Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 16, 2015

Fixed income investors dump US ahead of Fed decision

Ahead of the Fed's expected first rate hike in nine years, fixed income ETF investors have been taking money off the table, with US high yield bonds seeing significant outflows.

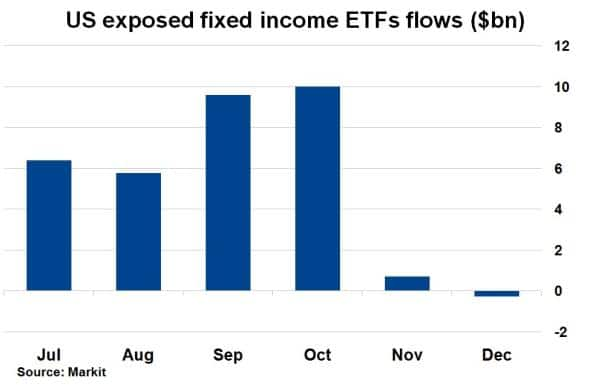

- US exposed fixed income ETFs have seen inflows taper in the second half of 2015

- High yield bond ETFs have seen $866mn of outflows in December

- Inflation linked ETFs remain the bright spot, with $240m of inflows in December so far

An interest rate rise was expected to come in September, but global volatility and emerging market jitters prevented Fed chairwoman Janet Yellen from starting monetary tightening. Today it is widely expected that the Fed will finally go ahead with the inaugural post financial crisis rate hike.

US ETFs shunned

Investors have been shifting away from fixed income products as the second half of this year has progressed. US exposed fixed income ETFs have seen $280m of outflows in December so far, on course to be the first negative flow month since June, according to Markit's ETP service.

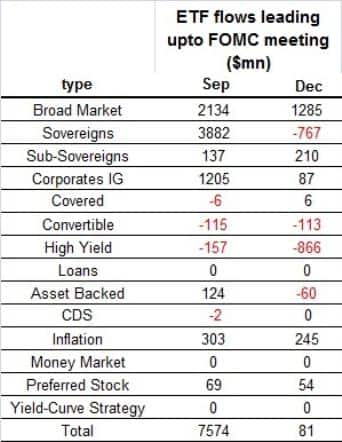

The tapering of flows comes just as the Fed looks almost certain to raise interest rates, a trend which differs greatly from what was seen just before the September FOMC meeting (when a rate hike was also expected). September and October saw $9.6bn and $10bn of US exposed fixed income ETFs inflows, respectively. The negative flows towards the end of the year represent a higher conviction from the market of a rate rise, given similar September market volatility.

High yield bears brunt

In the week leading up to September's meeting, the fixed income asset class of high yield bonds were shunned. Back then, conviction of a rate rise diminished as external volatility gripped the market. Investors subsequently dipped back into interest rate sensitive products such as corporate bonds and sovereigns, but also high yield bonds that benefit from a credit perspective as borrowing costs are kept lower for longer.

This time around, the picture could not be more different. US high yield ETFs have seen $866mn of outflows in December so far, in part due to falling commodity prices impacting commodity exposed high yield credits, but also a higher conviction of what is now seen as an inevitable rate hike.

The only US fixed income product that has seen relevant inflows in December has been, unsurprisingly, inflation linked bonds. A rate rise would confirm to the market that policy setters are comfortable in reaching their medium term 2% inflation target as US growth kick starts and the transient deflationary effects of low commodity prices pass. $245m has entered ETFs tracking TIPS in December as the market sets itself up for higher future rates.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-credit-fixed-income-investors-dump-us-ahead-of-fed-decision.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-credit-fixed-income-investors-dump-us-ahead-of-fed-decision.html&text=Fixed+income+investors+dump+US+ahead+of+Fed+decision","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-credit-fixed-income-investors-dump-us-ahead-of-fed-decision.html","enabled":true},{"name":"email","url":"?subject=Fixed income investors dump US ahead of Fed decision&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-credit-fixed-income-investors-dump-us-ahead-of-fed-decision.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fixed+income+investors+dump+US+ahead+of+Fed+decision http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-credit-fixed-income-investors-dump-us-ahead-of-fed-decision.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}