Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 13, 2016

Strong upturn in financial services helps support global economy, but overall growth remains muted

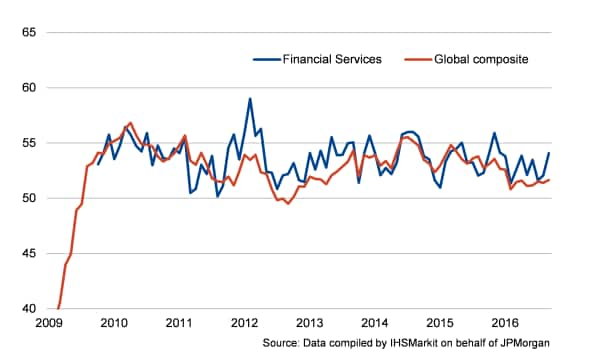

Financial services output growth accelerated to the fastest in nine months at the end of the third quarter. Boosting overall activity was a sharper increase in new orders placed at financial services firms, with the rate of expansion the quickest in over five-and-a-half years. As a result, pressure on capacity was evident, as backlogs of unfinished work rose to the greatest extent since August 2014.

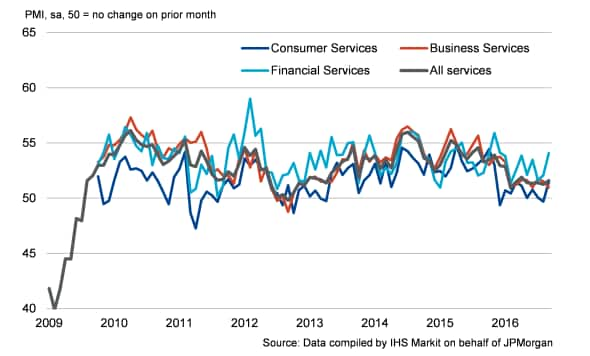

Global services: business activity by sector

On a less positive note, the rate of job creation in the financial services sector eased to the weakest in five months, reflecting weak confidence towards the outlook.

Also within the wider services sector, output growth resumed at consumer services, after having declined for the first time in eight months during July. Furthermore, the rate of expansion was the quickest in ten months, highlighting the extent to which consumers - generally enjoying low inflation and low interest rates - are helping to drive economic growth.

Growth in both financial and consumer services led to a sharper increase in overall global services activity, which rose at the strongest rate since April.

Notably, the upturn in financial services should bode well for the global private sector economy, as it has been closely correlated with the economic cycle throughout much of the survey's history (see chart). Encouragingly, the global composite seasonally adjusted Output Index picked up to an eight-month high.

Business activity

Investment goods output stagnates

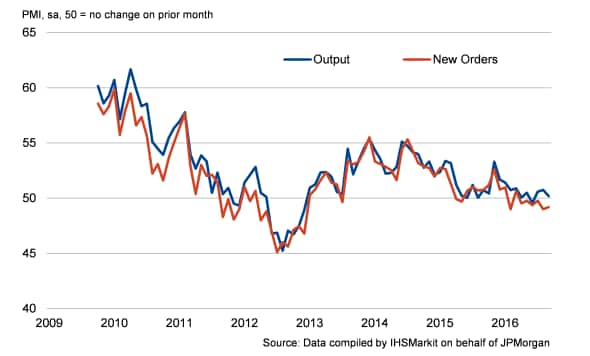

Meanwhile, the global manufacturing sector reported the slowest expansion in output since June, reflecting a broad stagnation in production of investment goods.

Moreover, new orders at investment goods producers contracted for the sixth consecutive month, albeit marginally. The slowdown in investment goods raises doubts about the strength of global capital expenditure and suggests that heightened levels of political uncertainty in many countries, including the US, the UK and other EU countries, are acting as a drag on global capex.

Investment goods

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102016-Economics-Strong-upturn-in-financial-services-helps-support-global-economy-but-overall-growth-remains-muted.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102016-Economics-Strong-upturn-in-financial-services-helps-support-global-economy-but-overall-growth-remains-muted.html&text=Strong+upturn+in+financial+services+helps+support+global+economy%2c+but+overall+growth+remains+muted","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102016-Economics-Strong-upturn-in-financial-services-helps-support-global-economy-but-overall-growth-remains-muted.html","enabled":true},{"name":"email","url":"?subject=Strong upturn in financial services helps support global economy, but overall growth remains muted&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102016-Economics-Strong-upturn-in-financial-services-helps-support-global-economy-but-overall-growth-remains-muted.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+upturn+in+financial+services+helps+support+global+economy%2c+but+overall+growth+remains+muted http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102016-Economics-Strong-upturn-in-financial-services-helps-support-global-economy-but-overall-growth-remains-muted.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}