Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 15, 2016

UK unemployment falls to lowest in over a decade, but job creation slows

News of better than expected health of the labour market in April suggests that employment is holding up despite signs that the economy is in the midst of a soft patch.

The rate of unemployment has fallen to its lowest for more than a decade and employment continued to rise in April. Pay growth has also picked up.

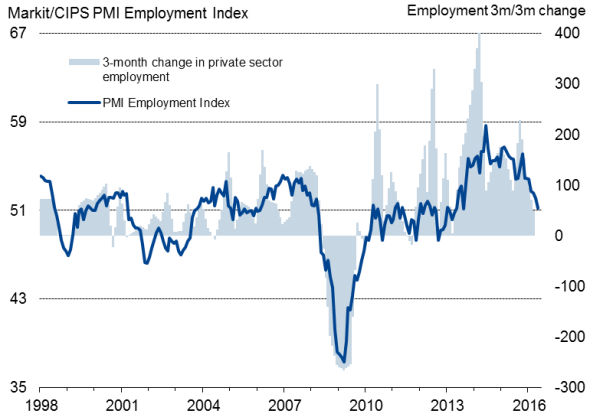

However, more recent survey data suggest that employers' demand for staff has cooled amid worries about Brexit and a slowing economy, suggesting the good news should be treated with some caution.

Falling joblessness, rising wages

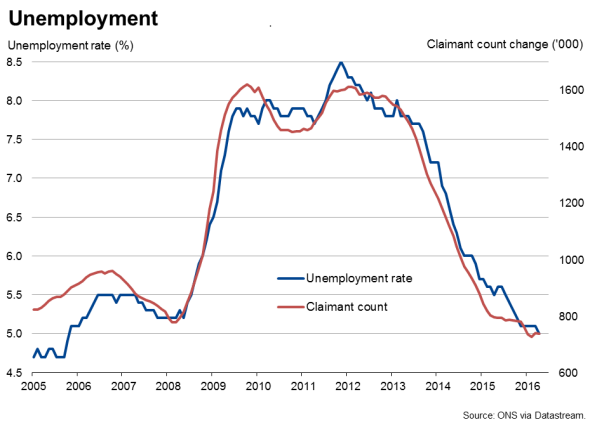

The unemployment rate fell to 5.0% in the three months to April, its lowest since October 2005, as a result of joblessness falling by 20,000 and employment increasing by 55,000, according to the Office for National Statistics.

Employment

There was also better news on wages, though it's not clear whether the underlying pay trend has improved significantly. Average wages rose 2.5% on a year ago in April, but the increase appears to have been driven by the introduction of the National Living Wage during the month. Over the three months to April, pay growth was unchanged at 2.0%, with pay excluding bonuses edging up a modest 2.3% compared to 2.2% in the three months to March.

Consumer driven growth

The improving labour market is helping support the economy via increased consumer spending. Separate survey data indicated that households enjoyed increases in both workplace activity and income from employment in June which, alongside low inflation, helped lift households' views on their finances.

Markit's Household Finance Index, measuring current financial conditions, picked up from May's 22-month low.

However, recruitment companies have meanwhile reported that although the introduction of the National Living Wage has pushed average wage rates higher, the increase in staff costs has also led to a pull-back in hiring at some firms. Slower economic growth and rising uncertainty may also have hit hiring in recent months, suggesting the labour market data for May and June may disappoint.

Outlook worries

The business surveys are pointing to a further slowing of economic growth in the second quarter, down to 0.2%, as a result of weaker global demand and intensifying uncertainty regarding Brexit. Companies have reported that both investment and hiring have been affected, albeit often temporarily until the outlook clears. The May PMI surveys recorded the weakest rise in private sector employment since August 2013. Similarly, although the official data showed employment rising in the three months to April, the increase was the smallest recorded for three years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-economics-uk-unemployment-falls-to-lowest-in-over-a-decade-but-job-creation-slows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-economics-uk-unemployment-falls-to-lowest-in-over-a-decade-but-job-creation-slows.html&text=UK+unemployment+falls+to+lowest+in+over+a+decade%2c+but+job+creation+slows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-economics-uk-unemployment-falls-to-lowest-in-over-a-decade-but-job-creation-slows.html","enabled":true},{"name":"email","url":"?subject=UK unemployment falls to lowest in over a decade, but job creation slows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-economics-uk-unemployment-falls-to-lowest-in-over-a-decade-but-job-creation-slows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+unemployment+falls+to+lowest+in+over+a+decade%2c+but+job+creation+slows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-economics-uk-unemployment-falls-to-lowest-in-over-a-decade-but-job-creation-slows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}