Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 14, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

- Short sellers check out large retailers in North America ahead of earnings calls

- Shorts profit off King Digital and El Pollo Loco as poor earnings minimise risk of squeezing

- Short appetite waned in Chinese property developer China Vanke but still tops Apac

North America

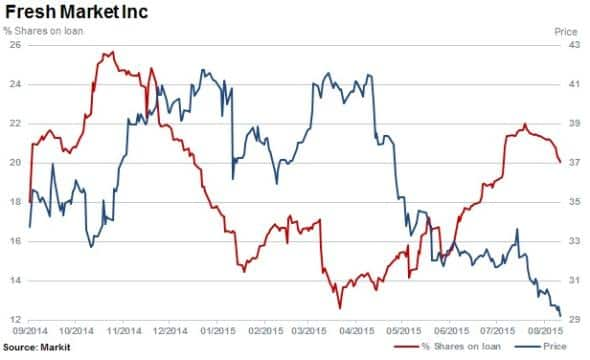

Most shorted ahead of earnings this week in North America is speciality food retailer Fresh Market. Currently 20% of shares are outstanding on loan and shares in the firm are down almost 30% year to date, however consensus forecasts for the quarter are expecting an uptick in earnings.

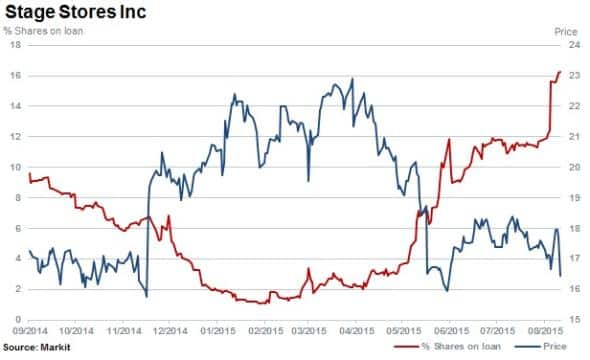

Seeing a strong rise in short interest ahead of its earnings expected out on August 20th is department store retailer Stage Stores. The company currently has 16% of shares outstanding on loan; rising 130% in the last three months.

Stage Stores posted a loss for its first quarter earnings for 2016 (ending April 2015), but consensus forecasts point to a second quarter recovery to match the previous year's quarter earnings level.

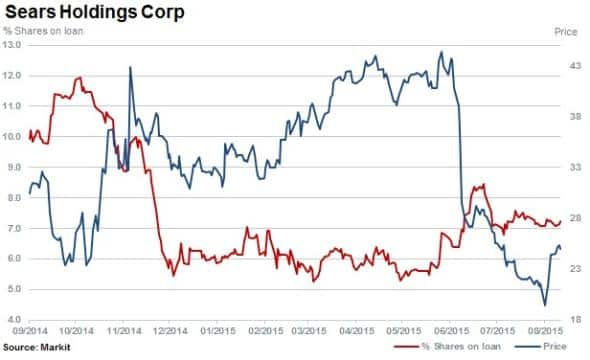

Sears has seen shorts cover positions since the last quarter of 2014 but a recent rise in short interest has seen shares outstanding on loan increase by a fifth to 7.2%. This has been well timed as Sears' stock has tumbled by 40% over the last three months. Revenue at the firm has declined by almost 50% over the last five years with the company posting losses for the last three.

Short Squeeze

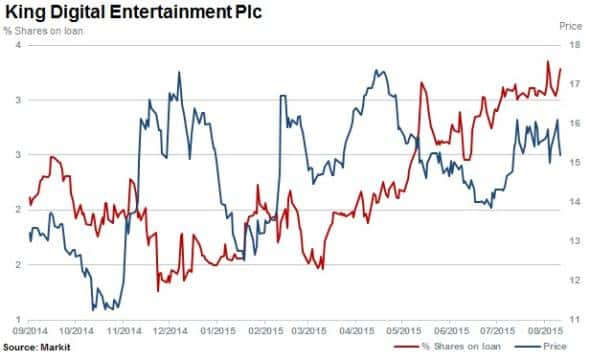

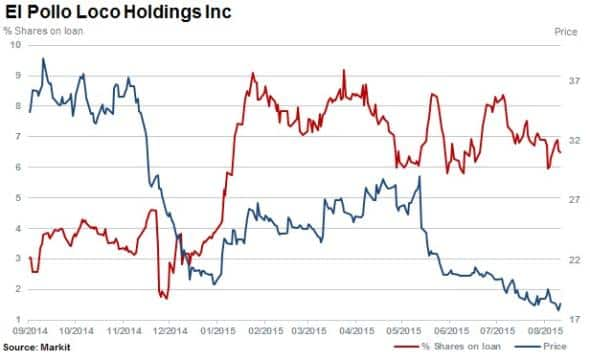

Research Signal's Short Squeeze model* identifies companies highly likely to suffer a squeeze under current trading conditions. Two companies that ranked highly in the model this past week were King Digital Entertainment, the maker of Candy Crush, and US chicken chain El Pollo Loco.

However a squeeze looks to have been avoided with shares coming under pressure at both firms after disappointing results out of both were released. This should prove profitable for short sellers, whose demand to short pushed up the cost to borrow above 5% for El Pollo and near 20% for King Digital.

Europe

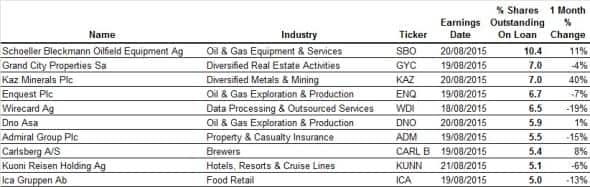

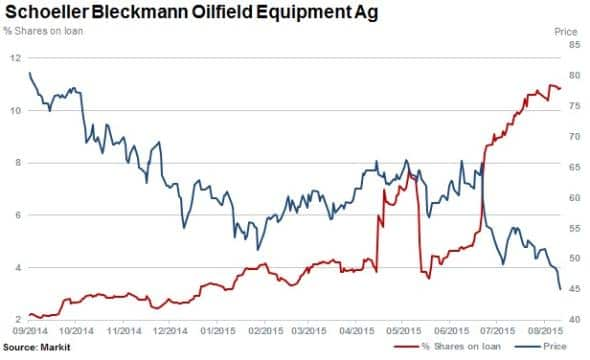

In Europe, Schoeller Bleckmann Oilfield Equipment is the most shorted ahead of earnings with 10.4% of shares outstanding on loan. Shares have slid by 44% in the last 12 months in the oil services and equipment firm with short interest increasing six fold over the same period.

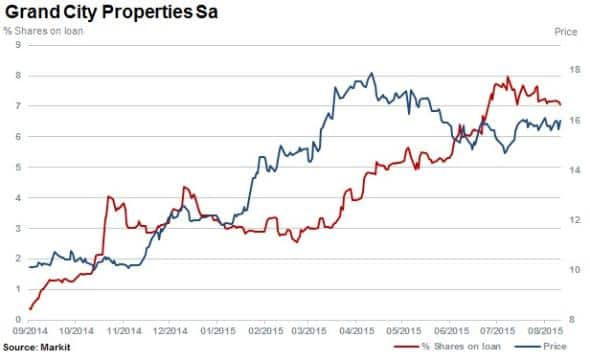

German real estate company Grand City Properties is the second most shorted in Europe, with 7% of shares outstanding on loan. Short interest has risen from negligible levels over the last 12 months with the stock price increasing by 65%.

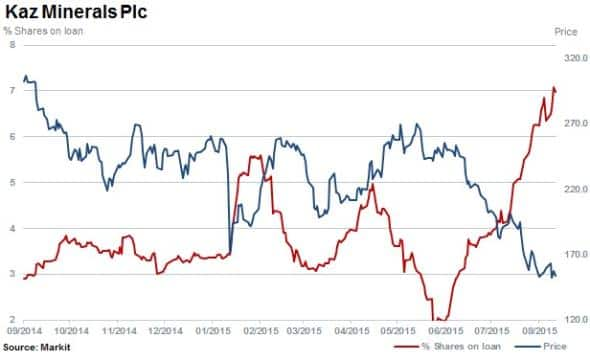

Third most shorted in Europe is open pit copper miner in Kazakhstan; Kaz Minerals. The company has seen a sharp spike in short interest with shares outstanding on loan having risen 130% in the last three months, while shares have dived by 43%.

Apac

Most short sold in Apac is Monadelphous Group with 15% of shares outstanding on loan.

The Australian engineering group has come under pressure as it serves the resources, energy and infrastructure sectors which have been particularly hard hit in recent months. The stock has declined by 55% in the last 12 months.

Second most shorted in Apac is one of the largest property developers in China; China Vanke, with 14% of shares outstanding on loan.

The developer's profit for the first quarter dropped almost 60% as activity in the region started to decline, however short sellers have retreated in recent months, perhaps on the back of increased government intervention, propping up equity markets.

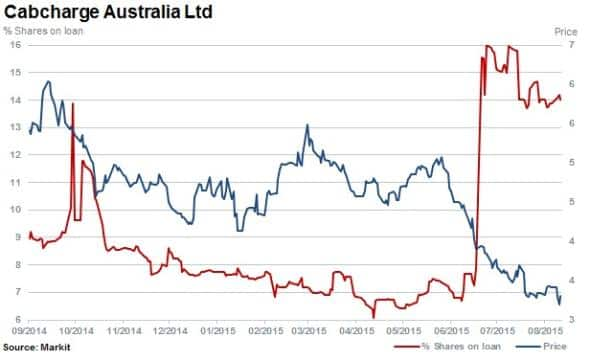

Former Australian monopoly Cabcharge has come under pressure due to increased competition from the likes of Uber, and regulatory changes forcing the cab card processor to charge lower fees. Short interest has jumped 100% in the last month with the stock falling 10%. The stock has slid by 40% over the last 12months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}