Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 16, 2016

Retail bears emerge after earnings disappoint

US retailers have seen a wave of negative sentiment in the last month, defying recent and relatively upbeat spending and sentiment surveys released last week.

- Short sellers have started to target the sector in the last month after previously covering

- Auto-exposed retailers targeted in current wave of bearish sentiment

- Six straight quarterly outflows have taken retail ETF AUM to a third of the levels seen in 2014

Bearish investors have chosen to ignore the relatively upbeat US retail and consumer confidence numbers that came out at the tail end of last week. Shorting activity in US retailers has instead continued to climb, reversing a covering trend seen in the run-up to the most recent earnings season.

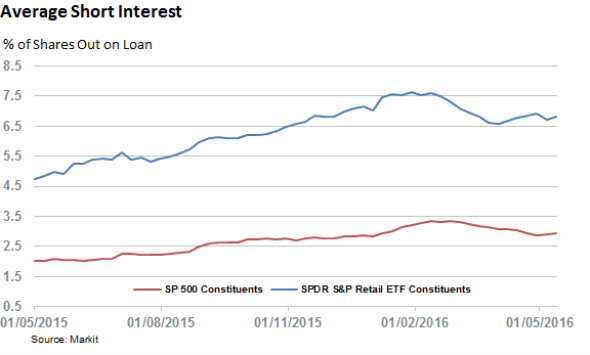

Demand to borrow shares in the constituents of the SPDR S&P Retail ETF (XRT) which tracks US focused retailers had fallen by 15% from the highs seen in the first week of April, but the recent disappointing Q1 earnings season has seen short sellers start to short the sector in earnest over the last few weeks. XRT constituents now see over twice the shorting activity on average than that seen across the S&P 500 index.

This recent spike in demand to borrow, which shows no signs of slowing down among the shares announcing earnings this week, has proved to be a canny bet given that the XRT underperformed the S&P 500 index by more than 5% after last week's slate of disappointing earnings. This underperformance is not a new trend, however, as the XRT trailed the wider S&P 500 index by roughly 10% in 12 months leading up to last week.

The big name to watch this week will be Hibbett Sports, which finds itself the most shorted US firm announcing earnings this week, with 26% of its shares out on loan.

Auto retailers targeted

One particular area attracting short sellers has been automotive-exposed retailers, with eight of the ten automotive focused constituents of SPDR S&P Retail ETF seeing an increase shorting activity since the start of the year. This rise in shoring activity can be seen across the board, as auto focused constituents of the XRT have seen demand to borrow surge by 60% year to date, while the rest of the retail field has seen flat demand to borrow.

The bid protagonists driving this trend have been car dealers Carmax and AutoNation which has seen short interest surge after disappointing in their last earnings updates. The former is now the most shorted of the lot with 21% of its shares out on loan while the latter has seen short interest surge by a notable seven-fold to hit 7.1% of shares outstanding.

ETF investors flee

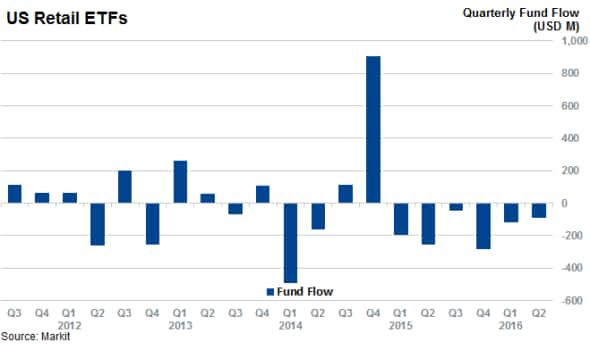

Few investors are lining up to buy into the recent dip given that the four US retail focused ETFs saw large outflows in the last two days of last week as the sector's shares registered new lows. But this exodus out of the sector is nothing new given that ETFs exposed to retail ETFs are on track for their sixth straight quarter of outflows. This impressive outflow streak means that the four ETFS which offer exposure to the sector now manage just one-third of the AUM enjoyed during their record high in Q4 2014, just before the sector started to lose ground the wider stock market.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-equities-retail-bears-emerge-after-earnings-disappoint.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-equities-retail-bears-emerge-after-earnings-disappoint.html&text=Retail+bears+emerge+after+earnings+disappoint","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-equities-retail-bears-emerge-after-earnings-disappoint.html","enabled":true},{"name":"email","url":"?subject=Retail bears emerge after earnings disappoint&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-equities-retail-bears-emerge-after-earnings-disappoint.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retail+bears+emerge+after+earnings+disappoint http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052016-equities-retail-bears-emerge-after-earnings-disappoint.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}