Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 13, 2015

Most Shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week, plus names identified as at risk of experiencing a short squeeze.

- Shorts sellers' orders on Zoe's Kitchen begin to get delivered as stock falls by a quarter

- US retailers continue to feel the pain inflicted by fast fashion and changing tastes

- Shorts in Penumbra being squeezed as the stock shoots up over 20% today on earnings

North America

US apparel and food retailers feature predominately in this week's most shorted ahead of earnings. However, retaining the pole position is Zoe's Kitchen, with 46.7% of shares outstanding on loan.

Short sellers look to have taken some profits off the table, covering 20% of positions in Zoe's. Short interest has declined from all-time highs of 57% while the stock has slid some 24% after peaking in July 2015.

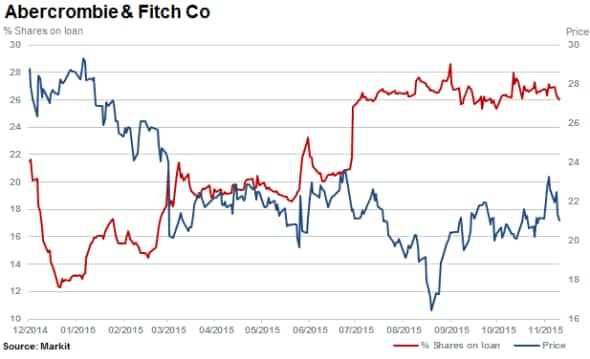

Second most shorted ahead of earnings is Abercrombie & Fitch with 26% of shares outstanding on loan. Short interest remains at elevated levels as US retailers continue to struggle against fast fashion competitors and changing consumer tastes. Short sellers have had to hold their ground in the last three months though as shares rallied 28%.

17.3% of shares of department retailer Stage Stores were outstanding on loan on August 20th when the company announced weaker than expected results and significant store closures. This proved to be a big payday for shorts as shares fell 30% the next day. Short interest has subsequently increased to 20% while shares in the company have continued to hover around the same levels.

Hibbett Sports joins other US retailers in the top twenty most shorted, which includes Buckle, Urban Outfitters and Gap (below) as well as Children's Place and Footlocker. Also featuring are food retailers Fresh Market and Keurig Green Mountain.

Fashion retailer Buckle has seen its shares continue to fall, declining by 25% in the last three months, while resurgent short interest has risen to 14% of shares outstanding on loan.

Urban Outfitters and Gap have both seen shares come under pressure in the last six months as short sellers increased their positions to above 7% of shares outstanding on loan each. Urban Outfitters stock fell 24% in the past six months while Gap has shed 31%.

Short squeeze

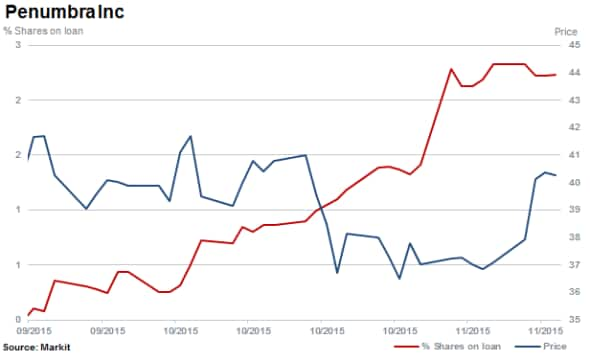

Penumbra has been flagged as a potential squeeze by the Short Squeeze* model since November 10th 2015. The company announced its earnings on November 12th and beat analyst estimates by $0.18.

Almost all shorts are being squeezed as the stock shot upwards over 20%. The average duration of trades is 14 days, indicating short term shorts were entering the names to bet on the earnings event.

Europe

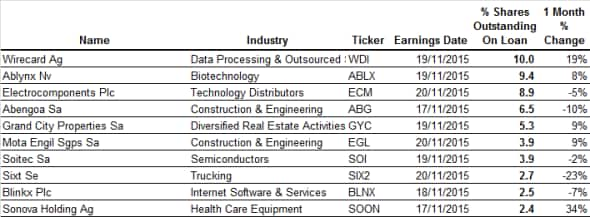

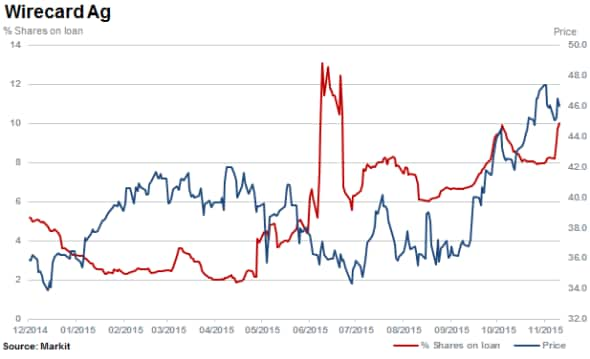

Most shorted ahead of earnings in Europe is German electronic payment solutions company Wirecard. Shares outstanding on loan have risen to 10%, almost doubling in the last year while the stock has surged 27% in the last three months.

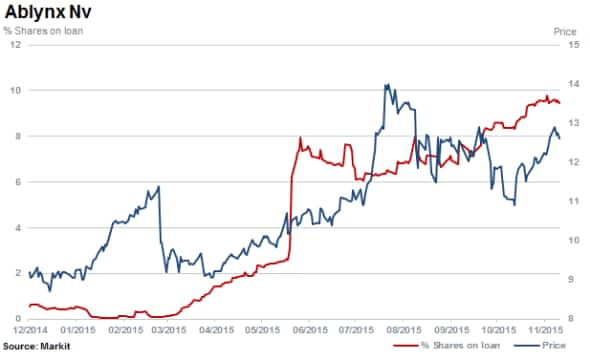

Second most shorted is Belgium based Ablynx with 9.4% of shares outstanding on loan. The company develops and researches nano-bodies for therapies and applications against serious and life threatening diseases.

Short sellers have begun to cover in Oxford headquartered Electrocomponents as shares rallied in recent weeks in the build-up to earnings. Shares outstanding on loan currently stand at 8.9%.

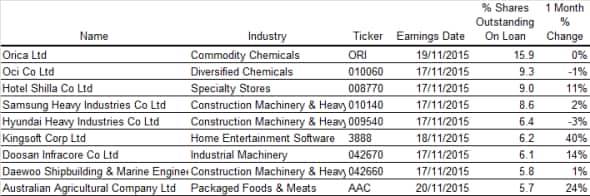

Apac

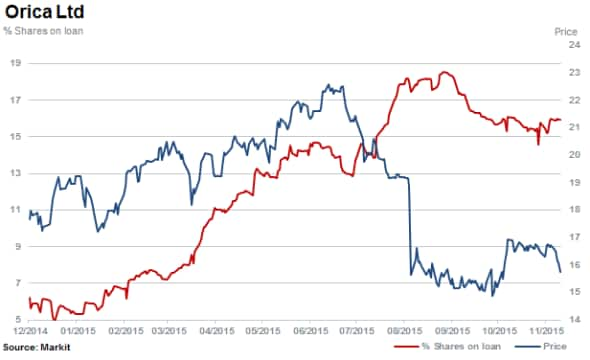

Most short sold in Apac is Orica with 15.9% of shares outstanding on loan. The Australian based company supplies commercial explosives to mining and infrastructure projects. Shares have fallen by a fifth year to date as commodity markets remain depressed globally.

Second most shorted in Apac is Korean chemical products manufacturer Oci with 9.3% of shares outstanding on loan. The firm is exposed to energy markets and has a large exposure to China. Shares have fallen 15% in the last three months.

All three Korean shipbuilders also see material levels of short interest ahead of earnings as world trade levels continue to decline amid a glut in supply of cargo ships and cheaper fuel costs.

Short squeeze

Research Signal's Short Squeeze model* identifies companies highly likely to suffer a squeeze under current trading conditions. One such company currently identified is bedding retailer Mattress Firm.

*To receive more information on Securities Finance, Research Signals, Exchange Traded Products, Dividend Forecasting or our Short Squeeze model please contact us

To read this article on our commentary website please click here.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-most-shorted-ahead-of-earnings.html&text=Most+Shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most Shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+Shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}