Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 15, 2015

Not everyone cheering Dell-EMC deal

The huge volumes of debt involved in the Dell-EMC merger have credit markets worried as bondholders on both sides of the table feel the impact.

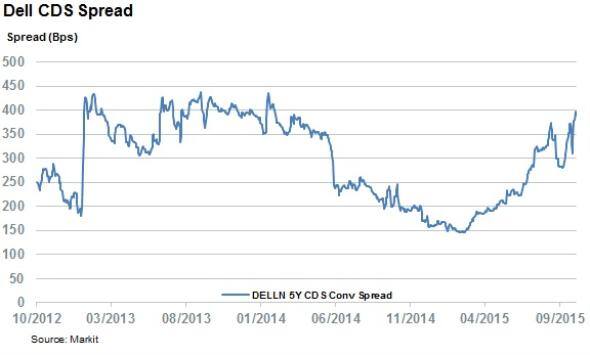

- Dell's CDS spread has jumped by a third in the last month to levels not seen since 2014

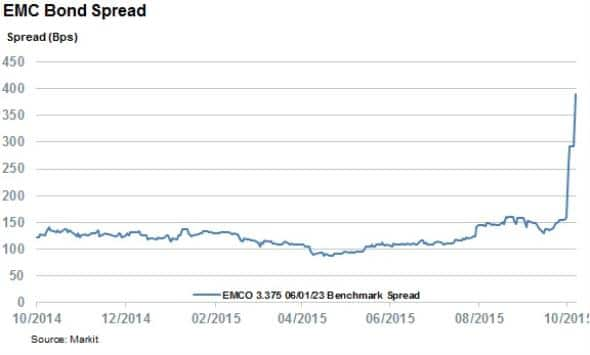

- EMC bonds have seen their spread over benchmark rates more than double

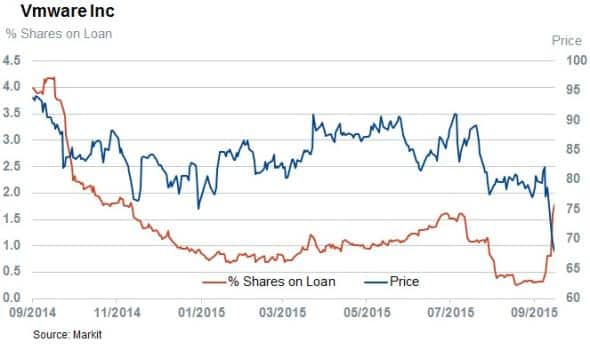

- WMware short interest tripled in the wake of the deal coming to light

Dell's deal to take over cloud storage and virtualisation firm EMC involves many working parts on both company's balance sheets. The $67bn deal, which would make it the largest technology tie-up upon completion, will see Dell take on $32bn of new debt onto its balance sheet, taking its total leverage to $50bn. This level of debt looks to have spooked some market participants, given that Dell's CDS spread has surged to levels not seen since the company was taken private last year in a $29bn leveraged buyout.

The latest Dell five year CDS spread stands at 390bps, more than a third higher than the levels seen just prior to the deal coming to light last week, which underpins the market's views on the large amount of debt that will sit on Dell's balance sheet after the deal completes.

Dell had largely answered investor doubts about its LBO as seen by the fact that the CDS spread more than halved in the nine months since the company went private to a low of 146bps in March. The slowdown in PC sales, which was one of the reasons for the EMC tie-up, had seen the spread revert, however, with the spread reaching 370bps during the worst of the recent market volatility.

Interestingly, Dell's bondholders have experienced the same volatility in the wake of the EMC deal. The benchmark spread demanded by investors to hold Dell's 4.625% April 2021 note was only 50bps wider at 400bps, less than the highs seen last month when investors required 420bps of extra yield to hold these bonds.

EMC bonds also suffer

While Dell bondholders have felt little of the credit volatility seen in the CDS market, existing EMC bondholders haven't been so lucky. The $5bn of bonds issued by EMC didn't have change of control clauses which would have forced Dell to cash them out at par. This would have come in handy given that the takeover means that these bonds now roll-up to a lesser rated parent company.

Dell current BB credit rating, two less than EMC's, means that the extra yield required by investors to hold EMC bonds more than doubled overnight to 390bps to match those of the lesser rated purchasing company.

VMware investors also out cold

Another stakeholder in the takeover acquisition left out cold in the deal is VMware equity holders. Dell will issue tracking stock in VMware to existing EMC shareholders, essentially diluting existing shareholders. This development saw VMware shares trade at a new two year low while short interest in the firm tripled to 2% of shares outstanding.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-credit-not-everyone-cheering-dell-emc-deal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-credit-not-everyone-cheering-dell-emc-deal.html&text=Not+everyone+cheering+Dell-EMC+deal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-credit-not-everyone-cheering-dell-emc-deal.html","enabled":true},{"name":"email","url":"?subject=Not everyone cheering Dell-EMC deal&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-credit-not-everyone-cheering-dell-emc-deal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Not+everyone+cheering+Dell-EMC+deal http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-credit-not-everyone-cheering-dell-emc-deal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}