indicate stagnating growth

- Emerging market ETFs have seen $3.7bn of outflows so far this quarter

- Bond emerging market ETFs on track for their worst ever quarterly outflow

The surging dollar and weakening commodities prices have combined to put pressure on emerging market economies which are dependent on natural resources. Compounding these strains, net importers of natural resources such as China have been hit with slowing growth; adding to commodities' sinking prices.

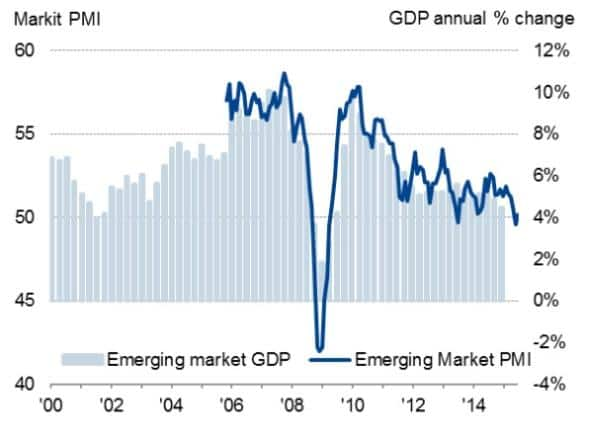

These forces have combined to see the June Markit Emerging Market PMI sink into negative territory for the first time in two years. The July reading rebounded somewhat to 50.2, but the index is still indicating that emerging market GDP grew at a pace of around 4% in the last few months. This growth indicates the weakest pace of expansion since the financial crisis.

This slowing growth has also been reflected in equity prices as the MSCI Emerging Market index slumped to a four year low in recent weeks. This has led to an exodus out of emerging market ETFs.

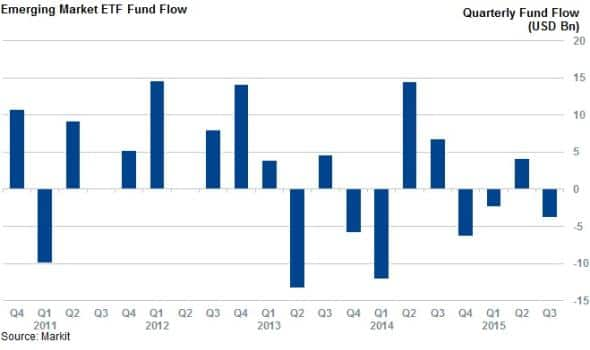

ETFs see outflows

So far this quarter, investors have pulled over $3.7bn out of the 229 emerging market and Bric exposed ETFs. While investors have been largely avoiding emerging markets in the last 12 months, the outflows seen so far this quarter are on track to mark the worst quarter for the asset class since Q4 2014.

The two largest products, the Vanguard FTSE Emerging Market ETF and the iShares MSCI Emerging Market ETF, which manage two thirds of total $120bn of emerging market ETF assets, have led the trend with a combined outflow of $2.6bn.

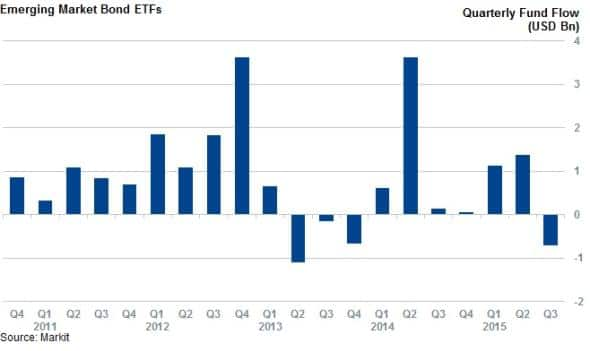

Bond funds also under pressure

The outflows haven't been limited to equity products as the 45 emerging market bond ETFs have seen $ 718m of outflows so far this quarter. If outflows continue at this pace, the asset class will experience its worst outflow period on record. The fund driving this trend has been the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) which has seen $628m of outflows.

Investors had been eagerly adding to their emerging market bond exposure in the last couple of years, as demonstrated by the seven consecutive quarterly inflows seen since Q1 2014. But it appears that the prospects of a US rate rise and the subsequent impact on emerging markets is causing investors to turn away from the asset class.

Investors are now requiring 300bps of extra yield over US treasuries to hold emerging market government bonds, up from a recent low of 250bps in May according to the Markit iBoxx Emerging Market Sovereign index. This means that the EMB ETF has underperformed the wider treasury index that tracked by the iShares U.S. Treasury Bond ETF by 2.7% in over that period.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-Equities-Investors-flee-emerging-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-Equities-Investors-flee-emerging-markets.html&text=Investors+flee+emerging+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-Equities-Investors-flee-emerging-markets.html","enabled":true},{"name":"email","url":"?subject=Investors flee emerging markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-Equities-Investors-flee-emerging-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+flee+emerging+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-Equities-Investors-flee-emerging-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}