Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 14, 2015

Short sellers target teen retailers

The recent American Apparel bankruptcy highlights the challenges facing certain clothing retailers within the Consumer Discretionary sector, which has still managed to outperform year to date.

- Weak sales sees average sector short interest spike higher in the third quarter

- Iconic US clothing brands see sales and shares fall, attracting short sellers to key names

- Shorts target fickle client demographics of Abercrombie & Fitch and Urban Outfitters

A long thread

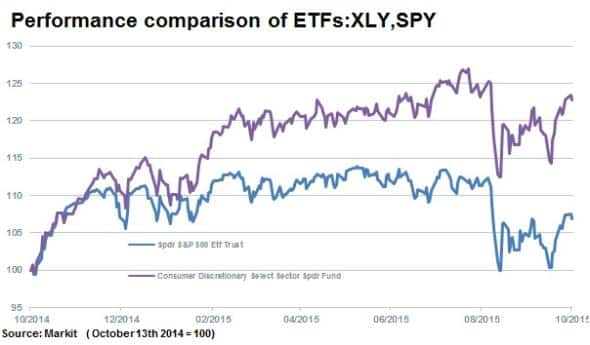

US Consumer Discretionary stocks have outperformed year to date and over the last 12 months, as shown below with the SPDR Consumer Discretionary Select ETF outperforming the SPDR S&P 500 ETF by a margin of 16%.

Key stock performances by large names such as Nike, Home Depot and Starbucks have lifted the entire sector but not all shares have seen similar share price movements.

Within Clothing and Apparel retailers, certain brands have been falling out of favour as of late; impacted by changing consumer tastes. Companies have also had to battle weaker sales outside of the US, impacted by a stronger dollar and weaker economies. These developments have lured short sellers to the industry.

Made in America

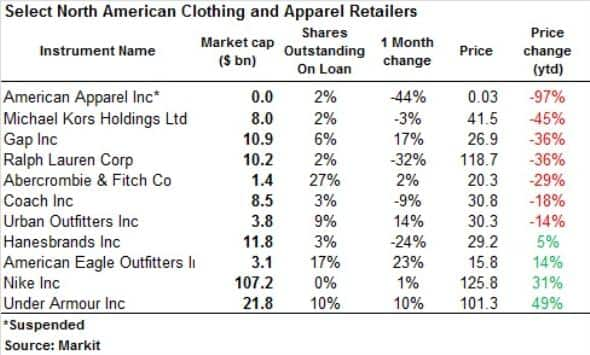

Across a universe of North American stocks within the sector (with more than $100m in market capitalisation), Apparel retailers have seen a significant rise in average short interest recently to 6.5%; 50% more than the sector average of 4.5%.

Short selling however has not been indiscriminate across the sector, with shorts instead targeting key names.

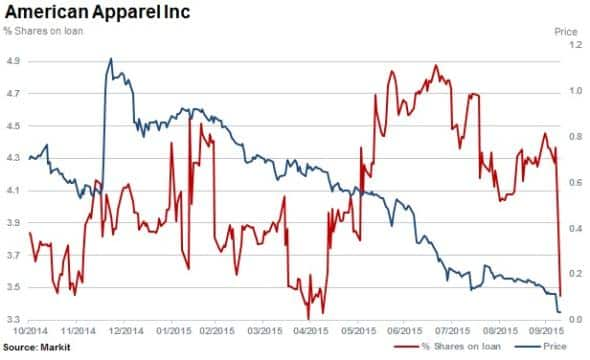

American Apparel has had its fair share of internal issues over the last few years with the company firing founder ceo Dov Charney in December 2014. The company has been unable to materially grow sales over the last three years, and has posted five years of consecutive losses.

American Apparel's shares were suspended from trading on October 6th 2015 by the NYSE as chapter 11 bankruptcy proceedings get underway to restructure the firm's debt burden. The bankruptcy underscores the challenges faced by certain retailers which have seen varying fortunes over the last few years.

Iconic brands

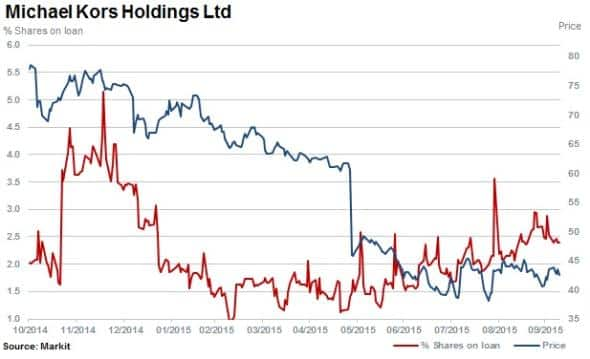

Michael Kors is one such firm. It has seen falling sales which it attributed to fewer tourists in the US and a stronger dollar impacting foreign sales. Its shares are 45% down year to date, but short sellers seem to be giving management the benefit of the doubt as the firm sees a relatively low 2.5% of its shares out on loan.

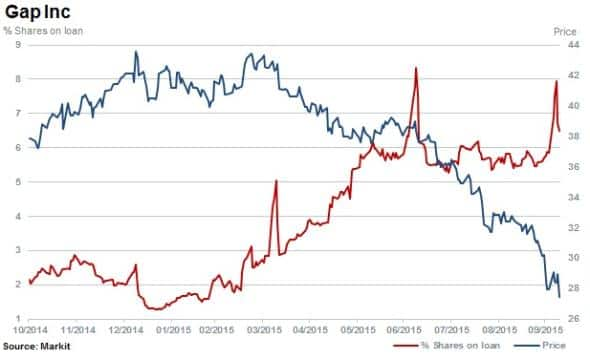

Gap's management has not benefited from the same luxury as its shares have attracted short sellers in 2015, with demand to borrow its shares jumping five-fold year to date to 6.5% of shares out on loan. Its stock is down over a third as the company also struggles with declining sales.

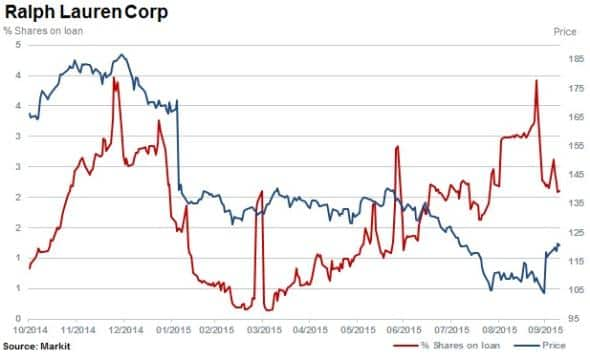

Shares in Ralph Lauren have also fallen over a third year to date, but jumped after news that Stefan Larsson from Old Navy (Gap) would take the lead at the company. Short interest has steadily climbed year to date but still remains relatively low at 2% of shares outstanding on loan.

Teen retailers see the action

Short sellers have been less hesitant to target historically teen focused retailers that have lost their cool and have large US mall exposure with declining foot traffic. The tastes of this coveted demographic have shifted away from logos and towards typically lower prices offered at fast fashion chains such as H&M and Zara.

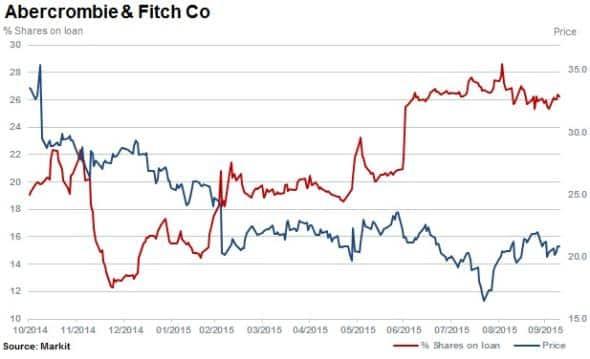

One stock that highlights this trend well is Abercrombie & Fitch with a third of shares sold short. The stock has fallen 29% year to date and 41% in the last 12 months.

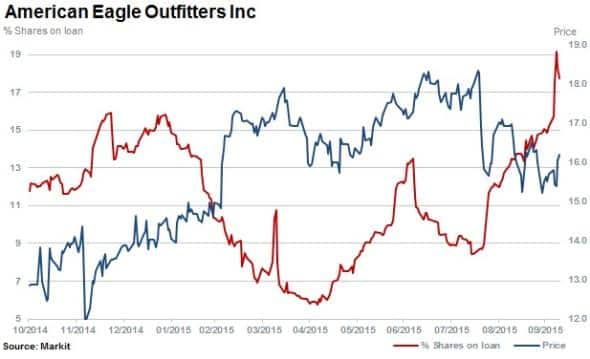

Short interest in American Eagle Outfitters has surged since April rising to 17% of shares outstanding on loan. Short sellers may be targeting the firm's recent foray into the competitive UK market as an entry ticket into Europe.

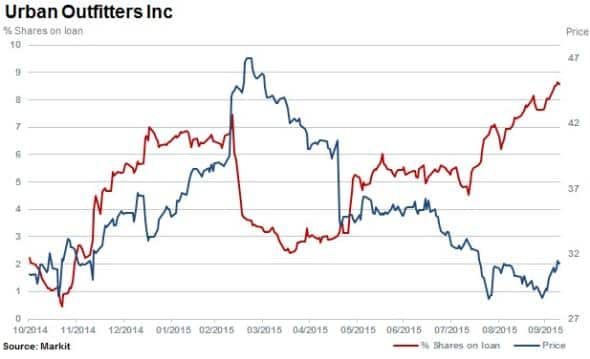

Short interest in Urban Outfitters has hit a two year high with 8.6% of shares outstanding on loan. The stock is down 35% since March highs.

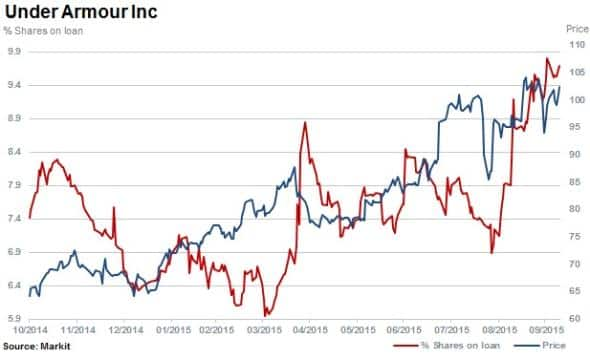

Shorts have followed Under Armour's share price rise with 10% of shares outstanding on loan currently.

The performance of the apparel brand has posted over five years of strong sales and earnings growth with strong consensus forecasts for the full year.

Relte Stephen Schutte, Analyst at Markit

Posted 14 October 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-equities-short-sellers-target-teen-retailers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-equities-short-sellers-target-teen-retailers.html&text=Short+sellers+target+teen+retailers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-equities-short-sellers-target-teen-retailers.html","enabled":true},{"name":"email","url":"?subject=Short sellers target teen retailers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-equities-short-sellers-target-teen-retailers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+target+teen+retailers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-equities-short-sellers-target-teen-retailers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}