Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2016

Industrial services leads Asian manufacturing upturn

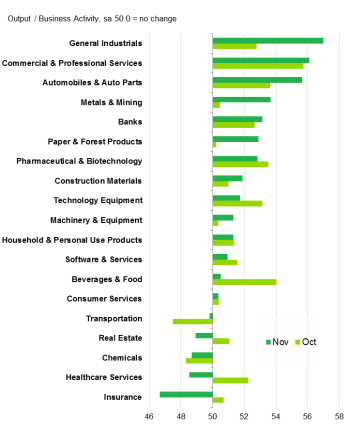

Most Asian sectors recorded a further expansion of business output in November, although the number of sectors showing output growth dropped to 14 out of 19 (from 17 in October). Moreover, the leaderboard signalled considerable change in terms of the best and worst performing sectors.

Signs of stronger demand in the Asian manufacturing sector fuelled a rise in output for most detailed sectors in the first two months of the fourth quarter. Increasing inflows of new orders in China and Japan contributed to the latest expansion. Notably, manufacturing companies related to the industrial metals industry saw a surge in business output during November.

Industrial services lead Asian expansion

Sources: IHS Markit, Nikkei.

Metals on the rise

A marked upturn in output at general industrial firms, which included manufacturing of metal products, lifted the sector to the top of the rankings. At the same time, output in metals & mining showed the largest monthly increase since August, elevating the sector to fourth in the rankings. As China makes up roughly half of global demand for base metals, continued improvements in China's manufacturing economy were partly behind the rise in demand for metal-related products.

Meanwhile, the automotive industry continued to show signs of improvement. In October, growth was signalled after four declines in the previous five months. The automobiles & auto parts sector built on October's renewed expansion and the third-fastest growing sector in November.

It wasn't just manufacturing companies that dominated the rankings, however, with commercial & professional services growth picking up to rest in second place, and banking sitting in fifth place, likewise seeing growth gain speed.

Declines in healthcare and insurance

Among the five sectors that signalled contraction in output during November, insurance came last in the rankings as it recorded a decline for the first time since the sector moved back into expansion five months ago. While the average PMI reading (50.4) for the insurance sector still signalled an expansion so far this year, it was markedly lower than last year (53.4), reflecting headwinds faced by the industry.

Separately, the decline in healthcare services output was steepest since June 2015. A fall in new orders suggested waning demand, which could be partially related to decreasing investments in the healthcare industry.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-economics-industrial-services-leads-asian-manufacturing-upturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-economics-industrial-services-leads-asian-manufacturing-upturn.html&text=Industrial+services+leads+Asian+manufacturing+upturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-economics-industrial-services-leads-asian-manufacturing-upturn.html","enabled":true},{"name":"email","url":"?subject=Industrial services leads Asian manufacturing upturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-economics-industrial-services-leads-asian-manufacturing-upturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Industrial+services+leads+Asian+manufacturing+upturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-economics-industrial-services-leads-asian-manufacturing-upturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}