Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 13, 2015

Securities lending revenue review

Although total global lending revenues have remained fairly steady in 2015, aggregate figures hide dramatic global shifts as Hong Kong pushes ahead to become the third largest equity lending market, behind the US and Germany.

- 2015 securities lending revenues to date at $4.13bn, down 3% on same spot last year

- European securities lending trails last year's total by 19.5% in dollar terms

- US and Asian revenues have offset disappointing European revenues

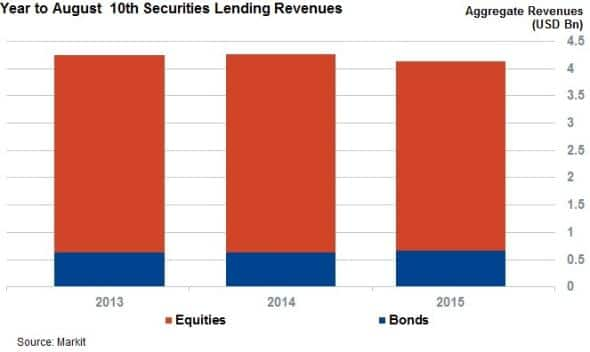

Securities lending revenues created when beneficial owners or agents lend out holdings of stocks or bonds generate over $6bn annually and provide a unique view into macro lending and shorting activities globally. In 2015 so far revenues have held roughly flat year on year, with a total of $4.2bn generated by securities lending transactions.

Equities generate significantly more revenue compared to fixed income securities, owing to their much greater demand to borrow and the fact that the fees generated by these loans are generally much higher. This holds especially true for specials shares, which command the highest fees. Fees for specials sometimes have occasionally reached over 100% in the most "special" cases, such as recent IPOs.

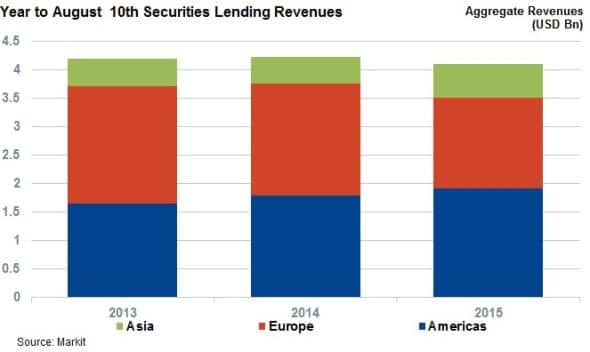

The flat aggregate number does hide large interregional differences however as short sellers shift their positions to react to global market forces.

Americas' securities lending revenues, which represent 46% of total global lending revenues generated so far in 2015, have built on last year's bumper total and are up by over 7% year on year (yoy). This increase was driven in large part by big increases in revenues generated by US equities and US listed ETFs which generated $147m more revenue in the year to August 10th than at the same point last year.

The strong revenues generated in the Americas contrast with weakness in Europe, where aggregate securities lending total for the year so far is down by 19% from the same point last year. It's worth noting that this number is impacted by the rising dollar, which has a negative effect on euro-generated revenues. While these numbers are reflective of this trend, they also highlight a general reticence to go short the current market given the ECB QE policy which has been supportive of asset values.

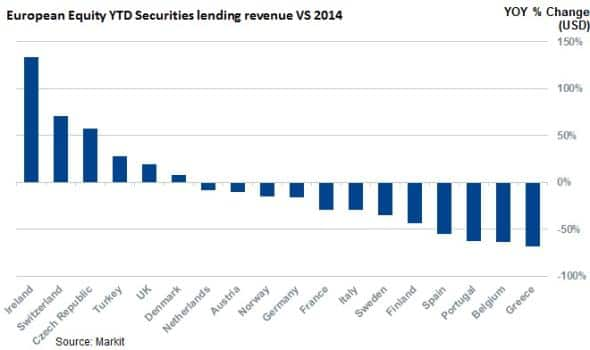

Europe's equities have led the trend with a 23% fall in revenues. This decline has not been driven by a single market as seven European markets find themselves in the ten global markets where securities lending revenue has fallen by the largest margin from last year's total to date.

Greek equities saw the largest declines in lending revenues, which is counterintuitive considering the economic situation. Lending activity completely stopped in late June after a short selling ban came into effect and put a halt to Greece's lending revenues, but short seller appetite was very mooted leading up to the ban regardless.

All has not been disappointing in the region however as Ireland and Switzerland registered large increase in revenues.

Swiss equity saw the largest increase of the two in terms of revenues with a $24m increase aggregate revenues to hit $59m for the year to August 10th. This was the result of a higher average lending fee increasing from 29bps to just over 50bps. Average utilisation and average value on loan also increased marginally over the first seven and a bit month.

Asia leads the way

Asia has proven to be the success story of the year for the industry with securities lending revenues in the region over a quarter ahead compared to the same last year.

Hong Kong equities led this trend with a 57% increase in revenues generated for the year to August 10th. This was the result of higher lending rates as the average borrow cost rose from an average of 1.27% to 1.92%; indicative of higher demand for select securities.

The mainland China securities lending market is still in its infancy, but short sellers has been flocking to the former British colony which has many dually listed shares and much less regulation. This large increase in short selling has helped Hong Kong become the third largest equity lending market in terms of revenue, after the US and Germany.

Andrew Laird | Securities Finance Analyst, Markit

Tel: +1 646-312-8990

andrew.laird@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-equities-securities-lending-revenue-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-equities-securities-lending-revenue-review.html&text=Securities+lending+revenue+review","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-equities-securities-lending-revenue-review.html","enabled":true},{"name":"email","url":"?subject=Securities lending revenue review&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-equities-securities-lending-revenue-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+lending+revenue+review http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-equities-securities-lending-revenue-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}