Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 15, 2016

Treasuries plunge below 2%; BHP succumbs to oil rout

Continued market volatility this week has seen increased demand for risk free assets, while an asset write off has sent BHP Billiton's credit risk soaring.

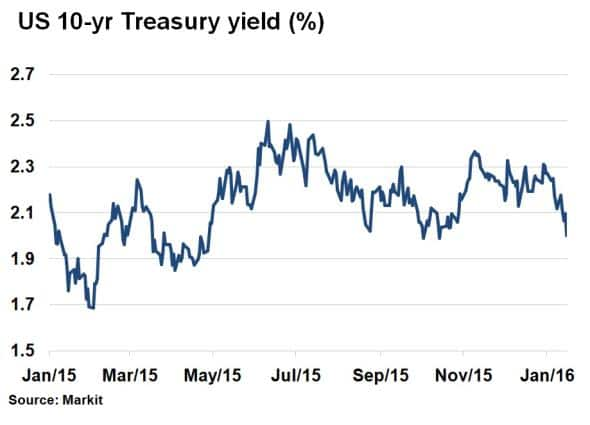

- 10-yr US treasury yields have fallen from 2.27% to 2% so far this year

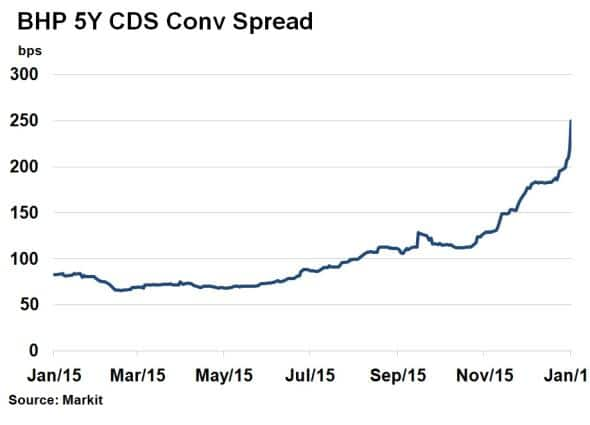

- BHP Billiton has seen its 5-yr CDS spread soar 26% this week

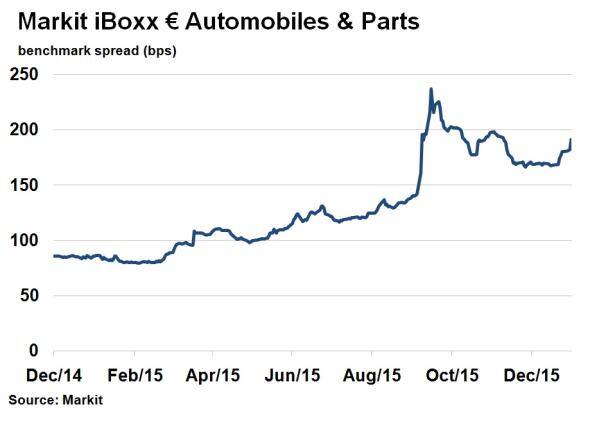

- Markit iBoxx " Automobiles and Parts index sees spread widen 9bps after Renault caught up in emissions scandal

Run for safety

After seeing the worst start to a year on record for the US stock market, investors have run for cover to "safe haven" assets such as US treasuries.

Yields on 10-yr treasuries have fallen from 2.27% to 2% (intraday today) so far this year, according to Markit's bond pricing service. The near 30bps swing was similar to that seen in late summer last year, amid similar global macroeconomic concerns.

But what makes the recent movement more compelling is the disparity in monetary policy between now and then, as the Fed has already begun tightening with a 25bps interest rate hike last month. Typically seen as a move to cool an economy, this may present a conundrum if global risks intensify.

Back in September, the Fed delayed raising interest rates for exactly these reasons. Lower 10-yr treasury yields are a signal of caution in the market, or expectations that the Fed may slow down their tightening cycle (futures now suggest July for the next hike), or scrap it all together.

BHP woes

Among London-listed European and international miners, the highly leveraged Glencore and Anglo American have grabbed much of the limelight as commodity prices fell throughout 2015. This week however BHP Billiton, an Australian mining giant, which was largely unscathed for most of last year announced plans to write off $7.2bn of its US shale assets and cut its dividend for the first time since 2008.

According to Markit's CDS pricing service, intraday 5-yr spreads widened to 250bps as of today; 51bps or 26% wider over the week. Ironically, having been warned by rating agencies that its dividend policy posed a risk to its credit rating, the announcement has actually seen the company's credit risk worsen, as perceived by the market. In fact, CDS spreads were already implying it's current A rating was under grave threat even before the announcement.

Renault enters the fray

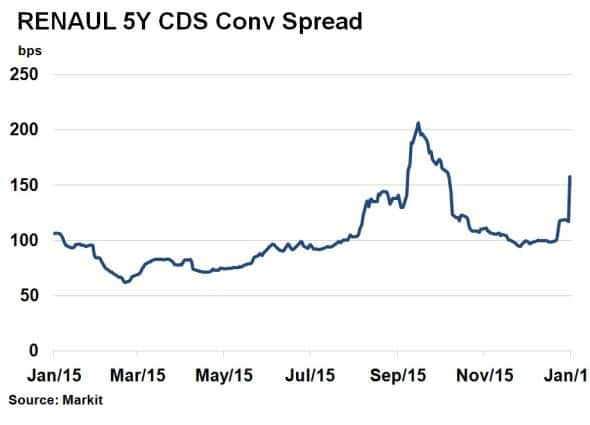

In an example of just how nervous investors have become in the wake of the Volkswagen emissions scandal, French car maker Renault saw its credit risk surge as news broke investigators visited three of its sites.

Renault's 5-yr CDS spread widened 40bps on the back of the news but the company soon announced that there were no irregularities found. Spreads however remain elevated, having only tightened 7bps as of today's intraday latest.

The effects were also far reached in Europe's auto's industry, as the Markit iBoxx " Automobiles & Parts index saw its annual benchmark spread, a measure of credit risk in the sector, spike 9bps. Although it remains well below last September's highs, it was another demonstration of how quick risk can escalate, given existing tensions in the sector.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Credit-Treasuries-plunge-below-2-BHP-succumbs-to-oil-rout.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Credit-Treasuries-plunge-below-2-BHP-succumbs-to-oil-rout.html&text=Treasuries+plunge+below+2%25%3b+BHP+succumbs+to+oil+rout","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Credit-Treasuries-plunge-below-2-BHP-succumbs-to-oil-rout.html","enabled":true},{"name":"email","url":"?subject=Treasuries plunge below 2%; BHP succumbs to oil rout&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Credit-Treasuries-plunge-below-2-BHP-succumbs-to-oil-rout.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Treasuries+plunge+below+2%25%3b+BHP+succumbs+to+oil+rout http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Credit-Treasuries-plunge-below-2-BHP-succumbs-to-oil-rout.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}