Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 17, 2017

UK inflation jumps to highest since July 2014

UK inflation rose more than expected in December, fuelling further suspicions that the Bank of England may start to mull the need for higher interest rates later in 2017.

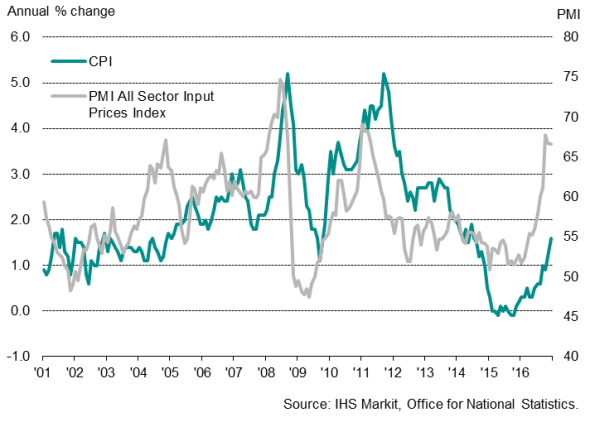

Inflation and producer prices

Consumer prices rose 1.6% on a year ago, according to the Office for National Statistics, up from 1.2% in November and its highest since July 2014.

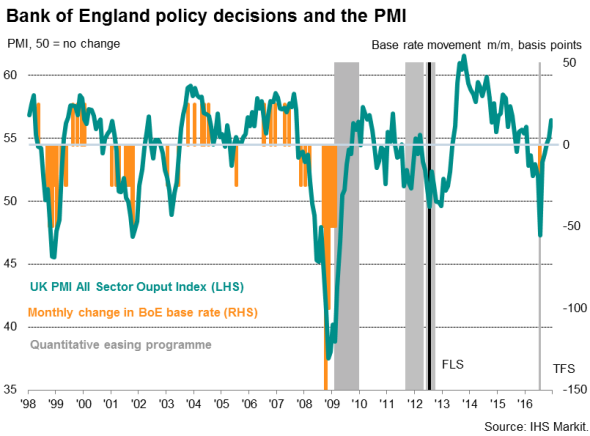

The upturn follows warnings from Bank of England governor Mark Carney that there are limits to the amount of inflation the central bank will tolerate, and today's data will further fuel suspicions that the next move in interest rates could be an increase. The economy showed surprising resilience in the latter half of 2016, with Brexit worries brushed aside by households and many businesses. Survey data showed the pace of economic growth in fact accelerating to the fastest for nearly one-and-a-half years in December, reaching levels normally associated with the Bank of England considering higher interest rates (see chart).

The upturn in inflation is being spurred to a significant extent by the combination of rising global commodity prices and the pound's depreciation. The further slide in sterling to 30-year lows in recent days and the sustained upward trend in commodity prices in the first weeks of 2017 will inevitably lead to further increases in companies' costs. UK manufacturers have been reporting the steepest rates of inflation for input costs and selling prices seen for over 20 years in recent months, according to survey data. The IHS Markit Materials Price Index (MPI) surged in the first week of 2017, gaining 2.9%. The index is now up 51% from a year ago.

Inflation therefore looks set to rise further in 2017, with 3% likely to be seen by the second half of the year. Whether the central bank will tolerate this level of inflation remains very uncertain, but will most likely depend on the extent to which consumers continue to spend in the face of Brexit worries and higher prices. At the moment, there seem to be few signs of any waning in households' appetite to spend, but we suspect that spending will soon slow as the reality of higher prices starts to bite.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012017-Economics-UK-inflation-jumps-to-highest-since-July-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012017-Economics-UK-inflation-jumps-to-highest-since-July-2014.html&text=UK+inflation+jumps+to+highest+since+July+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012017-Economics-UK-inflation-jumps-to-highest-since-July-2014.html","enabled":true},{"name":"email","url":"?subject=UK inflation jumps to highest since July 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012017-Economics-UK-inflation-jumps-to-highest-since-July-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+jumps+to+highest+since+July+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012017-Economics-UK-inflation-jumps-to-highest-since-July-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}