Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 16, 2017

Asia PMI signals softer growth momentum at start of Q2

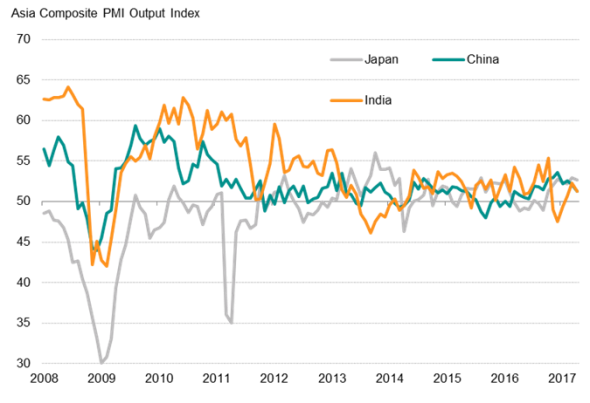

Growth momentum across Asia weakened slightly at the start of the second quarter, according to PMI survey data. The Asia Composite PMI, compiled by Markit from its various national surveys, registered 51.8 in April, down from March's near 3"-year high of 52.6 and lower than the average seen over the first quarter.

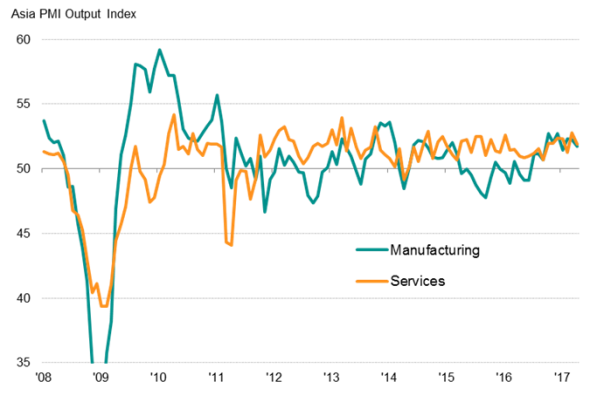

The latest reading is broadly consistent with Asia GDP growing at an annual rate of around 5.2% into the second quarter, down from approximately 5.5% at the end of Q1. Rates of output expansion in both manufacturing and services were in lockstep with each other, albeit both slower than seen in March. Nevertheless, the surveys point to on-going, broad-based moderate growth.

Asia PMI & economic growth

Sources: IHS Markit, Nikkei, Caixin, Thomson Reuters Datastream.

Manufacturing & service sectors

Sources: IHS Markit, Nikkei, Caixin.

Slower growth and inflation

Of the major Asian economies, Japan led growth for the second consecutive month, while weaker PMI readings were reported in China and India. But the fact that India's PMI remained in growth territory represents a marked improvement on the downturn signalled late last year after the implementation of the demonetisation policy.

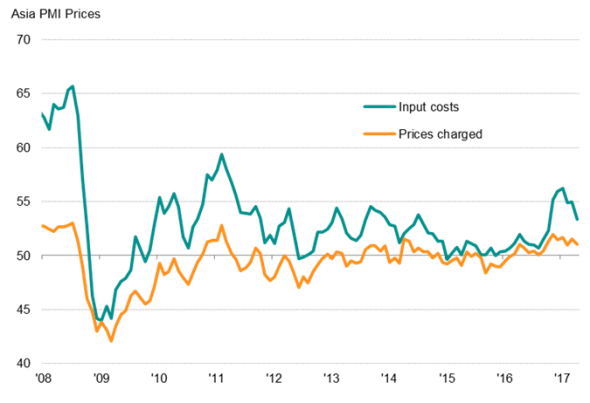

A waning of growth in the region was accompanied by an easing of inflationary pressures, especially in terms of input costs. Average cost burdens in Asia showed the weakest rate of increase in six months during April, which helped take pressure off selling prices. Firms raised their charges at the second slowest pace since September 2016. The moderation in inflationary pressures was seen across both manufacturing and service sectors.

Major Asian economies

Inflationary pressures

Sources: IHS Markit, Nikkei, Caixin

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-economics-asia-pmi-signals-softer-growth-momentum-at-start-of-q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-economics-asia-pmi-signals-softer-growth-momentum-at-start-of-q2.html&text=Asia+PMI+signals+softer+growth+momentum+at+start+of+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-economics-asia-pmi-signals-softer-growth-momentum-at-start-of-q2.html","enabled":true},{"name":"email","url":"?subject=Asia PMI signals softer growth momentum at start of Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-economics-asia-pmi-signals-softer-growth-momentum-at-start-of-q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+PMI+signals+softer+growth+momentum+at+start+of+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-economics-asia-pmi-signals-softer-growth-momentum-at-start-of-q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}