Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 13, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Changing fashion sees US apparel retailers attract shorts ahead of earnings

- Wirecard the most shorted company announcing earnings in Europe this week

- Acer continues to feature among the heavily shorted Asian companies

North America

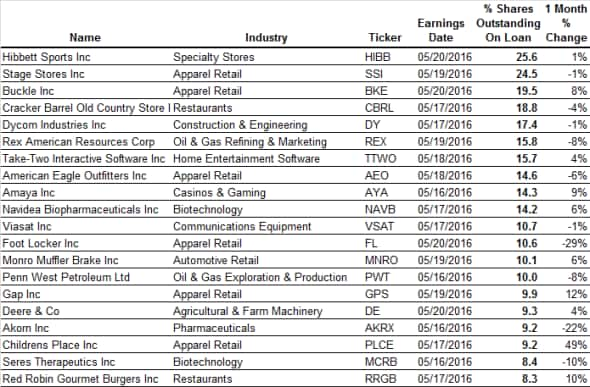

After a tough week for large US retailers, next week sees a wave of specialty and apparel retailers dominate the list of heavily shorted companies announcing earnings.

Sports retailer Hibbett Sports finds itself as the most shorted US company ahead of earnings with 25.6% of its shares out on loan. Sports retailers have had a tough first quarter culminating in the recent chapter 11 bankruptcy filing of Sport Authority in early March. This looks to have emboldened Hibbett short sellers given that demand to borrow the retailers shares shot past the 25% of shares outstanding for the first time in over two years.

Sports shoe retailer, Foot Locker, also finds itself on the heavily shorted list with over 10% of the firm's shares out on loan.

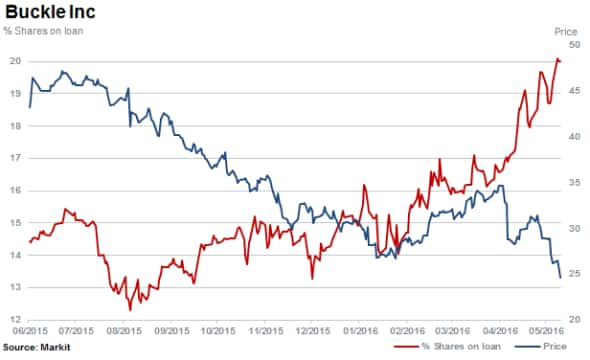

In the clothing retailers Stage Store and Buckle which have both seen their shares trade at recent lows over the last few weeks round out the top three most shorted names announcing earnings next week.

Farm equipment Deere also makes the heavily shorted list with over 9.3% of its shares out on loan. Deere has seen its business suffer in the wake of the commodities downturn which has seen the firm's most recent yearly revenue fall by over 20% from the previous year. This has made the firm a short target although demand to borrow the firm's shares has fallen somewhat in recent months as the current short interest is 20% off the highs seen in early March.

Europe

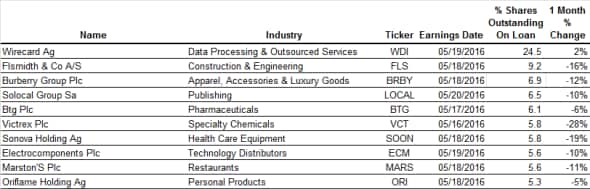

Most shorted ahead of earnings this week in Europe is Wirecard which has been the target of activist short seller Zatarra Researchwhich alleged the firm of fraud. While Wirecard shares have recovered strongly from their lows post the allegations coming to light, short sellers have been staying the course as demand to borrow its shares has remained near the 24% of shares outstanding mark despite the 30% adverse price movement.

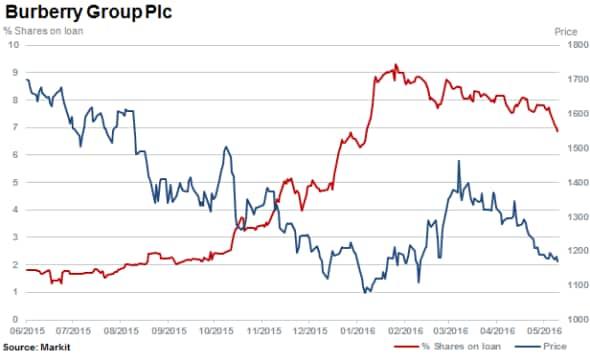

Another high conviction short announcing earnings this week is UK fashion retailer Burberry. The stock currently has 7% of its shares shorted ahead of it earnings update on Wednesday. The company has been hit by slowing demand from emerging Asian markets, most specifically China, which sent its shares tumbling last year. Short sellers have been actively adding to their position as the firm's shares retreated in earnest, but demand to borrow its shares has retreated from the highs seen earlier in the year when 9% of Burberry shares were out on loan.

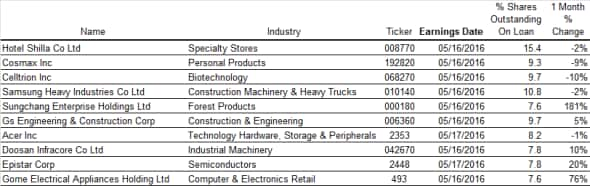

Apac

In Asia, hotel operator Hotel Schilla is the most shorted firm announcing earnings in the region with 15% of its shares out on loan. Short sellers have been circling round the firm as its duty free and hotel business came under pressure from falling Chinese visitor numbers. This means that demand to borrow its shares is now over five times the levels seen 12 months ago.

Perenial short Acer also makes the list of heavily shorted Asian shares ahead of earnings with 8.2% of its shares out on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}