Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 18, 2014

The Mighty Greenback

The strengthening dollar has seen companies which historically underperform in a strong dollar environment lag behind their peers by almost 15% since the start of the year.

- Companies negatively exposed have underperformed their peers in ten of the last 11 months

- Companies which perform well in strong dollar times have seen the opposite and outperformed by 5%

- Foreign revenues reported in dollars impact companies like Coca-Cola and Russian internet search provider Yandex

The US alone has fuelled global markets with $3.7 trillion since the crisis. The initial intent was to avoid financial and economic collapse, but the inflows subsequently propped up American and even global economies.

Tighter fiscal policy in the US, and expansionary moves elsewhere, lead to an interesting shift in expectations of medium term currency trajectories. Certain sectors and companies are poised to benefit and suffer as the reality of continued dollar strength begins to take hold.

The Mighty Greenback

The USD is one of the best performing currencies year to date, and it has been reported that this may only be the beginning in terms of its growing strength.

Dollar strength, using the Dollar Index as a proxy, clearly gained momentum between May and July this year as the market geared up for the end of QE3. Hints at an end to QE3 were given on May 1st by the Federal Open Market Committee (FOMC) however officially only came to an end on 29th October 2014.

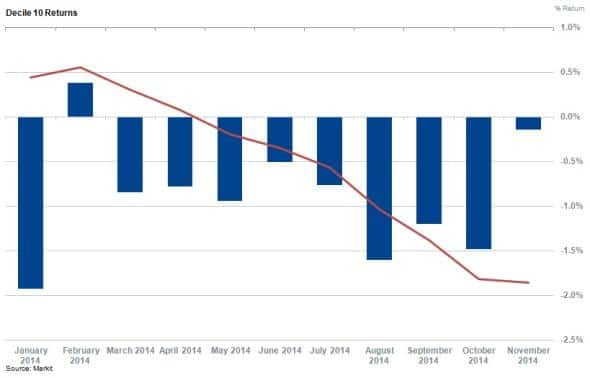

Analysing the Dollar Value Sensitivity factor* within the Markit Research Signals investment tool across a universe comprising 1,149 companies in the Markit US Large Cap universe, reveals a number of interesting data inferences. The tenth decile of companies with the most historical sensitivity to the dollar, has delivered negative relative returns in ten out of the past eleven months.

This underperformance cumulates to 9.7% year to date. Conversely, shares in the first decile which historically perform well have outperformed the rest of the largecap universe by 5.0%; making the return spread 15%.

The sectors that historically underperform in a dollar strengthening environment are basic materials, cyclical goods and services and energy companies, which dominate the constituents of the 10th decile.

Companies exposed to dollar movements

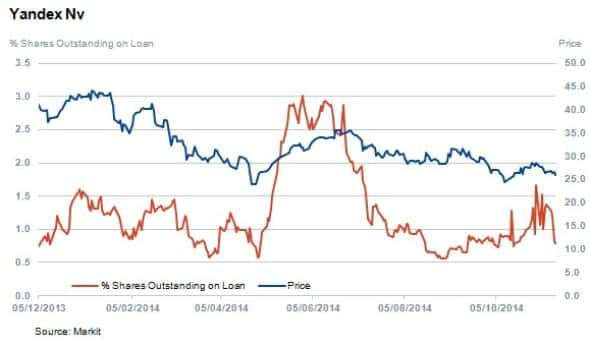

US based companies that specifically derive a large proportion of their earnings offshore are also in the top decile of companies. An example of such is New York listed but Netherlands based Russian internet search company Yandex.

Despite posting increased earnings for the past three quarters, analyst consensus for the fourth quarter earnings is 25% down. The company derives the majority of revenues from Russia, and as a result of dollar strength and rouble weakness the stock is down 39% year to date.

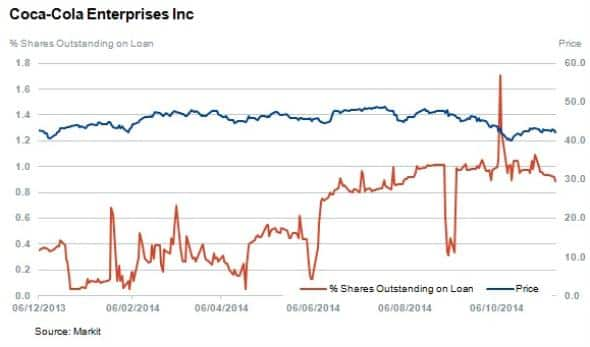

Another US based company that is exposed to dollar weakness due to the translation of significant foreign earnings is Coca-Cola. Short interest reached fifty-two week highs in October with 1.7% of shares outstanding on loan. The stock is down 4% year to date.

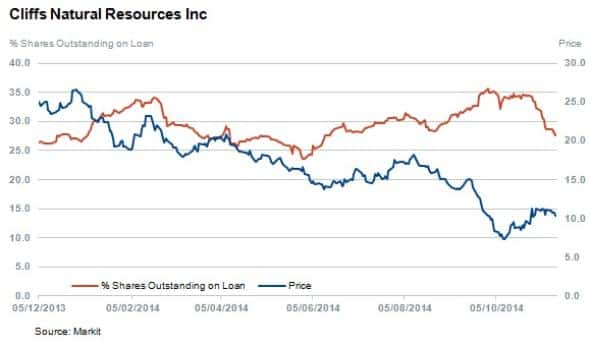

Other examples of negatively affected companies include energy exposed companies such as Franks international and Cliff Natural Resources, whose performances are inversely linked to the price of oil which has suffered in the recent dollar strength.

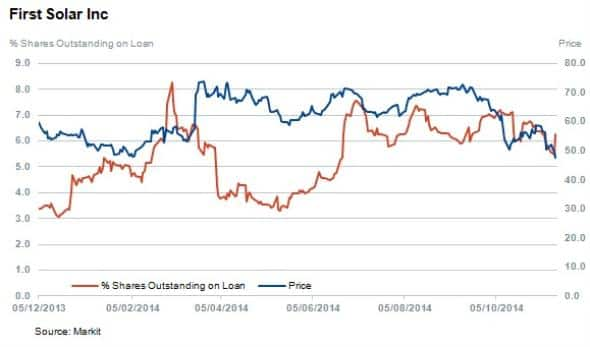

As energy prices have declined dramatically, substitute renewables are also positioned to face lower prices. Renewable energy play First Solar falls into the top decile of our sample and is down 12% year to date.

* The Markit US Dollar Value Sensitivity factor is defined as the beta coefficient to Change in US Dollar Value, which is estimated by a 60 month multiple regression of returns on several macroeconomic factors.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-equities-the-mighty-greenback.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-equities-the-mighty-greenback.html&text=The+Mighty+Greenback","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-equities-the-mighty-greenback.html","enabled":true},{"name":"email","url":"?subject=The Mighty Greenback&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-equities-the-mighty-greenback.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Mighty+Greenback http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-equities-the-mighty-greenback.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}