Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 15, 2016

Eurozone flash PMI signals strong end to 2016 and promising start to 2017

Flash PMI data showed the eurozone economy ending 2016 on a strong note, with robust growth accompanied by rising price pressures.

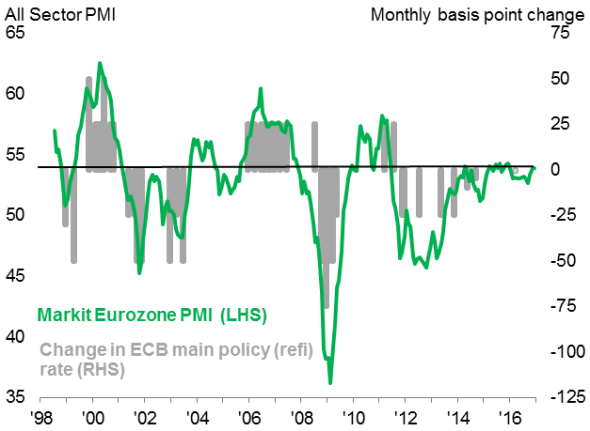

At 53.9 in December according to the flash estimate, the survey indicates that business activity grew at a rate identical to November's 11-month high, signalling GDP growth of 0.4% in the fourth quarter.

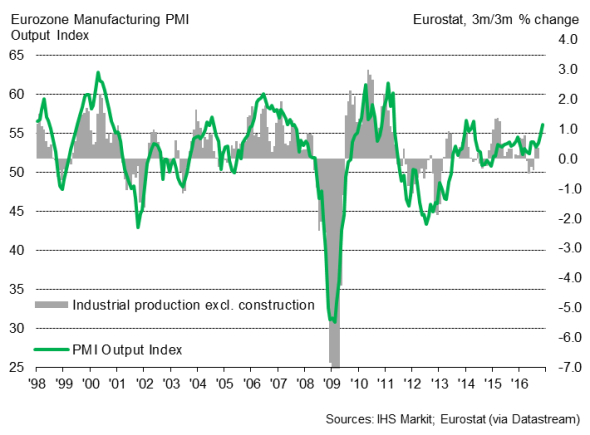

Manufacturing business conditions are improving at the steepest rate for five-and-a-half years as the weaker euro provided a boost to exports. The flash Manufacturing PMI jumped to 54.9, its highest since April 2011. Factory orders and backlogs of work were both reported to have risen to the greatest extents since April 2011.

The survey's manufacturing output index has risen to a level indicative of eurozone factory production rising at a quarterly rate in excess of 1%.

Eurozone manufacturing output

While service sector activity continued to rise, the rate of increase slowed, accompanied by similar moderations in growth of both employment and new business inflows. The expansion was nevertheless in line with the average seen in 2016.

Importantly, service sector optimism about the year ahead has meanwhile risen to an eight-month high, suggesting companies are largely shrugging off political uncertainty, for the time being at least.

However, while the December PMI surveys put the eurozone economy on a strong footing to start 2017, there is clearly the potential for political uncertainty to derail growth as elections loom in the Netherlands, France and Germany, and Brexit discussions begin.

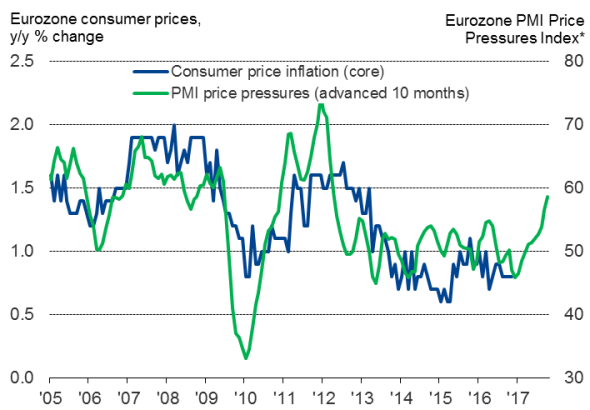

Besides the ongoing expansion, the most significant development in December was the intensification of inflationary pressures - a scenario that will please ECB policymakers.

Eurozone inflation

* Based on input cost and supplier delivery times indices.

Sources: IHS Markit, Eurostat.

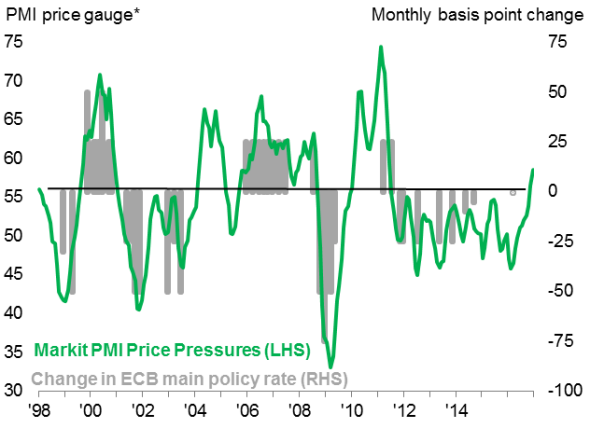

Eurozone PMI price pressures v ECB policy rate

* Based on input cost and supplier delivery times indices.

Rising global prices for many commodities, including oil and metals, is being exacerbated by the weak euro, pushing prices up at the sharpest rate for five-and-a-half years.

With the survey showing supply chain delays to be at their most widespread since June 2011, and backlogs of work across the economy growing to the greatest extent for five-and-a-half years in the closing months of 2016, the survey data suggest that capacity is being strained by the recent rise in demand. Such capacity shortages tend to spill over into higher prices in following months.

Eurozone PMI output v ECB policy rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Eurozone-flash-PMI-signals-strong-end-to-2016-and-promising-start-to-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Eurozone-flash-PMI-signals-strong-end-to-2016-and-promising-start-to-2017.html&text=Eurozone+flash+PMI+signals+strong+end+to+2016+and+promising+start+to+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Eurozone-flash-PMI-signals-strong-end-to-2016-and-promising-start-to-2017.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI signals strong end to 2016 and promising start to 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Eurozone-flash-PMI-signals-strong-end-to-2016-and-promising-start-to-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+signals+strong+end+to+2016+and+promising+start+to+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Eurozone-flash-PMI-signals-strong-end-to-2016-and-promising-start-to-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}