Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 17, 2015

Risk on in credit markets as Draghi/Yellen bullish

With European parliaments set to approve Greece's bailout, a calmer credit market is allowing QE to retake centre stage as positive market sentiment returns.

- Greece's government bond due 2017 has seen its price stabilise this week

- Periphery European spreads tighten to two month lows; but still 30bps higher than March

- Risk on sentiment also in US; high yield ETFs seen biggest inflows since February

Risk on

On Wednesday night Greek prime minister Alexis Tsipras secured parliamentary backing to secure a third bailout worth up to €86bn. ECB president Mario Draghi yesterday sounded upbeat about Europe's prospects, while the ECB raised its ELA cap on Greek banks. But today the ball is in Germany's court, whose parliament will also vote on the bailout deal agreed with Greece. If all goes smoothly, this week could mark the biggest turn around in credit markets this year, as risk on sentiment moves to the forefront.

The price of Greece's 2-yr bond due 2017 has remained stable over the last four days at 67-69 (cash basis to par). This translates into yields hovering in the mid-20%, down from 57% seen on July 8th.

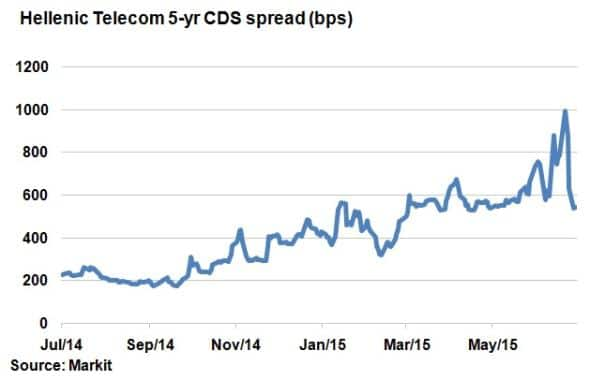

Hellenic Telecom, a corporate heavily linked to Greece's economic prospects, was the one of the best CDS improvers this week. Its 5-yr

CDS spread, which represents the cost of insuring against an underlying bond default, has tightened 329bps since last Friday's close; a 40 day low.

Periphery European sovereign bond spreads have also hit two month lows. Both Spain and Italy saw their 10-yr bond spread over German bonds close yesterday at 117bps. With Greece tensions easing, focus returns to the ECB's unprecedented QE programme once again. Spreads for Italy and Spain remain 30bps higher than that during the start of QE buying in March.

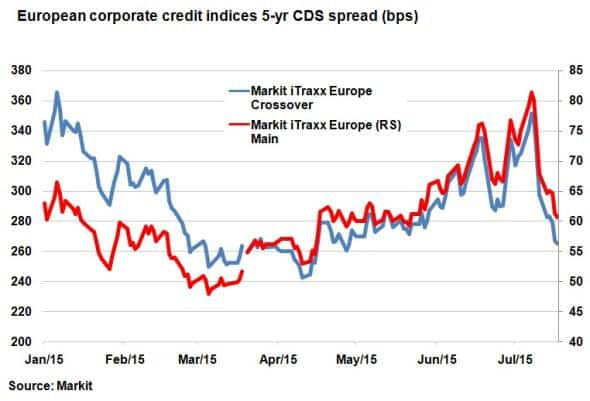

In corporate credit, the Markit iTraxx Europe has tightened 20bps in the last eight trading days. Similar moves were seen in high yield, with the Markit iTraxx Europe Crossover tightening 80bps. This drops means spreads are now returning to April/May levels.

The correlation between the two indices since June 1st has been 0.97, in stark contrast to the year to date correlation of 0.64; demonstrating the shift away from fundamentals in times of crisis.

US joins in

The mood in Europe has also translated across the Atlantic, as Fed chairman Janet Yellen gave bullish remarks about the US economy in front of congress. The Markit CDX.NA.IG index, which is made up of 125 investment grade single name CDS spreads, was 5bps tighter this week at 64bps at the latest; 4bps wider than the lowest level achieved on this year on March 5th.

Bullish sentiment has also translated into investor appetite as high yield bond ETFs experienced their biggest weekly net inflow ($1.66bn) since the week starting February 2nd.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Credit-Risk-on-in-credit-markets-as-Draghi-Yellen-bullish.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Credit-Risk-on-in-credit-markets-as-Draghi-Yellen-bullish.html&text=Risk+on+in+credit+markets+as+Draghi%2fYellen+bullish","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Credit-Risk-on-in-credit-markets-as-Draghi-Yellen-bullish.html","enabled":true},{"name":"email","url":"?subject=Risk on in credit markets as Draghi/Yellen bullish&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Credit-Risk-on-in-credit-markets-as-Draghi-Yellen-bullish.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+on+in+credit+markets+as+Draghi%2fYellen+bullish http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Credit-Risk-on-in-credit-markets-as-Draghi-Yellen-bullish.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}