Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 14, 2014

Low beta continues to perform

The recent bout of market volatility has seen the riskiest shares in the market underperform their low risk peers by a significant margin. We quantify the trend playing out across global equities.

- The most volatile US large cap shares have underperformed the market for the last three months

- This trend has been mirrored in global shares

- ETF investors have been actively playing this trend over the last few months

The autopilot looks to have been taken off the market since the opening weeks of the third quarter, as evident by the 5% fall in the S&P 500 index over the last nine trading days. This has brought along a return to volatility, with the VIX index surging by over 50% to hit its highest level in over two years. While the recent sell off has caught many by surprise, the equity market has been wary of risk for some months now, as the most volatile shares in both in the US and globally underperformed over summer.

High volatility underperforms globally

The 10% of constituents of the US large cap universe with the highest historical beta, a measure of market adjusted volatility, have failed to match the returns seen in the wider index for the last three months to the end of September. This universe of the 1170 US equities which make up 90% of the country's market cap has seen the most volatile group of shares trail the returns of the overall universe by nearly 5% in the three months to the recent sell off, with September representing the worst month for highly volatile shares since May 2012.

This trend has accelerated in the last couple of weeks and the first ten trading days of October have seen the high beta shares trail their peers by over 4%, putting them on track for their worst performance in three years. Cumulatively, the most volatile shares have trailed the rest of the universe by just under 8% since January after falling seven of the last 10 months.

Underperformance in high beta shares is not limited to historically volatile US shares. The highest beta shares in Asia Pacific and Developed Europe have also been the victims of sustained underperformance over summer, compounding a trend which started earlier in the year. The worst performance was experienced by highly volatile Asian Pacific shares.

Low volatility performs well

While investors have been actively avoiding high volatility shares, those at the opposite end of the spectrum have fared much better. Low volatility large cap US shares have outperformed the rest of the market by over 10% year to date after avoiding much of the recent sell off.

Perennial defensive sectors are among the lowest beta group of shares, and we see Tobacco and Utilities shares among those with the lowest beta volatility rank. Shares which rank well in these sectors include Altria, Southern and Philip Morris, all of which have outperformed the market over the last few weeks.

Low volatility shares have also outperformed their peers in Europe and Asia Pacific.

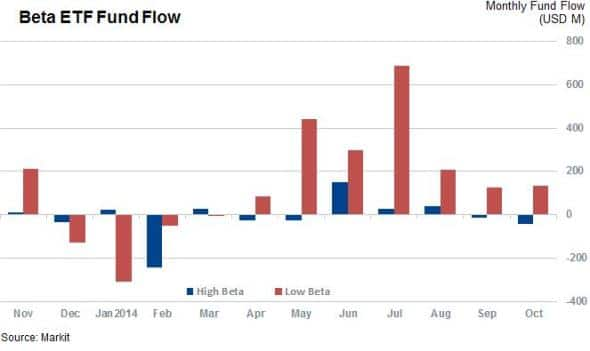

Beta ETFs favour low beta

ETF investors have been actively playing this trend in the last few months with funds targeting low beta shares experiencing large inflows over the last few months. The 49 products aimed at low beta investors have seen six straight months of inflows since April and are on track for another positive month in October. This has taken assets under management to an all-time high $15bn.

The relatively more niche high beta ETFs, which manage about 5% of the assets their low volatility peers manage, have seen outflows in the last couple of months as the strategy underperformed. The largest fund in this space, the PowerShares S&P 500 High Beta Portfolio has seen the largest outflows recently, as investors pulled over $50m from the fund since the start of October to take its asset base to $218m.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-equities-low-beta-continues-to-perform.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-equities-low-beta-continues-to-perform.html&text=Low+beta+continues+to+perform","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-equities-low-beta-continues-to-perform.html","enabled":true},{"name":"email","url":"?subject=Low beta continues to perform&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-equities-low-beta-continues-to-perform.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Low+beta+continues+to+perform http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-equities-low-beta-continues-to-perform.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}