Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 17, 2015

CMBS holds firm as US bond returns stumble

As US corporate and sovereign bond returns turn negative for the year, the CMBS market has remained resilient amid a strong commercial real estate market.

- Markit iBoxx Trepp CMBS Overall index has returned 0.69% ytd

- CMBS now outperforming corporates and sovereigns bonds amid the recent volatility

- Markit iBoxx Trepp CMBS Original AAA index has returned 289bps over than AAA corporates ytd

The commercial mortgage backed securities (CMBS) market in the US has enjoyed a continued recovery since the depths of the global financial crisis in 2008. The asset class, which comprises bonds backed by mortgages ranging from retail properties, office blocks, apartment blocks and hotels, slumped by nearly 50% during the crisis but was quick to par losses once the climate improved.

Since the financial crisis, US CMBS issuance has grown progressively and issuance is on course to surpass $100bn in 2015. This growth looks set to continue, given that the latest pace of CMBS issuance represents only 2% of US mortgage related security issuance, compared to 10% prior to the crisis CMBS issuance totalled $230bn in 2007. Issuance is now continuing to outpace other forms of non-agency mortgage related debt, such as the larger residential MBS market.

CMBS, especially pooled conduit loans which make up around two thirds of issuance, offer advantages such as prepayment provisions and can provide diversification advantages by spreading out the underlying collateral base. These attributes have been particularly beneficial to the asset class during the recent period of volatility.

Total returns

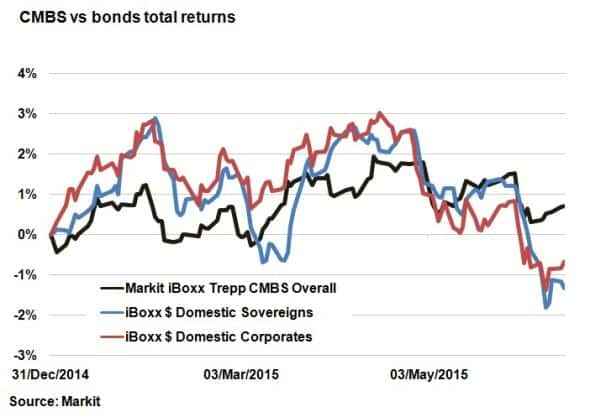

The latest volatility in global bond markets spanning back to mid-April has not served corporate and sovereign bondholders well. Total returns this year, as represented by the Markit iBoxx $ Domestic Sovereigns index and the Markit iBoxx $ Domestic Corporates index, have turned negative over the past two months.

In contrast, the CMBS market has held up well. The Markit iBoxx Trepp CMBS Overall index has generated a total return of 0.69% year to date (ytd); around 2.02% extra return over sovereigns and 1.37% over corporates.

The deviation in returns between CMBS and corporate and sovereign bonds highlights how well the asset class has held up amid the volatility. CMBS have also fared well during the last few years during a much more favourable economic backdrop for the underlying commercial loans. Sustained low interest rates and a stronger real estate market have made the recovery sustainable.

Rating sub-indices

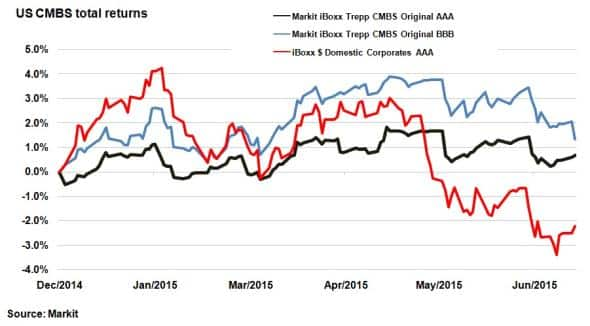

So far this year, the Markit iBoxx Trepp CMBS BBB sub-index has been the best performing cohort returning 1.35%. The index was the most successful rating sector for much of the year so far, up above 3% at one point in April.

But the recent volatility has seen the index retreat somewhat, while higher grade buckets have proven more resilient. This runs contrasts with the swings in corporate bonds, where the highest grade bonds have fallen by a wider margin that that their lower ranked peers.

This is exemplified by the fact that the Markit iBoxx $ Domestic Corporate AAA index is down by 2.22% ytd; compared to just 0.68% for the overall investment grade universe. This means that the highest rated CMBS securities have the outperformed corporate bonds of the same rating by a not insignificant 2.89% so far this year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Credit-CMBS-holds-firm-as-US-bond-returns-stumble.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Credit-CMBS-holds-firm-as-US-bond-returns-stumble.html&text=CMBS+holds+firm+as+US+bond+returns+stumble","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Credit-CMBS-holds-firm-as-US-bond-returns-stumble.html","enabled":true},{"name":"email","url":"?subject=CMBS holds firm as US bond returns stumble&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Credit-CMBS-holds-firm-as-US-bond-returns-stumble.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CMBS+holds+firm+as+US+bond+returns+stumble http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Credit-CMBS-holds-firm-as-US-bond-returns-stumble.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}