Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 13, 2015

Eurozone bond gains wiped out

The recent selloff across European bond markets has erased any gains investors have made this year to date.

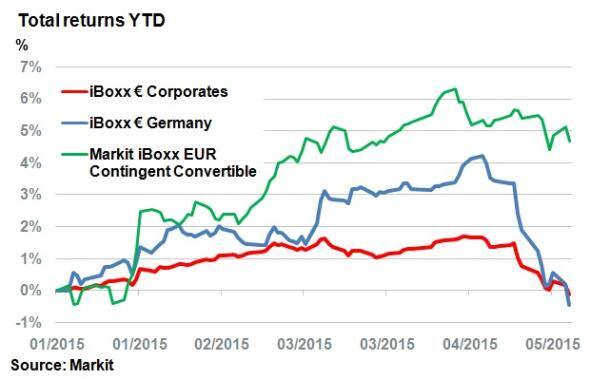

- Both the iBoxx € Corporates and the iBoxx € Germany have had their YTD gains wiped out

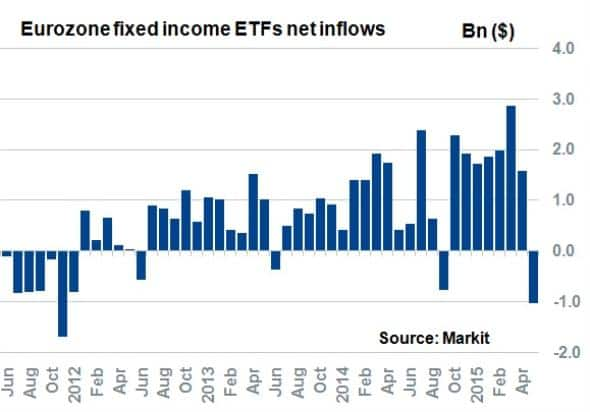

- Investors have been fleeing Eurozone bond ETFs, with May seeing strong outflows

- But bund selloff has done little harm to French OAT spreads, suggesting a yield shift

The global bond sell off has entered its third week now, with no sign of volatility fading.

Eurozone sovereign bonds have led the retreat. German bunds, considered the risk free rate in the eurozone, have seen their 10-yr benchmark rate shift a further 13bps wider yesterday to 0.73%, according to Markit's bond pricing service. The selloff has also extended into US treasuries and stock markets across the world as investors became unnerved. The DAX has fallen 6.4% in the last month alone, after gaining 17.8% in the first quarter this year.

Investment gains erased

Yesterday also marked a turning point in terms of returns made on European bonds this year. The Markit iBoxx € Germany, which comprises German bunds, saw all its total return YTD dive into negative territory after being up as much as 4% on April 20th. The sentiment was also felt in the corporate bond market, with the Markit iBoxx € Corporates index having erased all YTD gains in the last 18 trading days. In contrast, hybrid bonds, which trade with a higher credit spread than corporates, have been less susceptible to the sharp underlying interest rate movements. The Markit iBoxx EUR Contingent Convertible is still in positive territory this year to date, with a total return of 4.7%.

ETF investors have also been quick to react to the recent selloff. ETFs with a eurozone fixed income focus have seen outflows in May reach $1.03bn so far; the largest outflow in a single month since November 2011.

Only two months ago in March inflows hit a record $2.9bn, with investors believing the bull run in European bonds still had some way to go. Many investors front ran the ECB's QE actions, believing that sovereign yields and subsequent corporate bond yields were on a one way path towards zero and beyond.

But as yields began approach zero, sentiment changed and a combination of fundamental and technical reasons has caused vicious bouts of volatility over the last three weeks.

A fundamental shift?

Where do investors stand at the moment? Since ECB QE was announced, German bund yields have steadily declined in line with European corporate credit risk, as measured by the Markit iTraxx Europe index. But sentiment in corporate credit changed at the start of March, ahead of the bund sell off a month and a half later.

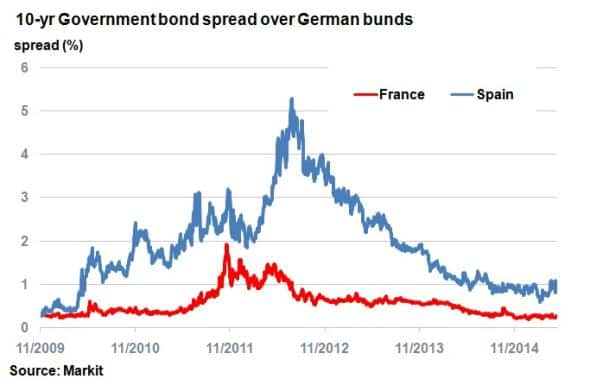

France remains stable

French Government bonds (OATs) have also help up during the last three weeks. The French 10-yr spread over bunds has remained steady at around 20-30bps.

Interestingly, the last time eurozone bonds sold off in 2011, French bonds moved in line with periphery names like Spain and Italy. In contrast, during this recent sell off, while small in comparison, French OATs have remained in line with bunds; suggesting a parallel yield correction across the board.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Credit-Eurozone-bond-gains-wiped-out.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Credit-Eurozone-bond-gains-wiped-out.html&text=Eurozone+bond+gains+wiped+out","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Credit-Eurozone-bond-gains-wiped-out.html","enabled":true},{"name":"email","url":"?subject=Eurozone bond gains wiped out&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Credit-Eurozone-bond-gains-wiped-out.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+bond+gains+wiped+out http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Credit-Eurozone-bond-gains-wiped-out.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}