Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 16, 2015

Benefits from following the bears

Markit Securities Finance has released a report with detailed findings outlining how securities lending data can potentially enhance the return objectives for long only and short trading strategies in multiple markets.

- Short selling metrics indicate US energy names remain as consensus conviction shorts

- Significant net alpha remains for short sellers even after accounting for high indicative fees

- Indicative fee to borrow a material metric for identifying possible future share price declines

For the full report on Thresholds in Securities Lending Metrics, please contact us.

The bear necessities

Academic evidence suggests that securities with relatively high levels of short interest should underperform securities with low levels as short sellers on average are typically informed traders who target overvalued securities. By filtering stocks using the above metrics, it is possible to aggregate a list of higher conviction shorts. These on average are more likely to underperform, according to the report's findings.

Analysing returns data from January 2007 to March 2015 using eight of Markit's Securities Finance lending metrics across four universes (see Appendix below) shows that material benefits to real world trading strategies can be achieved.

Relative underperformance

The highest performing metric across most universes is the indicative fee to borrow, with DCBS taking second place. A relatively high indicative fee implies high borrow demand or low lendable inventory available for a specific stock - or both.

Across large and small cap US universes, stocks with an indicative fee of less than 50bps are less likely to experience a month of large underperformance. Above this threshold of 50bps, the likelihood of a stock suffering a drop in share price increases in step with its borrow cost. The stocks on the most extreme end of the spectrum, those which command a borrow fee of more than 25%, are twice as likely to see their shares underperform the overall universe.

That threshold is higher in Europe at 87.5bps and even higher in Apac at 162.5bps, which probably accounts for the higher frictions that these markets generally experience in the securities lending market.

This phenomenon means that US shares with a fee greater than 1.6% experience negative annual excess returns, even when accounting for the running cost of keeping a short position.

The long and short of it

Current examples of companies screened for threshold metrics in the report, including high utilisation levels, high indicative fees, DSR and high levels of short interest %, are below

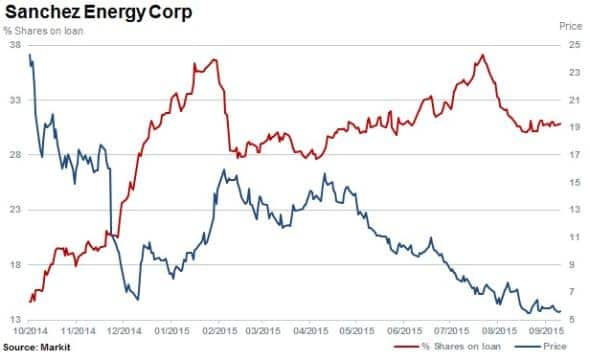

Not surprisingly a number of energy names feature in the US, with alternative oil & gas taking centre stage. Sanchez Energy continues to be a high conviction short with the indicative fee to borrow recently breaching 50% as the utilisation of stock to lend remains high at 80%. Sanchez stock is down 79% over the last 12 months.

Even though Chesapeakeshares have fallen some 48%, it remains an outlier in terms of its relative size as measured by market cap compared to other energy shorts. 28% of shares are currently outstanding on loan as the benchmark fee rises above 10% and utilisation levels hover between 80% and 90%.

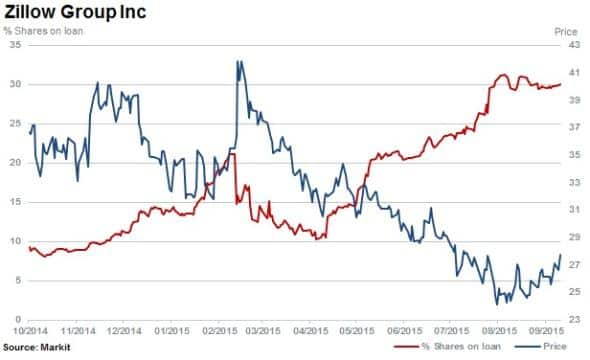

Other energy names breaking threshold metrics include Approach Resources, Penn Virgina Corp, Rex Energy and Tidewater. Online property service Zillow and Freshpet are non-energy names, making the cut in terms of threshold metrics.

87% of Zillow stock available to short is currently utilised, which has seen the indicative fee climb towards 15%. 30% of shares outstanding are out on loan with the stock falling by a third in the last 12 months.

Outside the US

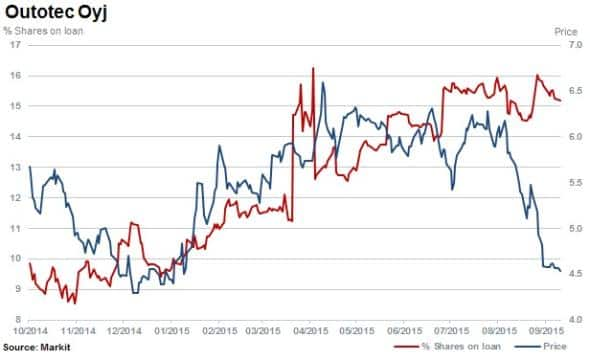

In Europe minerals and metals processor Outotec is among the top conviction shorts, with 15% of shares outstanding on loan, 85% utilisation and an indicative fee nearing 8%. The stock has fallen almost 25% in the last two months.

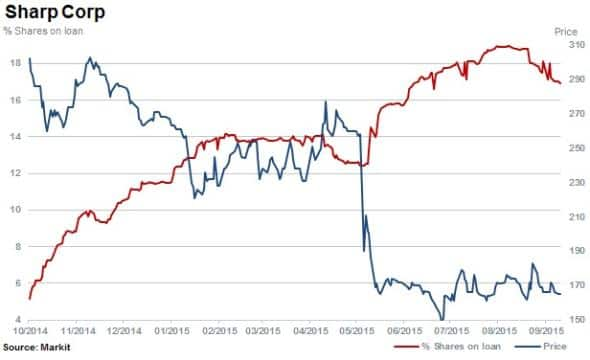

Among a universe of stocks in Apac, Japan's Sharp continues to attract short sellers with 16.9% of shares outstanding on loan, 90% utilisation and an indicative fee hovering near 10%.

Appendix: methodology and universe

Universe: Markit US Large Cap (USLC), Markit US Small Cap (USSC), Markit Developed Europe (EUR) and Markit Developed Pacific (APAC)

Metrics analysed: utilization, active utilization, indicative fee, the demand supply ratio (DSR), short interest as % of shares, lendable supply as % of shares, days to cover and the daily cost to borrow (DCBS)

*Relative underperformance is classified in the full research report as "an event where one month forward total returns of the stock fall below the 25th percentile of the cross sectional one month forward universe total return".

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092015-Equities-Benefits-from-following-the-bears.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092015-Equities-Benefits-from-following-the-bears.html&text=Benefits+from+following+the+bears","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092015-Equities-Benefits-from-following-the-bears.html","enabled":true},{"name":"email","url":"?subject=Benefits from following the bears&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092015-Equities-Benefits-from-following-the-bears.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Benefits+from+following+the+bears http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092015-Equities-Benefits-from-following-the-bears.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}