Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2015

US manufacturing shows signs of stalling at year end

Just as the Fed looks set to hike interest rates for the first time since 2006, the manufacturing sector shows signs of stalling. The flash PMI results show factories ending the year with the weakest growth of new orders since the global financial crisis.

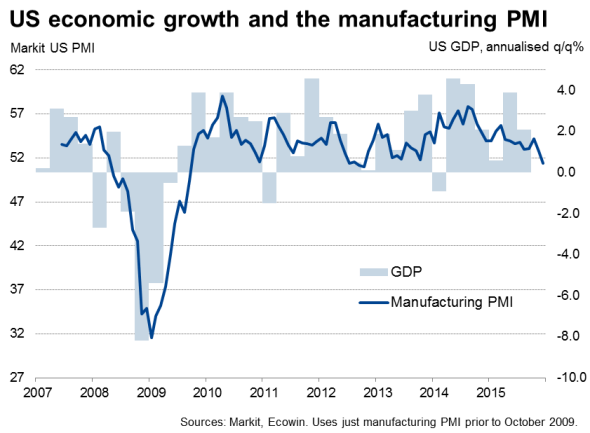

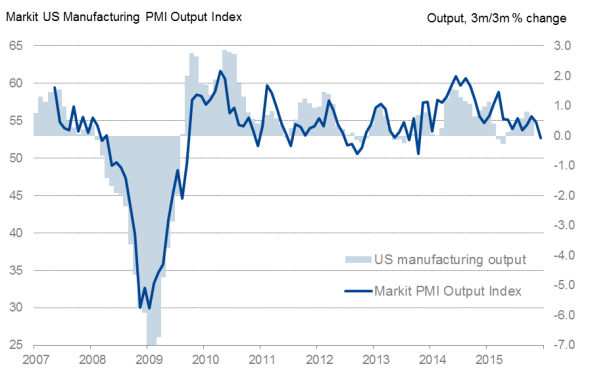

Markit's Flash U.S. Manufacturing Purchasing Managers' Index" (PMI") fell to 51.3 in December, down from 52.8 in November. Although still above the neutral 50.0 threshold, the latest reading pointed to the slowest improvement in manufacturing business conditions since October 2012. New order growth was the slowest recorded since September 2009, pushing output growth down to the weakest for just over two years.

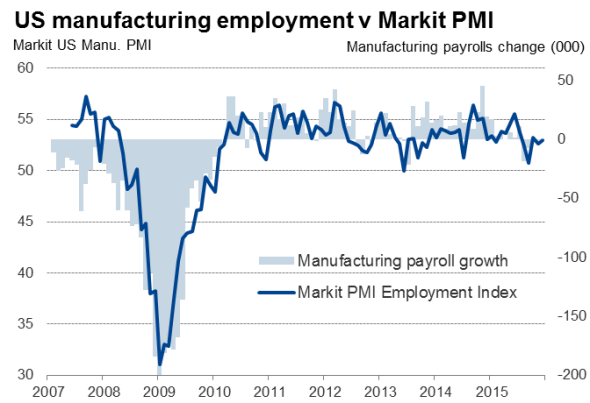

Low oil prices are hurting the energy sector, feeding through to reduced investment demand for plant and machinery, while the stronger dollar is hitting exports and encouraging import substitution. These are major headwinds that show no sign of easing any time soon.

Manufacturing output

Although manufacturing only accounts for around one-tenth of the economy, the Manufacturing PMI exhibits a high correlation of 77% with GDP as industrial activity has an important cyclical impact on other parts of the economy. With many sectors such as transport and business services dependent upon the manufacturing economy's health, the downturn in the survey data sends a warning signal that the US upturn appears to be rapidly losing momentum as we move into 2016. However, the picture will become clearer with the publication of flash services PMI numbers on Friday, which have been holding up better than the manufacturing PMI in recent months.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-economics-us-manufacturing-shows-signs-of-stalling-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-economics-us-manufacturing-shows-signs-of-stalling-at-year-end.html&text=US+manufacturing+shows+signs+of+stalling+at+year+end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-economics-us-manufacturing-shows-signs-of-stalling-at-year-end.html","enabled":true},{"name":"email","url":"?subject=US manufacturing shows signs of stalling at year end&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-economics-us-manufacturing-shows-signs-of-stalling-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+shows+signs+of+stalling+at+year+end http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-economics-us-manufacturing-shows-signs-of-stalling-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}