Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 14, 2015

German economic growth accelerates slightly as exports rise

German economic growth accelerated slightly in the second quarter, largely a result of a strong export performance. Markit's PMI data signal a continuation of this modest growth path moving into the third quarter and exchange-traded funds data highlight investors' appetite towards the German market.

Economic growth misses expectations

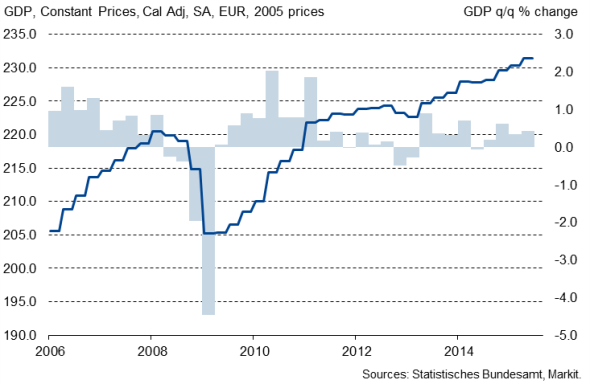

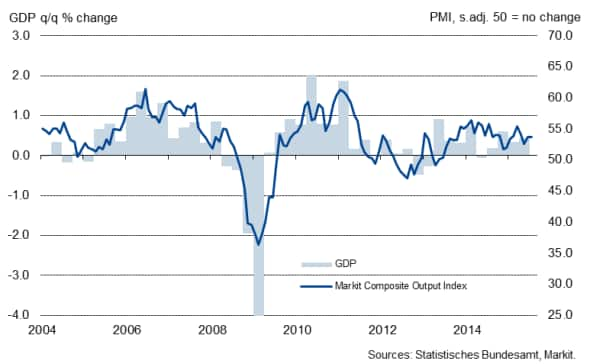

The German economy expanded 0.4% in the second quarter of 2015, according to a first estimate from the Federal Statistical Office Destatis. Economic growth accelerated slightly from the 0.3% pace seen in the opening quarter of the year, exactly in line with the signal from the PMI surveys but marginally below the Thomson Reuters consensus of a 0.5% rise.

Destatis reported that rising exports were the main source of increased gross domestic product, most likely boosted by the weak euro. The increase in foreign demand confirms signals sent by the manufacturing PMI New Export Orders Index. The survey data suggest that the average PMI reading for the index in the second quarter was the best since the third quarter of 2014.

Domestic demand also remained a driver of the economic upturn, with both household final expenditure and government consumption expenditure rising on the previous quarter.

Business survey data had supported the view that consumer demand remains a strong source of GDP growth, and suggest this trend gained momentum at the start of the third quarter. German retailers enjoyed their best quarter for two years in the three months to June, with the average PMI reading the highest since Q3 2013. The future for retailers looks bright too: July data highlighted the strongest rise in sales since 2006 and companies expect that August's sales will exceed previously set targets.

However, it was not all good news in the second quarter: fixed capital formation in construction declined in the three months to June and inventories were also reduced markedly, though this may lead to stronger third quarter growth if companies rebuild stock levels.

German economic growth

German GDP growth and the PMI

Positive start to third quarter signalled

Business survey data for July meanwhile suggest that Germany's private sector economy enjoyed further growth at the start of the third quarter. The Composite PMI Output Index (which combines output from the manufacturing and service sectors) held steady at 53.7 in July, and was broadly in line with the average for 2015 so far. Despite new orders increasing at a relatively subdued pace, companies were encouraged to further add to their payrolls, with the rate of job creation signalled by the PMI the most marked for five months.

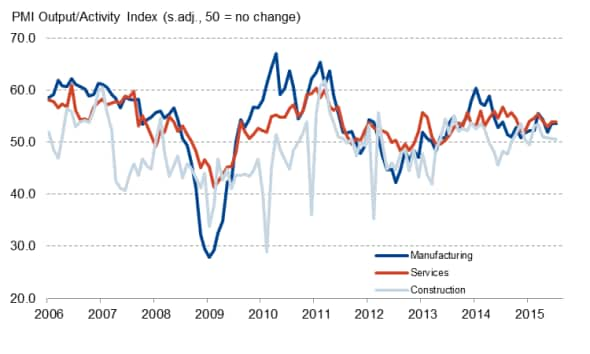

Looking at the sector level, the survey data reveal that growth rates of output at both manufacturers and service providers were almost identical in July, adding to hopes that Germany's goods-producing sector has recovered from what looks like a temporary soft patch in Q2.

However, activity in Germany's building sector remained subdued in July, following only fractional growth in the previous month. There is clearly a danger that the construction sector may struggle to achieve any meaningful growth in the third quarter, especially because the marginal increase in output was solely driven by the residential building sector. The 12-month outlook remains lacklustre too, with the level of positive sentiment across constructors the lowest in six months.

Output/Activity Index by sector

Source: Markit.

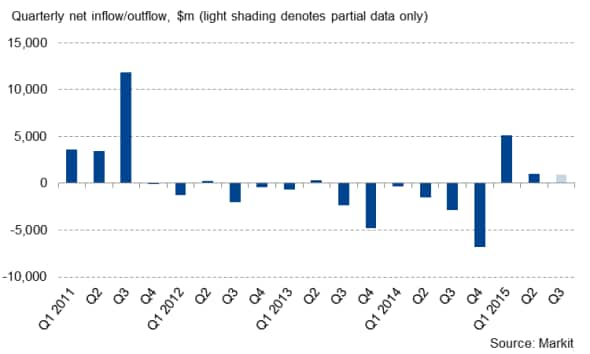

Investor sentiment improves

Meanwhile, exchange traded funds exposed to Germany have seen net inflows of $932 million in the third quarter so far, following increases in each of the previous two quarters. While monthly ETF data highlighted that investor sentiment deteriorated in April, with ETFs exposed to Germany seeing net-outflows of $2.3bln (likely to be affected by the Greek debt crisis), the data suggest that investors were largely unaffected by the ongoing debt negotiations in the last few months.

Germany-exposed ETF flows (quarterly)

Exchange traded funds (ETF) provide investors with easy, liquid exposure to various markets. Fund flows consequently provide a valuable and timely insight into how investor appetite towards different markets is changing.

Flash composite PMI data, published on 21st August, will provide further insight into the economy's performance in the third quarter.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-German-economic-growth-accelerates-slightly-as-exports-rise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-German-economic-growth-accelerates-slightly-as-exports-rise.html&text=German+economic+growth+accelerates+slightly+as+exports+rise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-German-economic-growth-accelerates-slightly-as-exports-rise.html","enabled":true},{"name":"email","url":"?subject=German economic growth accelerates slightly as exports rise&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-German-economic-growth-accelerates-slightly-as-exports-rise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+economic+growth+accelerates+slightly+as+exports+rise http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-German-economic-growth-accelerates-slightly-as-exports-rise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}