Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 16, 2015

Oil - winners and losers in the CDS market

There are conspicuous credits feeling the pain from the decline in the oil price

- The Swiss franc de-pegging has had a limited effect on the credit markets

- Oil exporters and oil services companies have been badly affected

- Copper has also declined, with Glencore among the casualties

Switzerland doesn't often feature in the credit world. The sovereign is AAA-rated and rarely trades in the CDS market due to its sound finances and status as a safe haven. But it was this superior credit standing that partly led to the dramatic de-pegging of its currency on Thursday.

The impact on the FX market was seismic. In comparison, the credit market was nonplussed. The Markit iTraxx Europe closed the week at 60bps, more than 2bps tighter than Wednesday's close. Swiss single names such as Holcim saw some widening, though the movements were relatively modest.

Eastern European sovereigns that have CHF loan exposure, such as Hungary, also widened, but again the deterioration was nothing out of the ordinary. The Swiss National Bank's reversal in policy is undoubtedly important, but the credit implications will be overshadowed by the ECB's QE decision next week.

Switzerland aside, the precipitous decline in the oil price has taken some of the attention away from Greece, albeit until the elections next week. Less than four months ago the price of WTI crude was more than $100 a barrel; now it is languishing below $50.

A bearish broker report drove the recent decline, but there are clear fundamental reasons behind oil's fall from grace. Supply remains buoyant, both from shale sources in the US and from OPEC. The latter shows no sign of changing its production policy; indeed, the Gulf states are engaged in a price war to protect market share. On the demand side, the eurozone is stuck in a slump and China is not growing at the rapid pace we have become accustomed to.

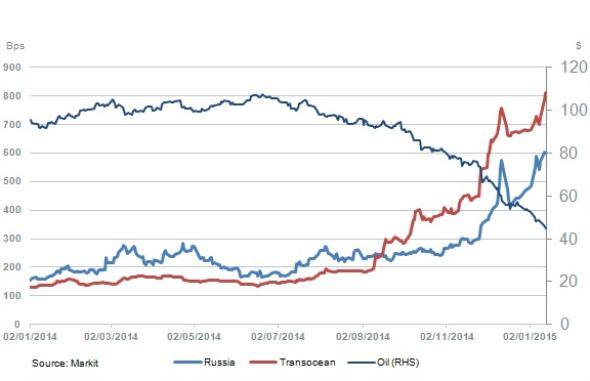

What does a falling oil price mean for the global economy and the credit markets? It results in a transfer of wealth from oil producers to consumers, which should provide a near-term boost to growth (the benefits to consumers are realised quicker than the losses to producers). But that will be of little comfort to oil exporting countries such as Russia and Venezuela. Both countries have seen their CDS spreads widen dramatically in tandem with the declining oil price.

Russia's spreads exceeded 600bps for the first time since March 2009, and the credit deterioration is all the more evident when one considers that it was trading at 300bps less than two months ago. The sovereign has ample reserves, but the combination of falling revenue from its main export and the impact of US/EU sanctions will impinge heavily on growth this year. Corporate defaults and concomitant bad debts in the banking system could follow, and the government may have to step in and provide capital. The ruble has weakened dramatically, and the CDS market is implying that Russia will struggle to hold on to its investment grade rating (it has a Markit Implied Rating of 'CCC').

Russia may be in a tight spot, but Venezuela is in an even worse position. It was downgraded two notches to Caa3 by Moody's, the agency citing the impact of lower oil prices on its already depleted reserves. The sovereign's CDS reflect its dire predicament - its one-year contract is trading at 54 points upfront, implying a 78% probability of default.

And it is not just government finances that are feeling the pressure from oil. Companies such as Transocean, an oil rig operator, have seen their spreads widen sharply. Transocean is an investment grade credit, but its Baa3 rating is on review for downgrade by Moody's, and the company's spreads of 900bps - almost 200bps wider than a week ago - imply that a cut to junk could be forthcoming. Its curve is steeply inverted at the short-end, an indication of the company's solid cash position, as well as the potential pitfalls in the years ahead if the oil price stays at current levels.

Oil is not the only commodity to experience a sharp fall in price. Copper has also declined, and Glencore, which generates a large proportion of its earnings from the industrial metal, felt the impact. The company's CDS spreads widened by more than 50bps to 212bps over the week, and the fact that it is based in Switzerland probably didn't help its cause.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-credit-oil-winners-and-losers-in-the-cds-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-credit-oil-winners-and-losers-in-the-cds-market.html&text=Oil+-+winners+and+losers+in+the+CDS+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-credit-oil-winners-and-losers-in-the-cds-market.html","enabled":true},{"name":"email","url":"?subject=Oil - winners and losers in the CDS market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-credit-oil-winners-and-losers-in-the-cds-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+-+winners+and+losers+in+the+CDS+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012015-credit-oil-winners-and-losers-in-the-cds-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}