Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 16, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Homebuilders KB Home and Lennar see covering in weeks leading up to earnings

- Short interest jumped by 65% on Cruise operator Carnival in month leading up to earnings

- Rocket Internet most shorted European company announcing earnings this week

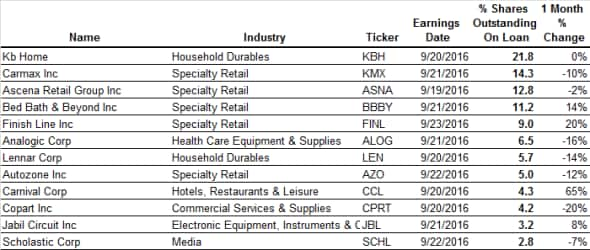

North America

Home builders are a key focus of this week's relatively light crop of heavily shorted companies announcing earnings as KB Home and Lennar have 21.8% and 5.7% of their shares out on loan, respectively. While both firms have seen constantly elevated levels of short interest in the eight years since the financial crisis, demand to short their shares has waned in the last few weeks.

The covering accelerated in the wake of buoyant earnings from fellow homebuilder Toll Brothers which saw its shares jump significantly after announcing better than expected order volumes. While the covering indicates that investors are less bearish on both firms in recent weeks, Kb Home still has over twice the level of shorting activity it did at the start of the year. This jump in short interest followed KB's disappointing fourth quarter earnings which saw its shares fall by over 15% after it missed delivery targets. Although KB shares have recovered all the ground lost in the wake of these disappointing earnings, the continued elevated level of short interest shows that the company still has some ground to cover in order to convince all its doubters.

The only company seeing any notable increase in short interest leading up to earnings is cruise operator Carnival Corporation. Carnival's short interest has climbed by two thirds in the last month with 4.3% of the company's shares now shorted. The company announced that the recent UK referendum would provide a headwind for bookings.

The recent surge in short interest indicates that short sellers looking to play the trend, especially since the pound's post brexit slump makes overseas travel much more expensive for UK consumers, which are Carnival's third largest source of passengers.

Specialty retailers also feature heavily in the most shorted ahead of earnings list. This week's crop of retailers includes secondhand car dealer Carmax, and accessories retailer Autozone. Women's clothier Ascena Retail, homeware firm Bed Bath and Beyond and sportswear retailer Finish line round out the five specialty retailers which see heavy demand to borrow leading up to earnings.

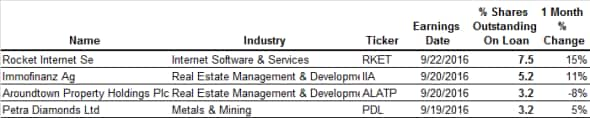

Europe

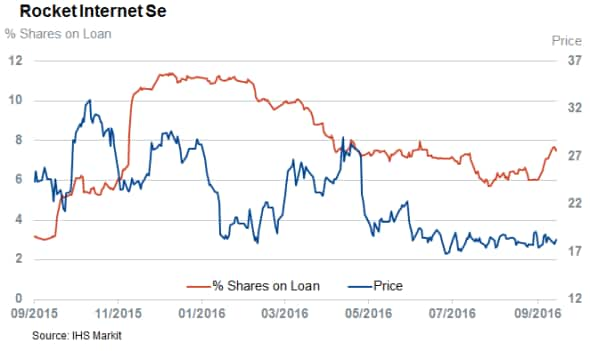

Rocket Internet is the most shorted of the four European companies seeing more than 3% of its shares out on loan leading up to announcing earnings this week. Rocket has been under criticism for what some describe as its copycat business model over the years. The company recently seen its shares slump after writing down the value of some the start-ups it funded. Short interest in Rocket has jumped since these writedowns with 7.5% of Rocket's shares now out on loan.

German real estate property company Immofinanz is the only other firm seeing more than 5% of its shares shorted leading up to earnings this week. Immofinanz has a large exposure to Russia and Eastern Europe which has made it a popular short in the last couple of years.

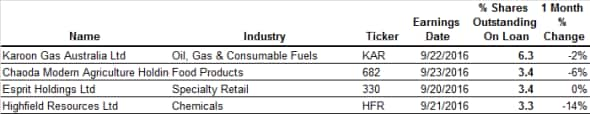

Apac

The only significantly shorted company announcing earnings in Asia this week is Karoon Gas Australia which has 6.3% of its shares shorted.

Demand to sell Karoon shares short has been sliding in recent months as the energy market stabilized. Its shares have not shown the same resilience, however, as they have only managed to rebound by 10% from the lows set in February.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}