Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 18, 2015

Robust UK retail sales growth adds to rate hike pressure

Retail sales growth slowed in May after a sunshine-related burst of spending in April, but the underlying trend remains impressively strong and adds to the likelihood of interest rates rising later this year rather than being delayed until 2016.

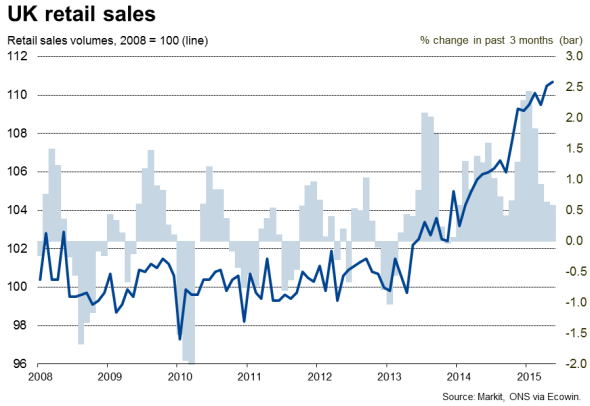

Measured on a rolling quarterly basis, sales have risen continually for over two years in what is now the longest period of sustained retail sales growth since comparable records began almost 20 years ago, notching up almost continual record highs (see chart). Add this to the fact that wage growth has picked up to a post-crisis high and unemployment is down to just 5.5%, the Bank of England is running out of arguments that it is appropriate for interest rates to remain at their all-time low of 0.5% for much longer.

The latest data showed retail sales rising a modest 0.2% in May, according to the Office for National Statistics. However, this weak expansion needs to be looked at alongside a 0.9% surge in April.

Sales over the second quarter so far are up 0.8% compared to the first quarter, adding to evidence that the economic upturn has picked up speed again after the disappointing performance indicated by GDP data in the opening quarter of the year (GDP rose 0.3% in the first quarter, albeit with revisions to construction output now pointing to a 0.4% increase).

Ongoing sales growth in the coming months is to be expected, given the buoyant fundamentals that should support spending.

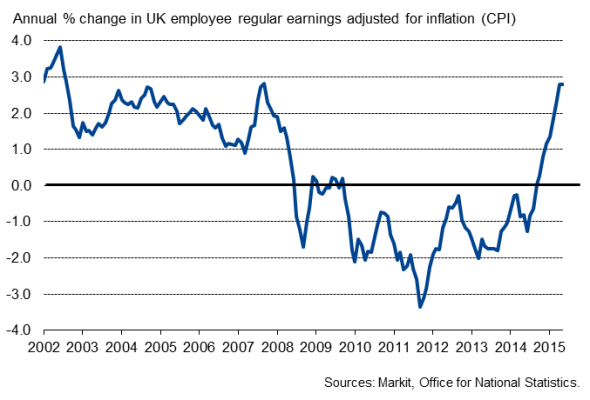

Sales are being boosted by a host of factors, including a buoyant labour market, record low borrowing costs and rising house prices, but also a combination of improved pay growth and low inflation. Wage growth has picked up to an annual rate of 2.7% while inflation remains near zero, meaning real pay growth - at 2.8% - is the highest since 2007 and a rate in fact not exceeded over the past decade.

Real wage growth (excluding bonuses)

Households' optimism about their finances in the year ahead is consequently running at an elevated level by post-recession standards, albeit down from post-crisis highs seen earlier in the year.

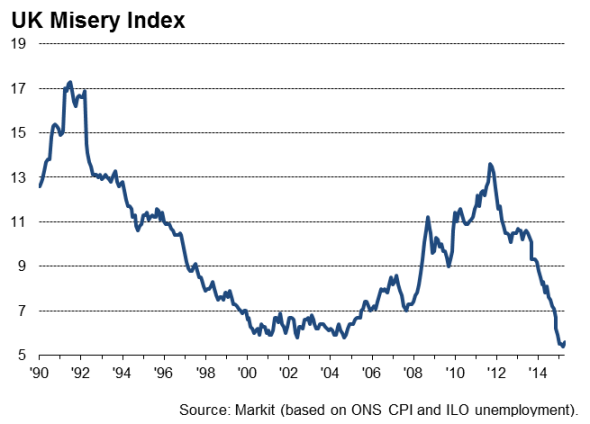

The so-called 'Misery Index', derived from unemployment and inflation data, meanwhile remains close to all-time lows.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-economics-robust-uk-retail-sales-growth-adds-to-rate-hike-pressure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-economics-robust-uk-retail-sales-growth-adds-to-rate-hike-pressure.html&text=Robust+UK+retail+sales+growth+adds+to+rate+hike+pressure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-economics-robust-uk-retail-sales-growth-adds-to-rate-hike-pressure.html","enabled":true},{"name":"email","url":"?subject=Robust UK retail sales growth adds to rate hike pressure&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-economics-robust-uk-retail-sales-growth-adds-to-rate-hike-pressure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Robust+UK+retail+sales+growth+adds+to+rate+hike+pressure http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-economics-robust-uk-retail-sales-growth-adds-to-rate-hike-pressure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}