Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 19, 2016

European hybrid bonds continue to underperform

Idiosyncratic risk in the European corporate hybrid bond sector has seen new issuance stall and credit spreads rise.

- European Hybrid bonds have underperformed their senior counterparts over the last year

- Idiosyncratic risk has been key driver, with Volkswagen and Total seeing spreads widen

- Markit iBoxx EUR Liquid High Yield Index yields just 20bps more than the Markit iBoxx " Non-Financials Subordinated index

The past year has been a testing time for the European hybrid corporate bond* market. New issuance has stalled and bond spreads have widened as market volatility has put investors in a risk-off mode. Even as the market outlook has brightened over the past couple of months, hybrids have continued to underperform their senior European corporate counterparts.

Hybrid on the rails

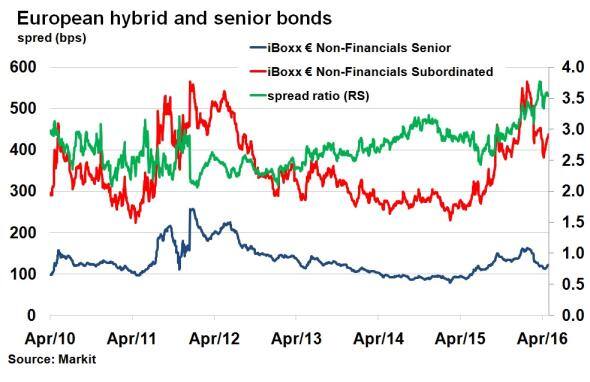

This underperformance marks a contrast to the start of 2015, when hybrids saw a resurgence in issuance as major European corporations exploited low interest rates. Risk in the sector tumbled, with the Markit iBoxx " Non-Financials Subordinated index seeing its spread (interest premium over German bunds) fall to 236bps as of last March. Since then, spreads have widened significantly, hitting 565bps in mid-February; the same level seen during the heights of the European sovereign debt crisis in 2011. Spreads have since come down to 437bps as of May 17th.

The spread ratio of the Markit iBoxx " Non-Financials Subordinated index and the iBoxx " Non-Financials Subordinated index has risen sharply since mid-last year, highlighting the underperformance of the hybrid market on a spread basis in comparison to senior corporate bond counterparts. The spread ratio is currently 3.55, a near six year high, from as low as 2.49 last July. Interestingly, even as market volatility has subdued and issuance in the senior European bond market has picked up over the past two months, the spread ratio has continued to remain at elevated levels.

Idiosyncratic drivers

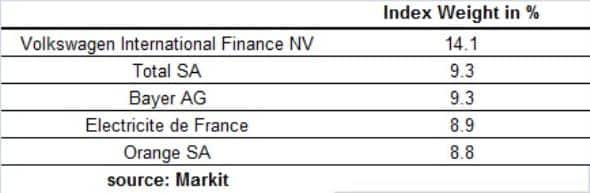

A closer look at the hybrid issuers presents a clearer picture, with idiosyncratic risks one of the main drivers of underperformance over the past year.

Over 14% of the Markit iBoxx " Non-Financials Subordinated index is composed of hybrid bonds issued by Volkswagen, the largest issuer in the index by weight. The German car maker saw its bond spreads flare up on the back of an emissions scandal last September, as the company faced drawn out litigation charges and reputational damage. French oil group Total, the next largest issuer of hybrids by weight, has struggled to deal with deteriorating oil and gas prices over the past year, forcing the company to restructure parts of its business. Its hybrid bonds currently trade at just under 400bps over German bunds.

Hybrids and high yield

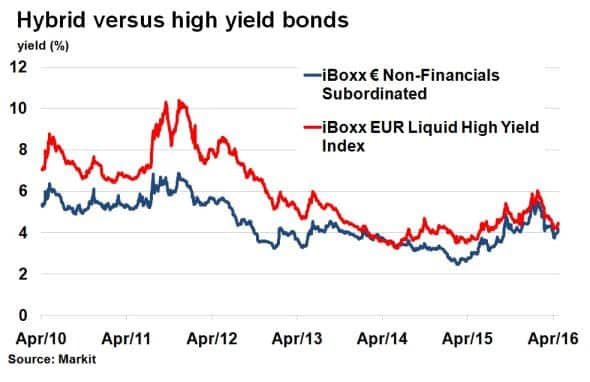

The underperformance of certain hybrid bonds has seen average yields rise in the asset class. This has seen the relationship between European high yield and hybrid bonds converge. The Markit iBoxx EUR Liquid High Yield Index now yields just 20bps more than the Markit iBoxx " Non-Financials Subordinated index, despite being of speculative grade quality.

*Hybrid corporate bonds are usually fixed coupon, perpetual in nature, and with pre-determined call dates. They are essentially an equal mix of debt and equity and rank ahead of common equity in the event of a default, but are subordinated to senior debt. From an issuer stand point, they provide extra capital protection due to their half equity structure while still maintaining debt status under tax rules.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-Credit-European-hy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-Credit-European-hy.html&text=European+hybrid+bonds+continue+to+underperform","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-Credit-European-hy.html","enabled":true},{"name":"email","url":"?subject=European hybrid bonds continue to underperform&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-Credit-European-hy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+hybrid+bonds+continue+to+underperform http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-Credit-European-hy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}