Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 17, 2015

Crackdown in Macau spreads to Vegas

Dwindling takings from VIPs has seen gaming revenues in Macau continue to decline, propelling short interest to new highs.

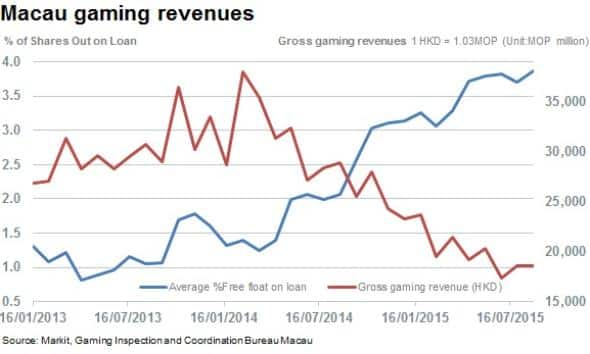

- Macau casinos' short interest has quadrupled in last year to 3.9% of free float

- Short sellers rewarded as the ten most shorted casinos saw their shares retreat by 44%

- Shorts now focusing on US operations with Wynn Resorts seeing a surge in shorting activity

Meagre takings in Macau

The former Portuguese colony and gambling mecca for Chinese punters recently announced that annualised GDP had declined by 26% in the second quarter, impacted heavily by declining profits in Macau casinos whose revenues fell by 40%.

Gambling revenue in the region peaked in late 2013 after many years of posting impressive growth. Since Chinese authorities undertook a corruption crackdown, high rolling VIPs have curtailed their spending, putting immense pressure of gaming revenues.

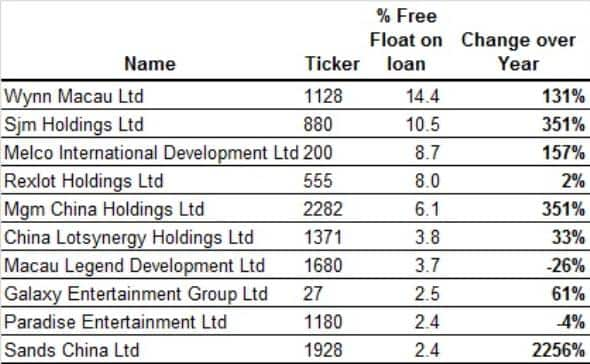

Short sellers have profited from betting against Macau casinos over the last 12 months with an average decline of 44% for the top ten most shorted year to date. Dividends have been cut and the average percentage of free float across the industry has continued to increase, rising to 3.9% currently.

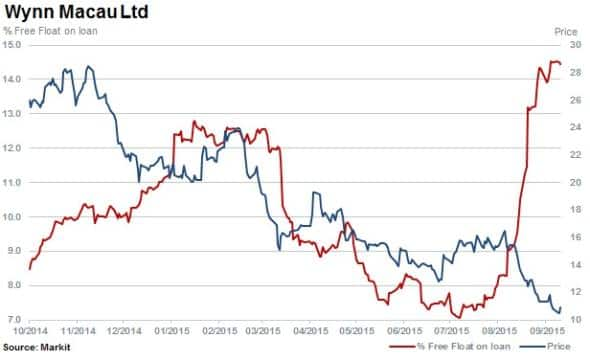

The most shorted casino in Macua by free float out on loan is Wynn Macau. Its short interest has risen 92% over three months to 14.4%. This has proved to be a canny move as its stock is down 56% over the last 12 months, to its lowest level in over five years.

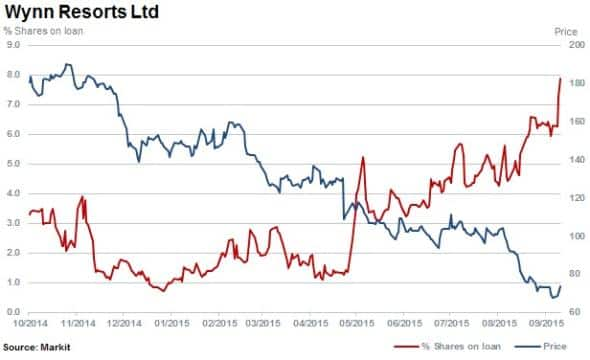

Shorts target Wynn Resorts

Shares outstanding on loan for US listed Wynn Resorts have risen almost fourfold in the last six months to 7.9%, while the stock has slid 43% (down 60% over 12 months).

Besides consensus earnings forecasts pointing to substantial reduction in revenues for Wynn, reports of a large loss in a Macua junket saw shares plummet in recent weeks. Further reports indicate that the loss may not be as large as initially reported, but such news will no doubt rattle investors and spur on short sellers.

The large potential losses faced by Wynn Macau and respectively Wynn Resorts highlights the often murky operating nature of the industry, especially the high end Chinese VIP market. The change in mood of the Chinese regulators has been the main catalyst spurring on short sellers in the last few months and the trend shows little signs of abating.

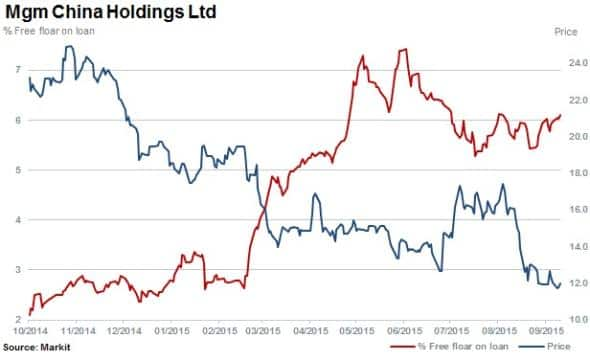

MGM China has seen free float on loan rise to 6.1% with shares are down 46% over the last 12 months. Similarly SJM Holdings has seen its stock fall 55% over the last 12 months as the free float out on loan has risen to 10.5%.

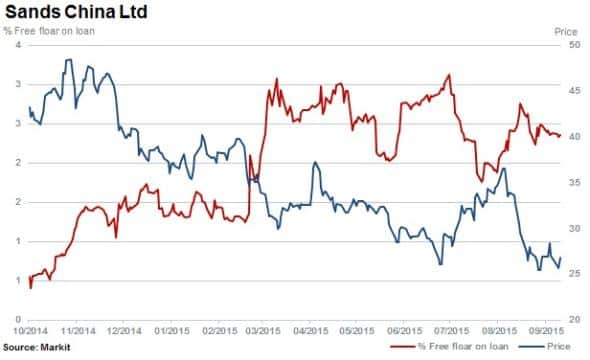

The largest operator in terms of size by market cap, Sands China, has not been immune to the trend as its shares have continued their fall over the last 12 months. Short interest now hovers in the 2.0 and 2.5% range, over four times the levels seen only 12 months ago.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Equities-Crackdown-in-Macau-spreads-to-Vegas.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Equities-Crackdown-in-Macau-spreads-to-Vegas.html&text=Crackdown+in+Macau+spreads+to+Vegas","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Equities-Crackdown-in-Macau-spreads-to-Vegas.html","enabled":true},{"name":"email","url":"?subject=Crackdown in Macau spreads to Vegas&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Equities-Crackdown-in-Macau-spreads-to-Vegas.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Crackdown+in+Macau+spreads+to+Vegas http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-Equities-Crackdown-in-Macau-spreads-to-Vegas.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}