Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 18, 2015

US flash PMIs show economic growth rate faltering at year end

The first US interest rate hike for almost a decade comes in a month during which the pace of economic growth showed signs of faltering, as highlighted by the rate of expansion in output one of the weakest seen over the past three years.

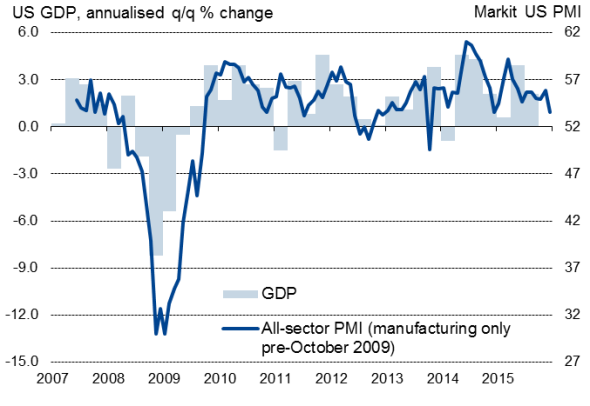

Markit's Flash Purchasing Managers' Index" (PMI") showed growth of the combined manufacturing and service sectors slowing sharply at the end of the year. With the exception of government shutdown in October 2013, the survey signalled the smallest monthly increase in business activity since December 2012.

The survey data are consistent with gross domestic product rising at an annualised rate of 1.8% in the fourth quarter. That's down only slightly from the 2.1% pace observed in the third quarter, but the survey shows a more severe slowing towards the end of the fourth quarter, with an annualised GDP growth rate of just 1.4% indicated for December alone.

Markit PMI and US GDP

Broad-based slowdown

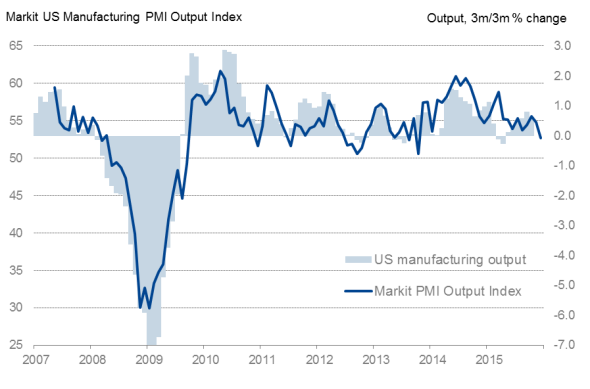

Manufacturing saw the weaker rate of expansion of the two sectors, with production growth slowing markedly to the weakest for over two years and signalling a near-stalling in the comparable official data series. Factories battled against headwinds of the strong dollar, weak demand in many overseas markets and reduced capex in the energy sector.

Manufacturing output

However, December also saw a steep downturn in service sector growth, which had so far been holding up far better than in manufacturing but registered the weakest rise for a year. As with last December, some companies again reported adverse weather conditions to have affected business. However, weather appears to have played less of a role in the slowdown this year, with businesses such as transport, accounting, financial services and consulting citing reduced demand for many services from the goods-producing sector, as well as signs of some increased reluctance to spend among consumers.

Activity growth weakened in response to a downturn in order book growth. Inflows of new orders to the two sectors showed one of the smallest increases seen this side of the global financial crisis, slowing sharply in services and almost stalling in manufacturing.

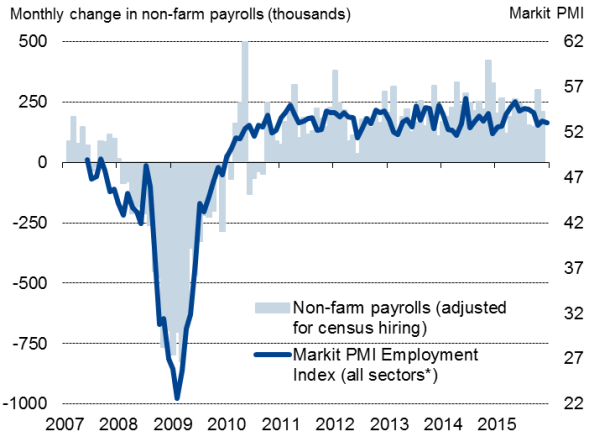

Hiring trend remains firm

Hiring remained encouragingly resilient in the face of the weaker growth trend. Payrolls showed a rise of similar magnitude to November's increase. However, the trend eased further in December and points to a non-farm payroll increase of 170,000, below the average of 201,000 signalled in the preceding 11 months of the year (and below the official year-to-date average of 210,000.

Employment

However, with business expectations about the year ahead dropping in the service sector to the lowest since August 2010, the sustained growth of hiring may soon peter out unless demand revives.

Prices held flat

Input cost inflation fell to the lowest since February, linked mainly to lower oil and energy prices. Firms responded by often passing lower costs onto customers, leaving overall prices charged for goods and service barely rising during the month.

Slowdown points to shallow rate hike trajectory

The lack of inflationary pressures, slowing growth of output and demand and the drop in business confidence are all disappointing news for an economy which has seen monetary policy tightened for the first time since 2006. The Fed announced a quarter-point increase in its fund rate target range for the federal funds rate to 0.25-0.5%, with a further four quarter point hikes signalled for 2016. However, any further slowing in the pace of growth and ongoing low inflation adds to the likelihood of a less aggressive rate hike progression.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-economics-us-flash-pmis-show-economic-growth-rate-faltering-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-economics-us-flash-pmis-show-economic-growth-rate-faltering-at-year-end.html&text=US+flash+PMIs+show+economic+growth+rate+faltering+at+year+end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-economics-us-flash-pmis-show-economic-growth-rate-faltering-at-year-end.html","enabled":true},{"name":"email","url":"?subject=US flash PMIs show economic growth rate faltering at year end&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-economics-us-flash-pmis-show-economic-growth-rate-faltering-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMIs+show+economic+growth+rate+faltering+at+year+end http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-economics-us-flash-pmis-show-economic-growth-rate-faltering-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}