Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 14, 2015

Covered bonds prove resilient amid selloff

Covered bonds have been largely shunned by investors seeking income, but their resilience amid market volatility has seen them outperform this year.

- Euro covered bonds have outperformed corps and sovs by 1.48% and 0.83% ytd

- Covered bonds have held up amid the recent volatility with spreads tighter than April levels

- European periphery covered bonds have widened since June, in contrast to sovereigns

Primary issuance in the covered bond market has come to a standstill over the past few months. The asset class, considered among the safest type of European bonds, has struggled to gain traction amid the recent turmoil in credit markets.

Tensions in Greece have been receding however, along with the worst of China's stock market volatility, which has seen some calm return to credit markets. In addition, covered bonds still benefit from the ECB's QE policy which could make them attractive for issuers looking to raise capital, meaning that the lull in issuance may be temporary only.

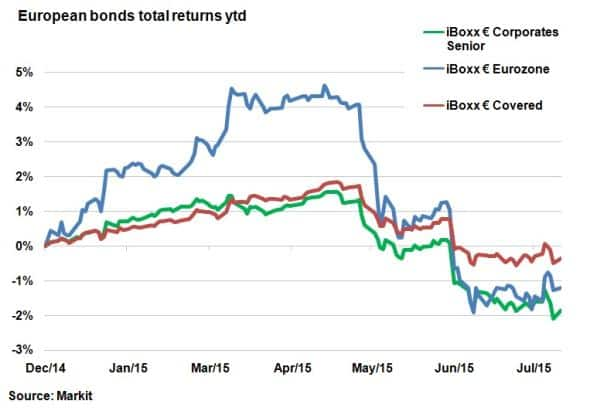

Total return

So far this year, European covered bonds have outperformed sovereigns and corporates by 0.83% and 1.48% respectively on a total return basis, according to Markit's iBoxx indices.

Most of this outperformance has been delivered since the start of June when the crisis in Greece exacerbated the sovereign bond selloff a month earlier. The crisis saw covered bonds stand out as they proved much less volatile in the face of the wider market selloff.

June saw the Markit iBoxx € Covered index return -1.05%, while the Markit iBoxx € Eurozone index and the Markit iBoxx € Corporates Senior index chalked up less impressive returns; -2.59% and -1.84% respectively. These figures highlight the fact that covered bond returns have been much less reactive to larger market moves.

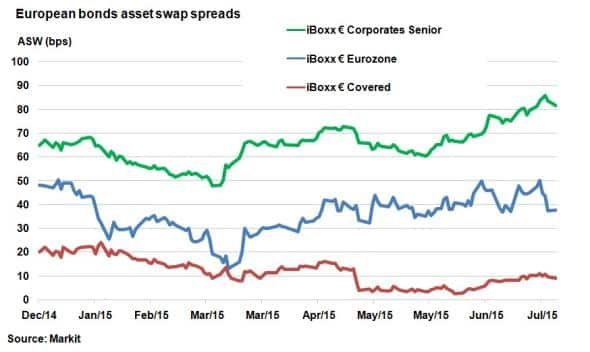

This resilience can also be highlighted by looking at asset swap spreads (ASW), which remain tighter than April levels. Essentially, investors are now willing to accept a smaller spread over swap rates that at the start of the market selloff, indicating a more bullish view of the asset class.

While they are less volatile, covered bond spreads and corresponding yields remain considerably lower than corporates and eurozone sovereigns. Inflows into ETFs tracking covered bond indices have remained relatively subdued over the past few months, demonstrating lack of investor appetite.

But spreads between covered bonds and sovereigns have been converging over the past few weeks. So far this month the asset swap spread for the Markit iBoxx € Covered index has widened 1bp to 9bps, while the iBoxx € Eurozone index has actually tightened from 45bps to 38bps. This converging basis can only benefit covered bonds as they start to become more attractive on a relative basis.

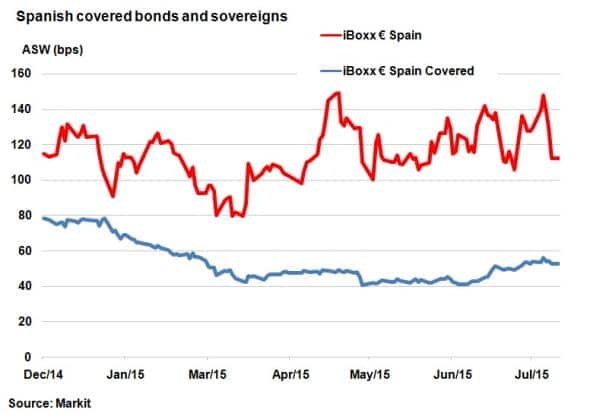

This trend was made further clear when looking at covered bonds issued in the European periphery. The Markit iBoxx € Spain Covered index ASW has widened 7bps since the start of June, while the Markit iBoxx € Spain index ASW has tightened 22bps.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-credit-covered-bonds-prove-resilient-amid-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-credit-covered-bonds-prove-resilient-amid-selloff.html&text=Covered+bonds+prove+resilient+amid+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-credit-covered-bonds-prove-resilient-amid-selloff.html","enabled":true},{"name":"email","url":"?subject=Covered bonds prove resilient amid selloff&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-credit-covered-bonds-prove-resilient-amid-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Covered+bonds+prove+resilient+amid+selloff http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-credit-covered-bonds-prove-resilient-amid-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}