Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 16, 2015

Shorts take aim at shaky IPOs

Recent IPOs have dazzled some investors and left others puzzled, with new launches showing striking price swings in 2015. As a result, conviction driven short sellers are now paying over 100% of value to place negative bets on shaky prices.

- High number of IPOs seen in China as companies rush to market prior to re-halting of IPOs

- Majority of IPO short sellers are concentrated in US and Japan

- Hot IPOs being circled by short sellers include Etsy, Fitbit and Shake Shack

Markets shorting the IPO

Short sellers are congregating around this year's prolific US IPOs. Much like 2014 the IPO hype has been present on the side of short seller too, hoping to profit from companies' falling stock.

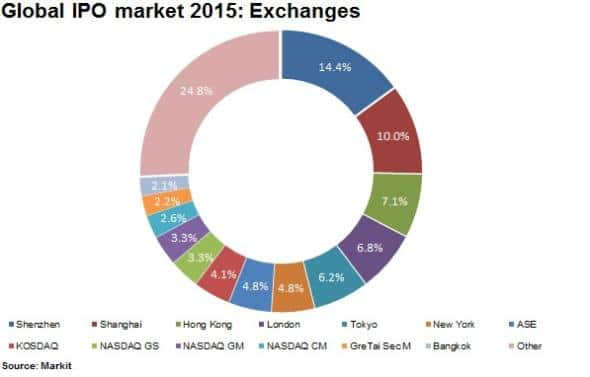

Over 700 companies have come to market globally in 2015, led by Chinese stocks after an IPO banduring 2013 was lifted early in 2014. However recent price collapses have seen authorities once again close the taps of new issuances, in efforts to stabilise the country's equity markets.

Shenzhen listed online video company Beijing Boafen is one of the fastest rising IPOs of 2015, with more than $100m market cap. The stock price is up 462% since floating in March 2015, even after a sharp pullback. However short selling in Boafen and mainland IPOs and shares remains limited. Minimal short selling is seen in China and Hong Kong listings despite the unprecedented rally, with negligible short interest levels registering.

Short sellers have concentrated their IPO efforts in US and Japan listed firms with IPOs with more than 1% of shares outstanding on loan featured predominantly in these two areas at 60% and 30% respectively.

Top US IPO shorts

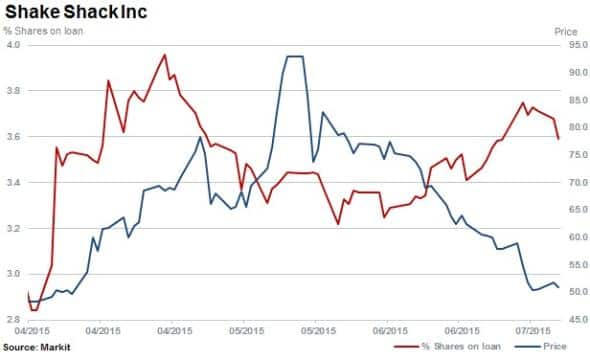

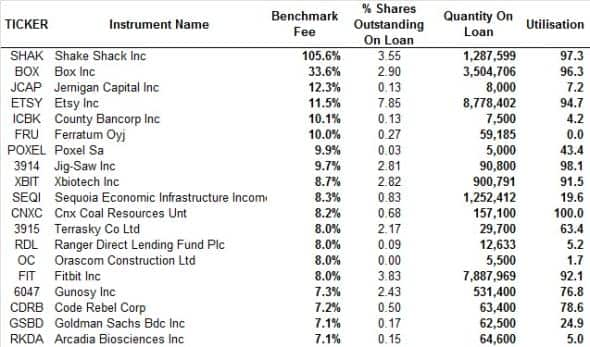

After squeezing in June 2015, short sellers are returning with renewed conviction to newly listed burger chain Shake Shack. With high utilisations levels denoting limited quantity available to short, Shake Shack is the most expensive to short IPO of 2015 to date. Short sellers are currently prepared to pay 105% to short the stock.

Shake Shack's shares outstanding on loan have increased to 3.6% and while the stock has declined some 45% from its highs, it is still up 23% since IPO.

Sector IPO shorts

The biotechnology, industrial machinery and pharmaceuticals sectors have led IPOs globally representing 15% of all listings, with internet & software services in fourth place followed by health care equipment.

Linking the technology and healthcare sectors is Fitbit, which launched an IPO in June 2015. The stock has risen 21% since June 23rd with analysts seemingly bullish, but despite this the stock has attracted short sellers. Shares out on loan have climbed to 3.7% since listing and the cost to borrow has risen to above 8%, with 92% utilisation levels.

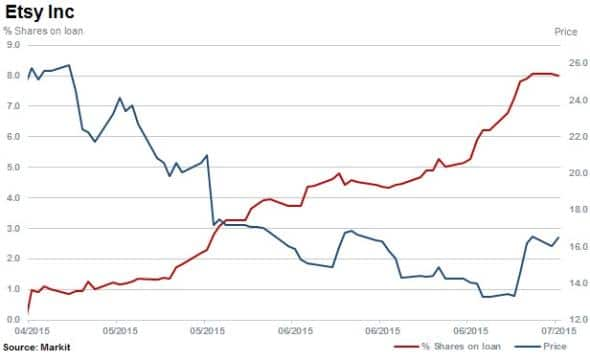

Costing more than 11.5% to short after listing in April 2015 is online marketplace Etsy. The stock has fallen 36% while short sellers have consistently increased positions. Currently shares outstanding on loan stand at 8%.

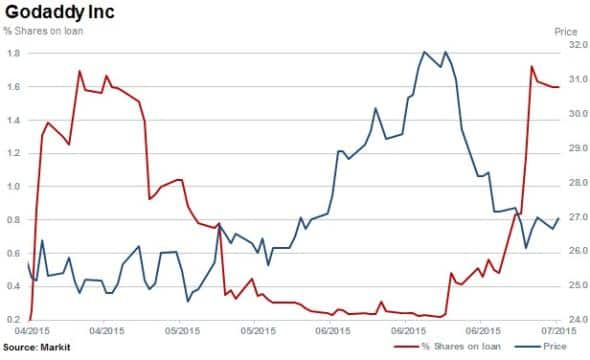

Internet stalwart Godaddy came relatively late to market in April compared to its younger aged peers; floated by private equity firms who acquired the business in 2011.

After witnessing a two month rally of 25%, the firm's shares have subsided 15% but short interest remains relatively low. Less than 2% of shares are currently outstanding on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-equities-shorts-take-aim-at-shaky-ipos.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-equities-shorts-take-aim-at-shaky-ipos.html&text=Shorts+take+aim+at+shaky+IPOs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-equities-shorts-take-aim-at-shaky-ipos.html","enabled":true},{"name":"email","url":"?subject=Shorts take aim at shaky IPOs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-equities-shorts-take-aim-at-shaky-ipos.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+take+aim+at+shaky+IPOs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-equities-shorts-take-aim-at-shaky-ipos.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}