Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 15, 2016

Japanese manufacturers report strong end to the year

Japan's manufacturing economy ended 2016 on a high note, with growth of output, new orders and employment all gaining momentum. However, margins are also being squeezed, with costs rising at an increased rate but selling prices falling.

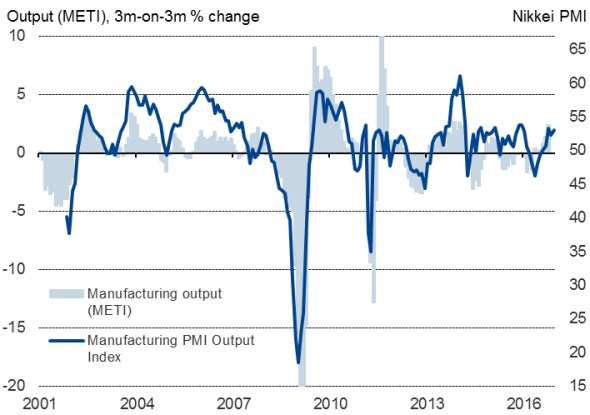

Manufacturing output

Strong end to the year

The flash Nikkei Manufacturing PMI, compiled by Markit, rose from 51.3 in November to 51.9 in December, its highest since January.

The average PMI reading of 51.6 for the fourth quarter is the highest since the final quarter of 2015, and suggests that manufacturing will have made a positive contribution to economic growth at the end of the year.

The survey showed manufacturing output rising at the second-fastest rate so far this year, indicating that the official (METI) measure of manufacturing production is rising in the fourth quarter at a quarterly rate of approximately 1.5-2.0% (note that the survey's Output Index exhibits an 80% correlation with the METI three-month rate of change, with the PMI leading the official data series by one month).

Combined with recent services PMI data, which showed tertiary sector growth reaching a ten-month high in November, the latest survey data suggest GDP growth will have accelerated from 0.5% in the third quarter to around 1.0% in the fourth quarter.

The stronger PMI readings in recent months contrast with the contraction signalled throughout the six months to August, and reflect a combination of factors which include a recovery from earthquake-related disruptions in the second quarter, stronger global demand and a recent deprecation of the yen.

Rising demand boosts production

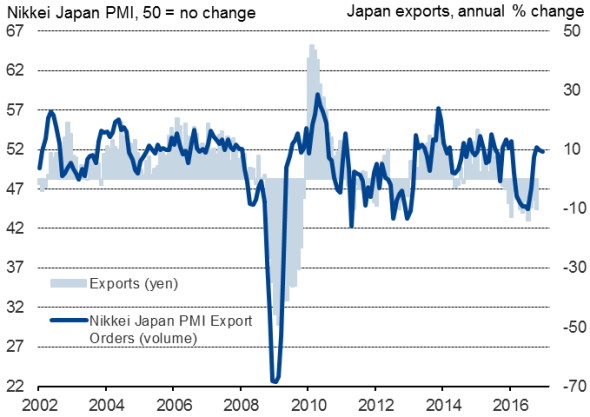

The December survey data showed output being buoyed by new orders growing at the strongest pace since January.

The rise in export order books slowed slightly but was nonetheless strong enough to end the best quarter so far this year in terms of overseas sales, which companies have attributed to the weakening of the yen relative to the US dollar as well as strengthening demand in key export markets, notably China and the US.

Exports

The upturn in demand prompted firms to take on extra staff at a rate not seen since April 2014. However, with the survey also indicating the largest fall in backlogs of work for four years, the pace of hiring may slip again unless new order inflows pick up further.

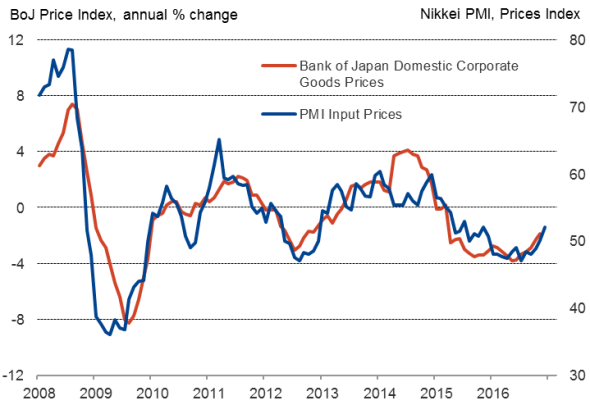

Margin squeeze

While the weaker yen helped drive an increase in exports, the exchange rate also pushed up the cost of imported raw materials, notably oil. Average input costs showed the largest monthly increase since November 2015. However, average selling prices fell marginally, indicating a squeeze on manufacturers' profit margins, which could also feed through to a reluctance to add to staff numbers.

Prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Japanese-manufacturers-report-strong-end-to-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Japanese-manufacturers-report-strong-end-to-the-year.html&text=Japanese+manufacturers+report+strong+end+to+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Japanese-manufacturers-report-strong-end-to-the-year.html","enabled":true},{"name":"email","url":"?subject=Japanese manufacturers report strong end to the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Japanese-manufacturers-report-strong-end-to-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+manufacturers+report+strong+end+to+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Japanese-manufacturers-report-strong-end-to-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}