Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 14, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Retailers Sears and Abercrombie heavily shorted

- Easyjet sees a fourfold jump in short interest since the Brexit referendum

- Cyberdyne short interest at an all-time high after activist pressure

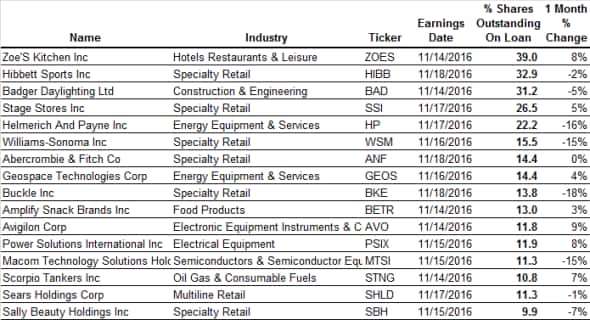

North America

Consumer focused stocks feature heavily among this week's list of heavily shorted companies announcing earnings in North America. While overall consumer spending has been relatively buoyant, short sellers have always had an affinity for the sector's laggards to target the sector's laggards, especially after previous poor results.

This is definitely the case for casual dining chain Zoe's Kitchen which tops the list of high conviction shorts announcing results. The majority of the 39% of Zoe's shares which were borrowed came in the wake of its poor second quarter earning which saw the firm disappoint on a venue basis as well as trim its forward guidance. This prompted short sellers to double down on an already heavily shorted name after its shares retreated by a quarter.

Retailers are also high on consumer focused short sellers' minds with seven retailers featuring among this week's high conviction short targets. Sport retailer Hibbett Sports is the most shorted of the list as just under a third of its shares are out on loan, an all-time high for the firm. Short sellers have continued to stay in this name despite the fact that better than expected profits in its last two quarterly earnings figure have seen its shares rally from the lows set at the start of the year.

Teen retailer Abercrombie & Fitch has not had the same run of good results and the firm's most recent quarterly earnings, which saw Abercrombie lower its full year expectations, saw short sellers more than double their positions to the current 15% of shares outstanding.

Another household name seeing heavy demand to borrow its shares is Sears which has 11% of its shares out on loan. Sears, who is no stranger to short sellers, has seen a doubling of its demand to borrow since the start of the year when its shares were trading over 40% higher.

Looking beyond focused stocks, Badger Daylighting continues to feature high on the most shorted ahead of earnings despite the fact that its most recent earnings update, where the company announced its firs YoY growth in quarterly revenues, sparked a 36% rally in its stock price. Short sellers have shown no signs of wavering in the face of this recent rally as the current demand to borrow Barger's shares has actually increased in the last three months.

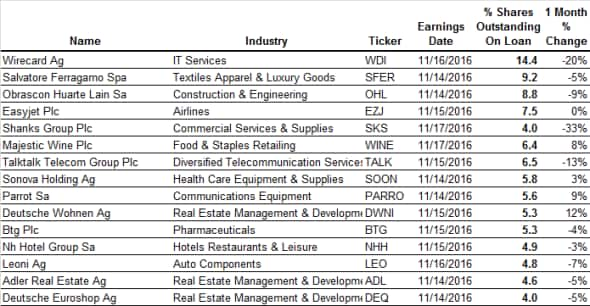

Europe

The key European short target announcing earnings this week is German payment processor Wirecard. Wirecard came under heavy scrutiny earlier this year when a critical research report raised allegations regarding the company's lack of internal controls. The resulting fall saw short sellers zero in on Wirecard shares of which 25% were out on loan at the peak in April. However, the company has been able to placate some its doubters and its shares have rebounded from the lows. Short sellers are also showing little appetite to short into this recent rally as the current demand to borrow Wirecard shares is down by over a third from the previous highs.

Short sellers have shown much more tenacity in fashion retailer Salvatore Ferragamo, the second most shorted firm announcing earnings in Europe this week. Ferragamo has suffered from two straight quarters of falling sales, as the European luxury sector was forced to contend with falling demand for their wares. While this string of poor earnings results hasn't taken a material amount off of the company's share price, it has attracted short sellers which have more than doubled their positions in the last six month to the current 9% of shares outstanding.

Airline Easyjet is the highest conviction UK firm announcing earnings with over 7.5% of its shares out on loan. Easyjet's recent bearish activity has come at the wake of the UK's recent referendum which has taken 20% off the value of the pound. These currency headwinds have not only forced the company to contend with rising fuel costs, which the company singled out as the reason for its October profits warning, but it also stands to make UK consumers less keen to travel overseas which could further hurt results. Short sellers have taken these developments to heart as Easyjet's current short interest is over four times its pre referendum level.

Another pound reliant stock coming under pressure from short sellers is Majestic Wine which has 6.4% of its shares out on loan. Majestic did come under pressure from short sellers in the wake of the referendum as investors bet that a falling pound would negatively impact Majestic's business despite the fact that the firm proactively hedged its sterling exposure. The company's most recent wave of shorting activity was unrelated to the referendum however as it followed poor results which were mostly attributed to poor results in Majestic's US operations.

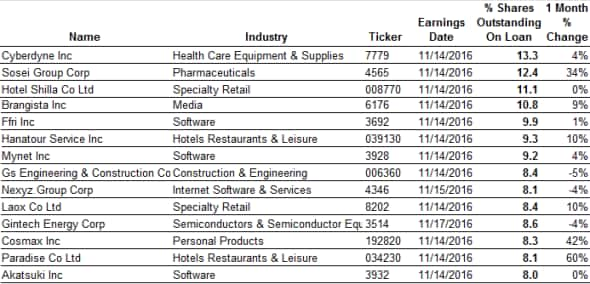

Asia

Activist short sellers are also in this weeks' most shorted Asian company, Cyberdyne, which has 13.4% of its shares out on loan. The maker of robotic exoskeletons was singled out by Citron Research back in August which proclaimed that the company is undeserving of its current valuation. This announcement led to a sharp sell-off in Cyberdyne shares which the company has yet to recover from and prompted short sellers to increase their already high positions to the current all-time high.

Korean hotel operators also feature high on short seller's priorities with Hotel Shilla, Hanatour and Paradise co all making the list of heavily shorted companies announcing earnings.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}