Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 17, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

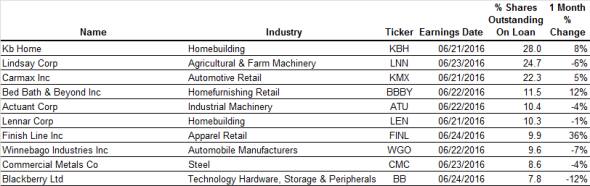

- US homebuilders KB and Lennar join Carmax as the most shorted stocks in North America

- UK's Majestic Wine's shares soar as shorts cover ahead of earnings...and Brexit vote

- South Korean firm Viromed is the most shorted in Apac

North America

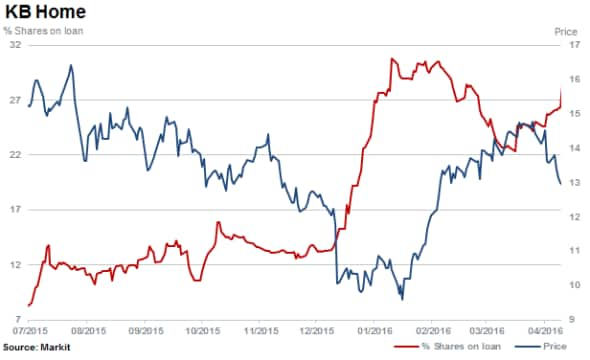

Most shorted ahead of earnings this week in North America is US home builder KB Home with 28% of its shares currently outstanding on loan (short interest).

Shorts had previously covered positions in the stock since February as shares rallied but the stock has once again come under pressure with a jump in shorting levels seen recently. Lennar, another US home builder, joins KB with a recent 25% jump in short interest, rising to 10.3%.

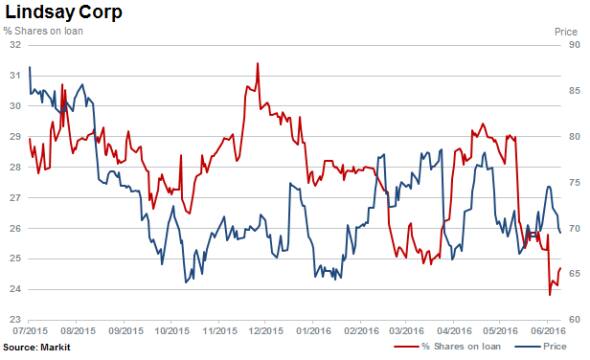

Meanwhile short sellers have covered positions in Lindsay Corp, a previous most shorted stock. Short interest has declined to just under one quarter of shares outstanding on loan. While still remaining heavily shorted, the irrigation system provider's shares have fallen 4.7% year to date as its earnings have continued to deteriorate.

Short sellers have continued to build up positions in used car business Carmax. Short interest has climbed higher to 22.3% in the past 12 months while shares in the company have fallen by one third. Shorts continue to target the firm as growth falls short of expectations, despite the firm posting sales and earnings growth.

Other notable North American firms making the top ten host shorted include Winnebago and Blackberry which have both seen short sellers cover with short interest declining to 9.6% and 7.8% respectively.

Meanwhile Bed Bath & Beyond still attracts meaningful short interest levels with 11.6% of shares outstanding on loan. Shares have fallen 12% year to date after plummeting 37% in 2015.

Europe

Most shorted ahead of earnings in Europe is Austrian based lighting solutions provider Zumtobel. With 6.2% of shares outstanding on loan, shares in the light maker have cratered over 50% in 2016 with consensus forecasts pointing to a loss being posted for the company's fourth quarter.

Second most shorted in Europe is UK wine retailer Majestic Wine. The company has seen shares rally 45% in the past six months which has sent short sellers covering. Shorts have closed out a third of positons in the past three months with short interest of 4.2% currently. Shares however are still trading below 2013 highs and full year earnings are expected to be half of that achieved in 2014.

Apac

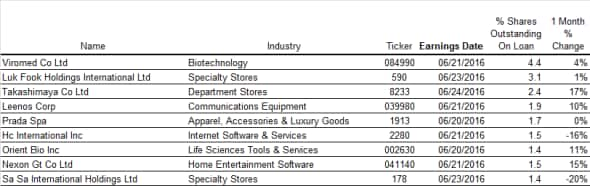

Most shorted ahead of earnings in Apac is Korean biotech firm Viromed with 4.4% of shares outstanding on loan.

Shares in Viromed, which focuses on protein-based therapeutics for life threatening diseases, have drifted lower in 2016, falling almost 22.6% year to date.

Second most shorted ahead in Apac is Luk Fook Holdings which operates speciality jewellery stores in Hong Kong and China. The company currently has 3.1% of shares outstanding on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}