Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 15, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Retailers and oil & gas helicopter charter the most shorted in North America

- Short sellers doubt fairly robust results expected from Coca Cola Hellenic

- Sanrio's Hello Kitty retains position as the most shorted in Apac ahead of earnings

North America

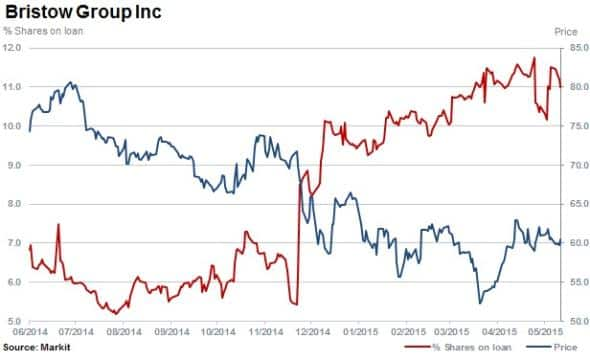

A refreshing week ahead as the only oil & gas firm occupying the top twenty North America is Bristow Group with currently has 11% of shares outstanding on loan. The firm provides helicopter charter services to oil & gas majors around the world.

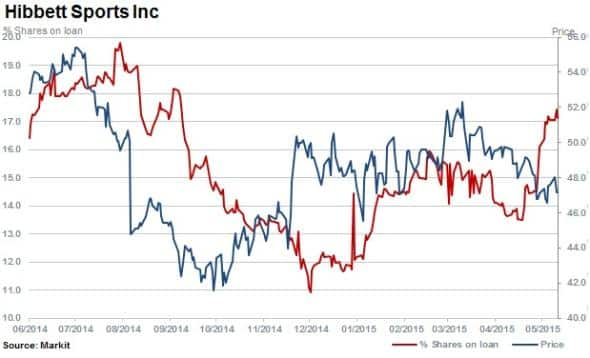

Most shorted this week in North America is Hibbett Sports, a sporting goods retailing chain. The retailer has 17% of shares outstanding on loan, having recently jumped by 27% in the last month. Consensus forecasts point to robust sales for the fiscal year for HIbbett but operating profits are expected to be flat. Absent of any major announcements, short sellers may be expecting earnings to disappoint.

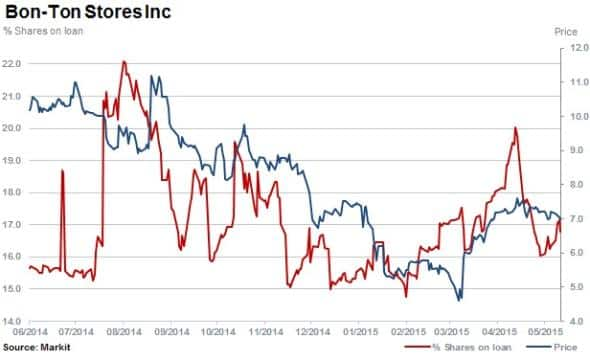

Second most shorted ahead of earnings is Bon-Ton Stores with 16.8% of shares outstanding on loan. The retail department store owner and operator sells apparel, accessories, cosmetics and furniture. Since 2010 the firm's sales have stagnated with the firm posting four consecutive years of net losses. Consensus forecasts expect these losses to continue despite forecasts for a strong earnings from the holiday trading quarter over 2014/2015.

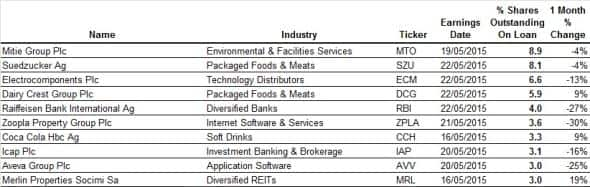

Western Europe

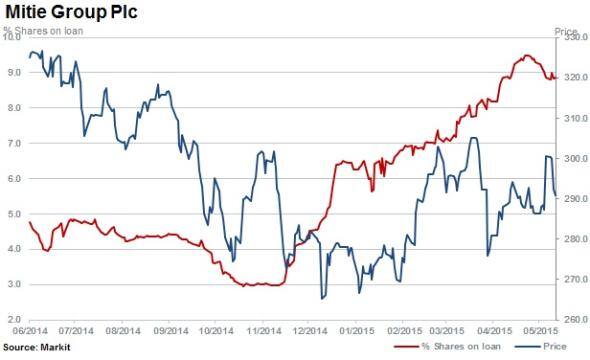

Facilities management, care provider and outsourcing firm Mitie Group, is the most shorted in Europe ahead of earnings with 8.9% of shares outstanding on loan. The company is facing allegations, levelled this week, that it has not been paying care worker staff the minimum wage. News prompted a sharp sell off in shares.

Short sellers in Zoopla have retreated 30% in the last week as the stock moved 9% higher. Shares outstanding on loan have fallen to 3.6% after reaching highs above 5% after steadily rising on concerns on the impact of new entrant; On the Market.

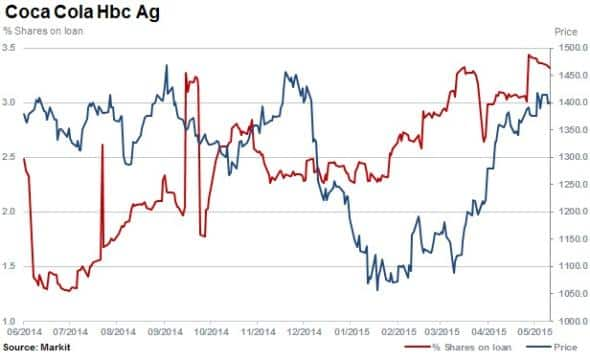

Shares in Coca Cola Hellenic have rallied since February despite the company's exposure to Greece. The company released a trading statement expecting single digit growth in the fragile economy. Short sellers however do not seem convinced, with shares outstanding on loan increasing by 26% to 3.3% while the share price has increased 31% since the beginning of January 2015.

Asia Pacific

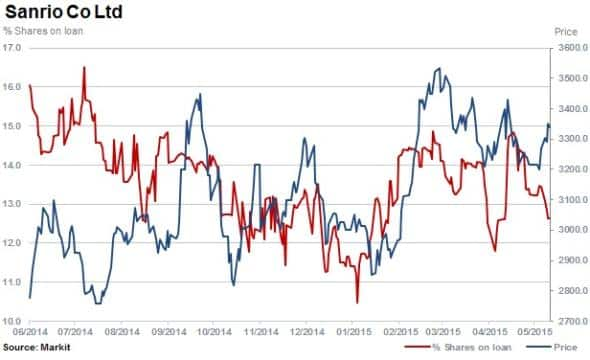

Sanrio retains its position as the most shorted stock in Apac ahead of earnings.

The character goods and merchandise manufacturer, most well-known as the Hello Kitty brand, has seen a modest decline in shares outstanding on in the past month to 12.6%.

Solar sell manufacturer Gintech Energy is the second most shorted in Apac ahead of earnings, with 7.5% of shares outstanding on loan. Shares in the company have continued to slide over the last 12 months, declining 45%. Short interest has declined in the last three months by 23%. Consensus earnings forecasts expect the company to post its largest loss per share since FY11.

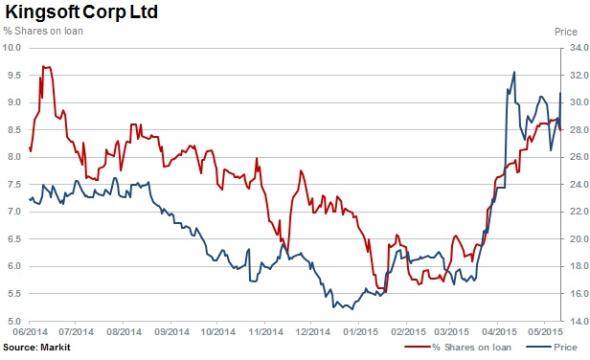

Beijing based, and not to be confused with King Digital, Kingsoft develops a wide range of software and applications. Shares in the company have increased by 72% since the end of February accompanied with a 46% increase in shares outstanding on loan to 8.5%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}