Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 16, 2015

Near-record outflow from emerging market ETFs in June

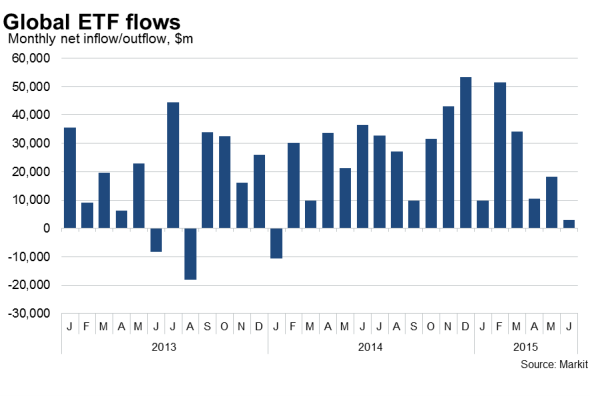

Exchange traded funds are set to see the lowest net inflows since January 2014 as inflows into equity funds are being offset by net withdrawals from fixed income funds for a second successive month in June, and emerging market ETFs see near-record withdrawals.

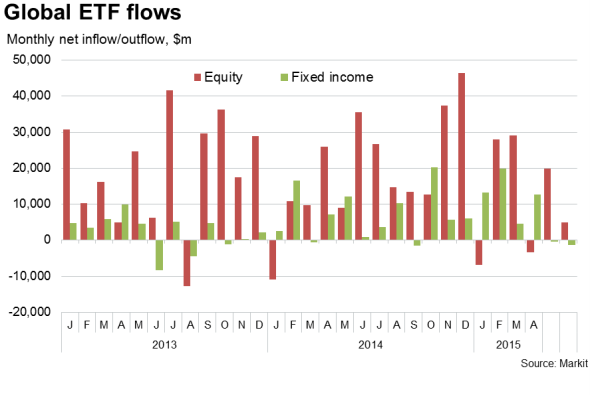

As of 12 June, global ETFs notched up $3.0bn of inflows, comprising $5.0bn of inflows into equity funds but a $1.4bn outpouring from fixed income funds. The fixed income outflow is already four times larger than the $0.3bn outflow seen in May which, although only modest, was notable in being the first seen since last September.

The recent fixed income outflows represent a significant turnaround in investor sentiment compared to prior months, when the prospect, and then the commencement, of quantitative easing by the ECB led investors to boost their exposure to bond markets.

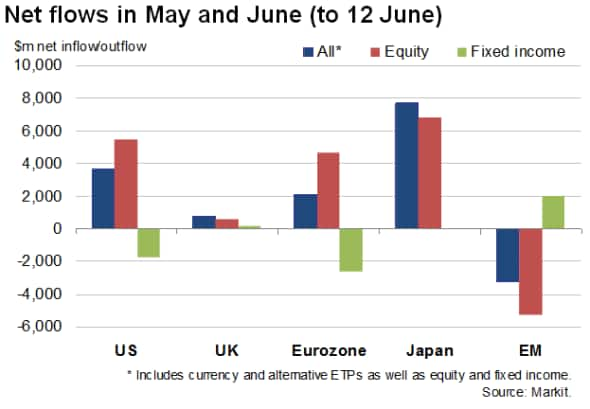

Second month of US and eurozone fixed income outflows

June's fixed income outflows have been concentrated in the US and the eurozone, with outflows of $1.4bn and $0.6bn, respectively. The latter builds on a record $2.0bn net outflow in May as investors pulled back from a QE-related surge in appetite for buying into euro area bonds, most likely linked to a combination of factors, including fewer worries about a deflationary slump.

Appetite for exposure to US bonds has also now been hit for two consecutive months, coinciding with growing expectations of the Fed starting to hike interest rates later this year amid signs that the economy is rebounding after a weak start to the year.

Emerging market worries

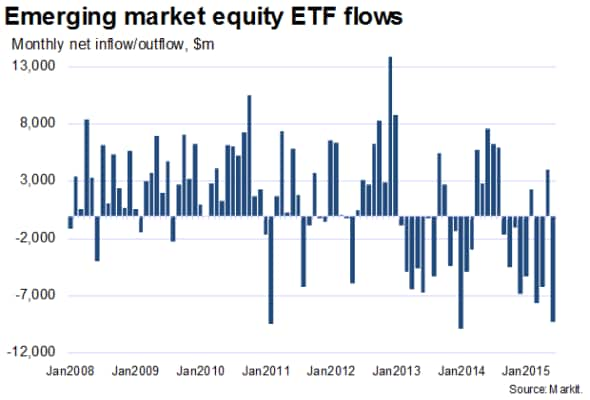

One of the major concerns for 2015 has been whether the prospect of hiking US interest rates will lead to a repeat of the 2013 "taper tantrum", in which emerging markets bonds were hit as the Fed talked up the central bank tapering its bond purchases.

In June 2013, following the May FOMC meeting in which tapering was mooted, outflows from ETFs exposed to emerging markets gathered momentum, suffering a $9.0bn net outlflow, comprising a fixed income fund net outflow of $2.2bn and a $6.7bn exodus from equity funds. Between February 2013 and March 2014, emerging market ETFs saw a net outflowing of $44bn of assets under management.

In 2015, it is the prospect of a hiking of interest rates rather a tapering of central bank asset purchases that is thought to be contributing to outflows from emerging market ETFs; the conviction of which has grown since stronger than expected non-farm payroll numbers were released in early June, adding to signs that the economy was rebounding from its first quarter sort patch. So far in June, emerging market exposed ETFs have already seen a net outflow of $8.1bn, fuelled by a net $9.3bn outpouring from equity funds, which is already close to the previous record equity outflow of $9.9bn seen in January 2014.

However, care must be taken in assigning blame for the loss of investor appetite in emerging markets. June's outflows have been led by a $5.9bn exodus from ETFs specifically exposed to China. The $2.2bn withdrawn from other emerging markets is only one-fifth of the $10.7bn loss seen in June 2013.

While China has seen a net $18.8bn drop in assets under management so far this year, other emerging markets have collectively seen a $6.0bn increase.

Profit-taking after the bull-run in China's equity markets this year and disenchantment with China's economic performance may help explain emerging market outflows more than worries about Fed policy so far this year, but it looks like both factors are now playing important roles.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Economics-Near-record-outflow-from-emerging-market-ETFs-in-June.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Economics-Near-record-outflow-from-emerging-market-ETFs-in-June.html&text=Near-record+outflow+from+emerging+market+ETFs+in+June","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Economics-Near-record-outflow-from-emerging-market-ETFs-in-June.html","enabled":true},{"name":"email","url":"?subject=Near-record outflow from emerging market ETFs in June&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Economics-Near-record-outflow-from-emerging-market-ETFs-in-June.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Near-record+outflow+from+emerging+market+ETFs+in+June http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Economics-Near-record-outflow-from-emerging-market-ETFs-in-June.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}