Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 14, 2014

How to deal with a problem like Russia

Russia's apparent incursion into Ukraine reignites geopolitical risk

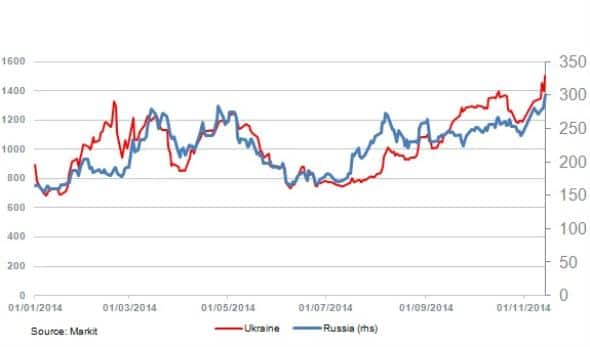

- Ukraine's CDS spreads hit 1,500bps for first time in almost five years

- Russia breaches 300bps

- Liquidity is strong in Russia but weak in Ukraine

Geopolitical risk was all the rage earlier this year and played a major part in credit spreads widening in several short, sharp bursts. Monetary policy soon resumed its role as the main driver of sentiment, but there were indications this week that it may have to move aside temporarily.

Ukraine CDS spreads widened 175bps this week and are now at their widest level since December 2009. Prices in the cash market also collapsed, a reflection of renewed concerns that the conflict with Russia may be about to flare up again. Reports that Russian troops have entered eastern Ukraine were reminiscent of the incursion in August. The military presence was subsequently withdrawn, but if the reports are true, then we could be seeing further escalation.

Ukraine's CDS spreads breached 1,000bps in August - a significant move at that time. But now they are being quoted at 1,500bps, and the curve is steeply inverted - a typical sign of credit distress. Angela Merkel indicated on November 11th that the EU is not planning further sanctions on Russia, which may lead some in the market to expect additional military incursions into the Ukraine.

Credit investors have their eyes on Ukraine's dwindling foreign exchange reserves and the currency is rapidly losing value after the central bank abandoned it unofficial peg last week. The depreciation places immense pressure on the country's banking system and there is no sign of the IMF increasing its inadequate bailout programme agreed in April.

So, it is no surprise that the CDS markets are pointing towards a probability of default in excess of 60%. But it should be noted here that Ukraine's CDS are by no means the most liquid in the sovereign market. Few dealers regularly quote the name and the bid-offer spreads tend to be around the 100bps level, according to Markit liquidity metrics. Fast money investors that often get involved in high beta trades may not be quite as keen as they once were.

Russia's CDS, on the other hand, are among the most liquid in the market. It regularly ranks in the top ten active names (DTCC), trades with a bid-offer spread of about 3bps and has a plethora of banks making markets on the sovereign. Russia is trading at 300bps (the first time it has breached this level since October 2011) and if the conflagration in eastern Ukraine intensifies we can expect spreads to widen further.

Leaders of the G20 meet this weekend, and not for the first time they will no doubt be discussing how to deal with a problem like Russia.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-credit-how-to-deal-with-a-problem-like-russia.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-credit-how-to-deal-with-a-problem-like-russia.html&text=How+to+deal+with+a+problem+like+Russia","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-credit-how-to-deal-with-a-problem-like-russia.html","enabled":true},{"name":"email","url":"?subject=How to deal with a problem like Russia&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-credit-how-to-deal-with-a-problem-like-russia.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=How+to+deal+with+a+problem+like+Russia http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-credit-how-to-deal-with-a-problem-like-russia.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}