Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 13, 2017

European economy expanding and investing for the future

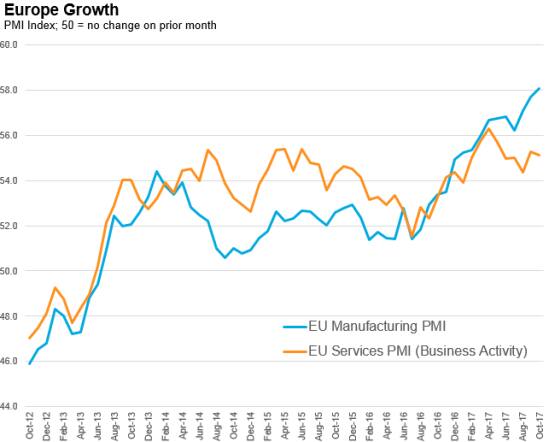

The latest PMI® data from IHS Markit signalled a strong performance for the European economy at the start of the fourth quarter. With the EU Manufacturing PMI registering the second-strongest performance in the last 17 years, alongside the best spell of service sector growth for six years, the region is set to see its fastest expansion for a decade. Moreover, detailed survey data show this upturn is translating into a welcome trend of rising capital expenditure.

Capex keeps accelerating

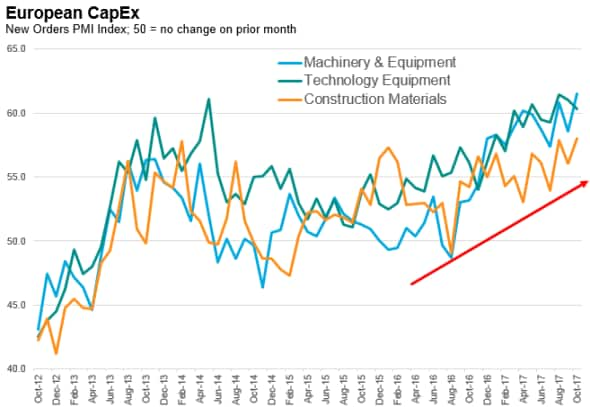

An especially welcome feature of the current upturn in the EU economy is the increase in capital expenditure by companies, as represented by their investment in fixed assets such as factories, shops and offices, and their spend on equipment. Rising capex means productivity should start to improve, which will in turn feed through to higher returns, therefore boosting profits and wages and making the upturn more sustainable. PMI data offer an excellent means of tracking capex by surveying new orders received by producers of machinery & equipment, technology equipment and construction materials.

For more than a year, the new orders PMI indices for the three sectors have indicated expansion. The upturn was led by machinery & equipment in October, the sector experiencing ten-and-a-half year high in terms of its new order growth.

Basic materials showing signs of a surge

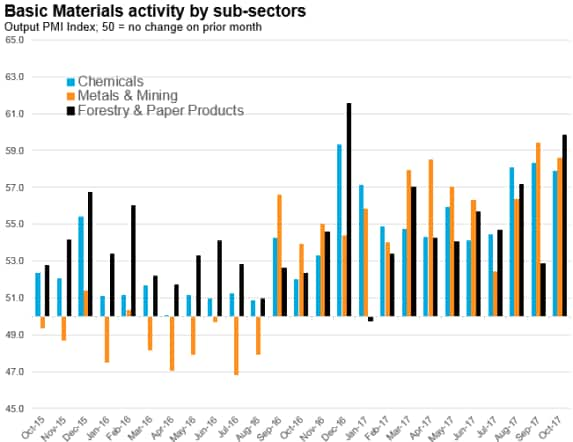

The sector PMI data give indications of how growth is generated across different segments of an economy. In Europe, manufacturing growth has been led by industrial goods since the start of the year, and more recently by basic materials sector, which in October saw its best performance in almost 20 years of data collection. The basic materials sector upturn has been almost equally fuelled by its three sub-sectors, with an impressive revival for metals & mining companies which had shown signs of contraction during the majority of 2015 and 2016.

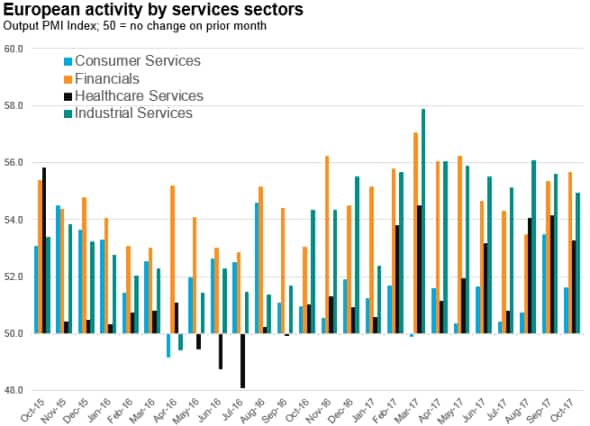

The service sector seems to be a more modest contributor to the European economic recovery, with its output growth trailing behind that of manufacturing. While the broad industrial services sector is enjoying a spill-over benefit from the manufacturing upturn, and financial services firms are reporting especially strong growth, consumer services continues to lag.

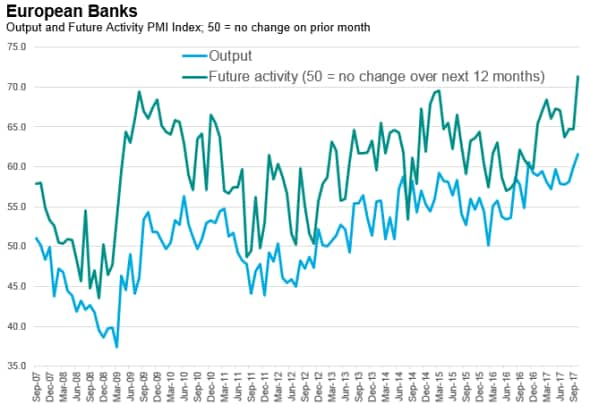

The banking sector in particular has boosted the performance of the broader financials segment, seeing business activity growth accelerate to an 11-and-a-half year high in October. The banking sector also reported rising optimism. The future activity index, a forward-looking indicator tracking anticipated activity over the coming 12 months, has bounced even further, to a 13-and-a-half year high.

Mathieu Ras | Economist, IHS Markit

Tel: +442072602145

mathieu.ras@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-Economics-European-economy-expanding-and-investing-for-the-future.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-Economics-European-economy-expanding-and-investing-for-the-future.html&text=European+economy+expanding+and+investing+for+the+future","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-Economics-European-economy-expanding-and-investing-for-the-future.html","enabled":true},{"name":"email","url":"?subject=European economy expanding and investing for the future&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-Economics-European-economy-expanding-and-investing-for-the-future.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+economy+expanding+and+investing+for+the+future http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112017-Economics-European-economy-expanding-and-investing-for-the-future.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}