Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 16, 2015

Asian credit most stable within emerging markets

Despite global macroeconomic events shaking bond markets around the world, Chinese and Filipino government debt have continued to hold firm.

- Fixed income emerging market ETFs are on course for their first monthly outflow of 2015

- Asian local currency bonds have proved much less volatile in the wake of recent selloff

- iBoxx GEMX China and iBoxx GEMX Philippines have outperformed their Asian peers

Incorporating emerging market credit can be a key part of asset allocation for fixed income investors. Emerging markets bonds typically provide investors higher returns albeit for a higher degree of risk while also providing diversification benefits.

Their popularity is best gauged by emerging market fixed income ETFs that have enjoyed stellar growth since the first fund was launched in 2007. These funds now boast over $20bn in AUM.

But signs that growth is beginning to stall have emerged this month, with emerging market fixed income ETFs set to book their first net monthly outflows for the year to date. This has coincided with the recent volatility in developed sovereign bond markets, which has moved yields wider. Market jitters have been further exacerbated by recent 'Grexit' concerns, encouraging flight to "safe" assets and away from riskier emerging market debt.

Emerging markets also face the potential risks associated with US monetary policy normalisation. The last time investors sold off emerging market ETFs in droves was during the US 'taper tantrum' of 2013. Mitigating these risks as much as possible depends on where geographically investors have been investing.

Local sovereign debt

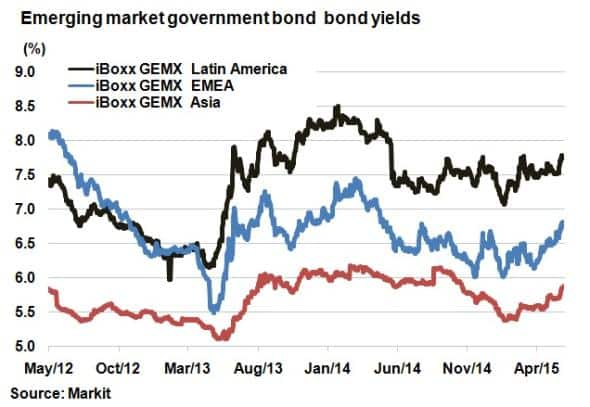

Broadly speaking, emerging markets can be separated into the three main areas; Asia, Latin America and Emea. The performance of these areas is captured by the Markit iBoxx GEMX, a group of emerging market indices that incorporates bonds issued by central governments in their domestic currencies.

Yields in bonds issued by all three above regions have been rising since the end of January this year, but the movement has been less pronounced in Asia. From January 31st till present, the iBoxx GEMX Asia index annual yield has widened 46bps, compared to 57bps and 74bps for iBoxx GEMX Latin America and iBoxx GEMX EMEA respectively. Notably, over the last three years the standard deviation of yields has been a lot lower in Asia (0.28), compared to Emea (0.48) and Latin America (0.59).

The lower volatility among Asian local currency government bonds demonstrates the region's stability in the wake of global macro events compared to other emerging market regions. Asia also has a much larger percentage of sovereign debt outstanding in local currency compared to Latin America and Emea; making the region less susceptible to swings in the US dollar.

Although it has a higher duration and a lower yield, iBoxx GEMX Asia still provides over 300bps of extra yield over 10-yr US treasuries and is better equipped to face global macro headwinds than emerging market counterparts.

Asian credit performance

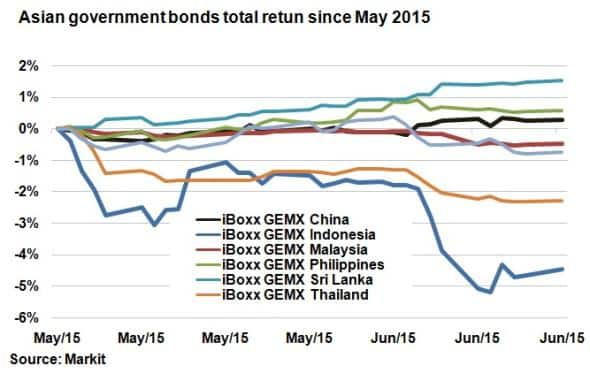

The recent volatility in bond markets has affected the credit risk associated with some Asian governments. Malaysia and Indonesia have seen 5-yr CDS spreads widen 20bps and 16bps respectively, although they are the riskiest within the region. China and Philippines, the stronger credit nations, have seen CDS spreads increase by a much less significant extent.

This sentiment is also mirrored in bonds. Over the past two months Chinese and Filipino government bonds have outperformed their Asian peers on a total return basis, with the iBoxx GEMX China and the iBoxx GEMX Philippines providing positive returns. In contrast Indonesia, Malaysia, Thailand and India all provided negative total returns over the past two months.

While investing in emerging markets still presents many risks including contagion from the developed markets, certain areas remain resilient like China and the Philippines.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Credit-Asian-credit-most-stable-within-emerging-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Credit-Asian-credit-most-stable-within-emerging-markets.html&text=Asian+credit+most+stable+within+emerging+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Credit-Asian-credit-most-stable-within-emerging-markets.html","enabled":true},{"name":"email","url":"?subject=Asian credit most stable within emerging markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Credit-Asian-credit-most-stable-within-emerging-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+credit+most+stable+within+emerging+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062015-Credit-Asian-credit-most-stable-within-emerging-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}