Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 15, 2015

Exporters drive Japanese dividends

The depreciating yen has export heavy carmakers and industrial firms set to drive dividend payments in the newly formed Nikkei 400 index in the coming fiscal year.

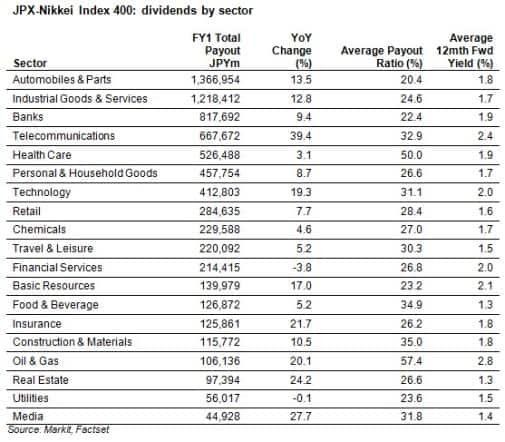

- Carmakers are set to pay the most dividends out of any sector of the newly formed Nikkei 400 with JPY 1.36 trillion of payments

- Toyota is set to be the largest single dividend payer in the index with over twice the payments of the second largest payer, NTT Docomo

- Investors have continued to plough funds into yen hedged ETFs, suggesting export driven dividend boost may be set to continue

The Japanese central bank's recent drive to lower the country's currency looks set to (literally) pay dividends in the coming year, according to the latest research from Markit's dividend forecasting research which has export heavy carmakers and industrial services firms set to be the largest payers of the newly formed Nikkei 400 index.

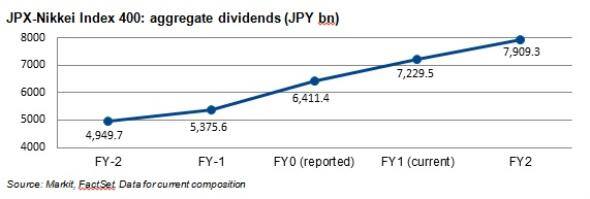

The index, whose constituents are set to pay an aggregate JPY 7.22 trillion in the coming fiscal year, is heavily reliant on the previously mentioned sectors for that total, with these firms set to pay just over a third of the index's total dividend payments. Automobile firms and their component makers come in as the largest paying sector, with JPY 1.36 trillion of dividends; a number that is slightly ahead of the JPY 1.21 trillion which industrial goods firms are set to return to investors.

On the same theme, technology firms are also forecast to boost payments in the coming year as the sectors aggregate payment is set to jump by over 19% from the previous year - beating the 12.8% payment boost expected across the index.

Companies driving the trend

Toyota, which drives over two thirds of its revenue from outside Japan, is the standout payer among the sectors with a forecasted JPY 613 billion. The falling yen has seen net income at the firm double in 2013 from the previous year, owing to a large surge in revenues. The recent fall in the yen's value in October looks set to push this trend onwards in the current fiscal year, as Toyota recently announced two straight above expectations earnings releases.

Also in the auto space, Nissan and Honda are forecast to boost payments along with tire company Toyo Tire which has guided that it will boost payment by two thirds from the previous year.

In the industrial sector, robotic and automation firms Keyence and Fanuc are both expected to post strong increases in dividend payments in the wake of large boosts in turnover, which both firms have been able to convert to the bottom line.

No sign of any wariness of yen's level

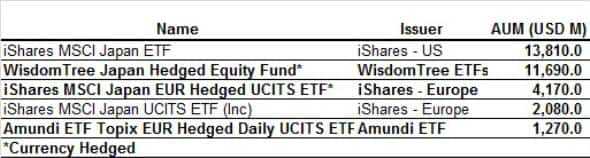

If ETF flows are anything to go by, the yen does not show any signs of reverting back from its recent levels as overseas investors have continued to add to their yen hedged Japan exposure. These products, which protect investors from further fall in the yen's level, have grown in popularity over the last 12 months and now manage 46% of all overseas Japan tracking funds. A switch out of these funds could be read as a reversal to the recent trend as investors would benefit from a rise in the value of the yen relative to international currencies.

The largest such funds, the WisdomTree Japan Hedged Equity Fund, now manages a quarter of all Japanese exposed overseas funds with assets of $11.7bn currently under management.

Interestingly, this desire to hedge against the falling yen is evenly split among US and European investors.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012015-equities-exporters-drive-japanese-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012015-equities-exporters-drive-japanese-dividends.html&text=Exporters+drive+Japanese+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012015-equities-exporters-drive-japanese-dividends.html","enabled":true},{"name":"email","url":"?subject=Exporters drive Japanese dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012015-equities-exporters-drive-japanese-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Exporters+drive+Japanese+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012015-equities-exporters-drive-japanese-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}