Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 16, 2014

Short sellers catch recent downturn

The recent market downturn has seen shorts add to their already elevated positions in the wake of the S&P's 7% decline in the last month, which saw the most shorted companies fall by over twice the index average.

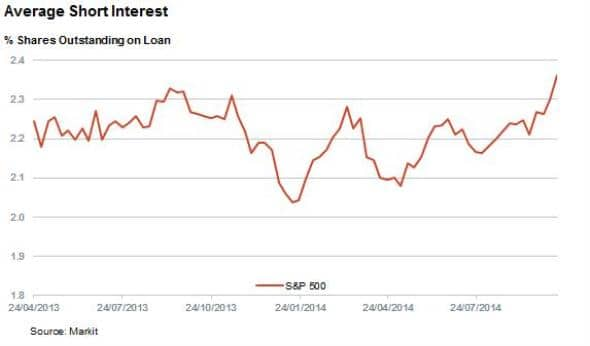

- Average short interest in S&P 500 companies now stands at an 18 month high after steadily increasing in the last few months

- The ten most shorted companies a month ago have fallen nearly twice as hard as the rest of the market

- Shorts look to have been caught out by the fall in oil prices as many energy underperformers saw little short interest heading into the selloff

In contrast to the events of 2013, which saw shorts retreat in the face of rising markets, this year saw shorts add to their positions as the market posted new all-time highs; this looks to have paid off in the recent market correction.

Shorts elevated heading into correction

The average demand to borrow shares in S&P 500 constituents stood at 2.2% of shares outstanding a month ago. This represented a 6% increase from the average demand to borrow seen at the start of the year despite the fact that the index was trading at an all-time high.

This stands in stark contrast to last year when shorts were actively covering more of their positions in the face of the market's rising level. It seems that short sellers were much more sceptical of the recent market highs than those seen at the tail end of last year.

The market's subsequent tumble has seen shorts add to their positions in the last month and the average demand to borrow constituents now stands at 2.4% of shares outstanding, the highest level in over 18 months for the index.

Most shorted underperform

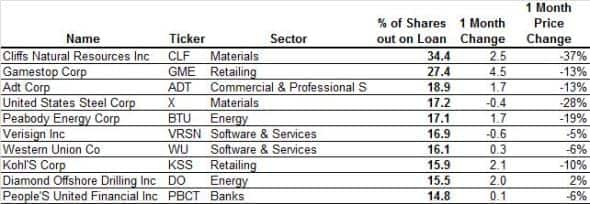

From a P&L point of view, the recent sell-off has played out well for short sellers, as the most shorted shares heading into the downturn have underperformed the market by a wide margin. The ten most shorted S&P 500 constituents a month ago have seen their shares tumble by 14% on average; nearly twice the average fall seen in the index.

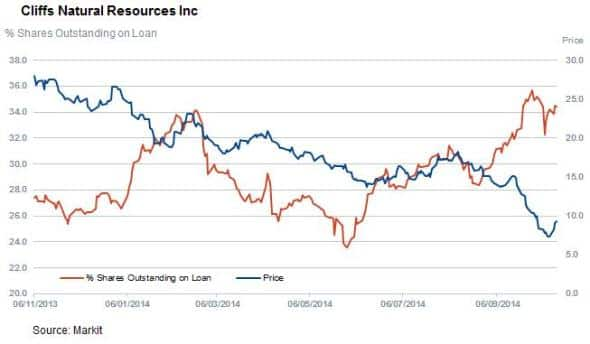

Top in the list of short seller's profitable positions was Cliff's Natural Resources which has fallen by 37% in the last month as the fall in energy compounded an already painful situation for the company's shareholders. Shorts have taken this opportunity to add to their positions, cementing the company's status at the top of the most shorted list.

Fellow coal company Peabody Energy has also made a successful short in the last month with after falling by just under 20%.

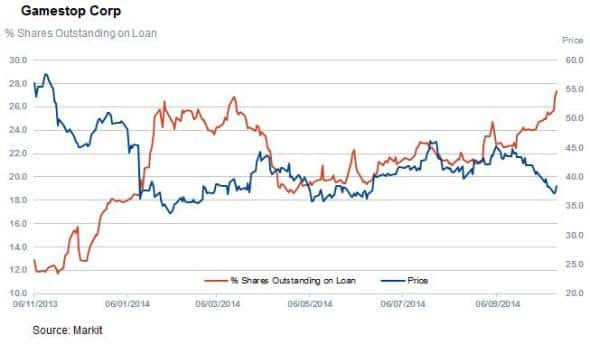

Retailers also made the list of fruitful shorts in the last month with Gamestop falling 13% in last four weeks, as wells as Kohl's which fell by 10%.

The only firm to see its price rise in the last months among the ten most shorted firms was Diamond Offshore Drilling which posted a 2% price rise in the last month. The firm has still made a successful short over the last year however as its shares have nearly halved year to date.

Energy see surge in shorts

While Peabody and Cliff's were successful energy shorts, it seems that the recent tumble in oil prices had not been foreseen by short sellers as many of the firms that saw their prices tumble in the last month saw little in the way of short interest a month ago. This as the sector led the index down, with a 17% average fall.

In fact, the 17 energy companies whose shares have retreated by more than 20% in the last month had an average demand to borrow of 2.2% of shares. This includes Newfield Exploration, which had less than half a percent of shares out on loan coming into the latest correction as its shares fell by 33%.

Shorts look to be repositioning themselves in the sector however the sector has seen the second largest jump in average short interest in the last month with average demand to borrow jumping by 12% in the last month to 3.2% of shares.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-equities-short-sellers-catch-recent-downturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-equities-short-sellers-catch-recent-downturn.html&text=Short+sellers+catch+recent+downturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-equities-short-sellers-catch-recent-downturn.html","enabled":true},{"name":"email","url":"?subject=Short sellers catch recent downturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-equities-short-sellers-catch-recent-downturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+catch+recent+downturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-equities-short-sellers-catch-recent-downturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}