Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 13, 2015

Commodities turmoil set to impact earnings

Analysts have forecast further weakness in commodities exposed stocks in the lead up to the first quarter earnings season: a trend that is starting to impact the wider industrial sector.

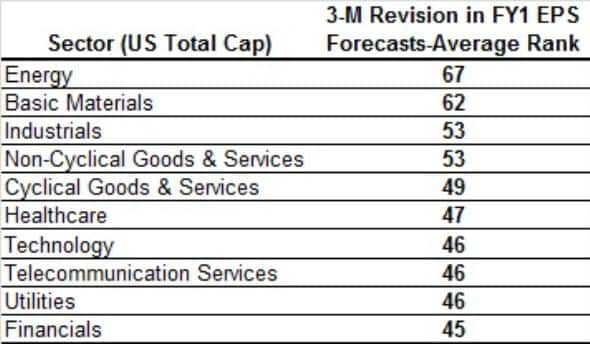

- Energy and basic materials stocks have seen the worst average revisions

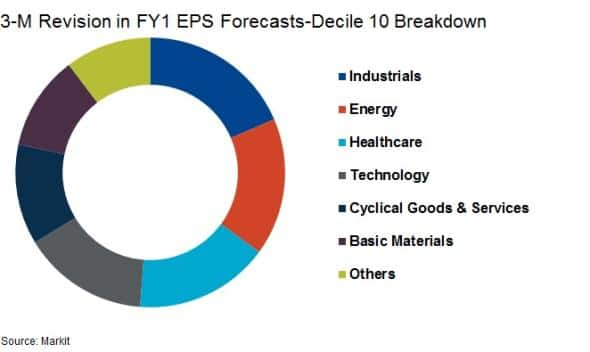

- Industrial stocks most represented among the 10% of shares seeing the worst revisions

- Worst ranked shares see double the short interest increases of their better ranked peers

All eyes will be on US corporate earnings in the coming few weeks to gauge the strength of the US economy in the wake of the recent dollar strength and falling oil price.

The first quarter earnings season kicked off last week when aluminium producer Alcoa published its (somewhat disappointing) Q1 results, the next two weeks will see the bulk of announcements with nearly 200 constituents of the S&P 500 set to announce results.

A review of the companies seeing the worse downgrades heading into the earnings season reveals that analysts are wary of shares exposed to energy and basic materials, owing to the continuing weakness in commodities prices.

But arguably more worrying for policy makers is the fact that the Markit Research Signal 3M Revision in FY1 EPS Forecast, a factor which highlights changes in analyst forecasts over the preceding three months, also highlights weakness in industrial shares ahead of a key test for US economic growth.

Worst downgrades: energy and materials Energy and basic materials shares see the worst analyst revisions among constituents of the Markit US Total Cap universe, a group of stocks consisting of over 3000 shares - over 90% of the publically traded US market capitalisation. These shares have an average sector rank (from a score of 1-100) of 67 and 63 respectively, which puts them ten ranks below the third worst ranked: the industrials sector.

This will come as little surprise to market watchers, as commodities prices which drive much of the profitability in the energy and materials sectors are hovering at multi year lows owing to weak global demand. Alcoa's results may indicate that this bearish analyst sentiment is well placed as the company saw its shares fall after failing to live up to its revenue expectations.

S&P 500 names to watch in these sectors this earnings season are National Oilwell, Owens Illinois and Halliburton which have all seen estimates downgrades, ranking them among the worst 2% of the universe's constituents.

Industrials also feeling bearish

Industrial stocks make up the largest proportion of the worst ranked 10% of shares which could indicate that the commodities slump may be starting to spread to the wider economy. There are now 54 industrial names among the worst ranked group of shares with the likes of Caterpillar, Circor and Tennant seeing the worse recent revisions.

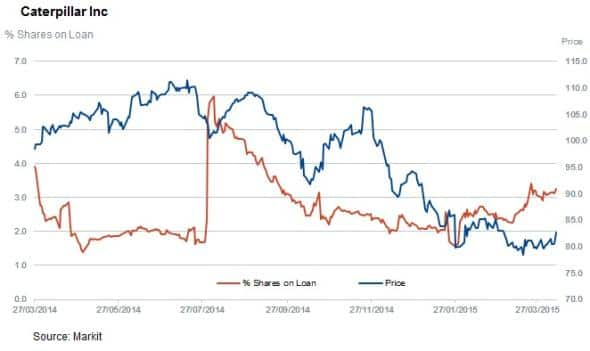

Caterpillar has seen analysts trim more than a third off their EPS expectations for the coming fiscal year, earning the firm the second worse rank. Short sellers have taken notice as the proportion of CAT shares out on loan has increased by more than 50% over the last three months.

Short sellers target downgrades

This increase in shorting activity is not isolated to CAT as the average demand to borrow shares among the industrial names seeing the worst analyst downgrades has far outpaced the rest of the Total Cap universe.

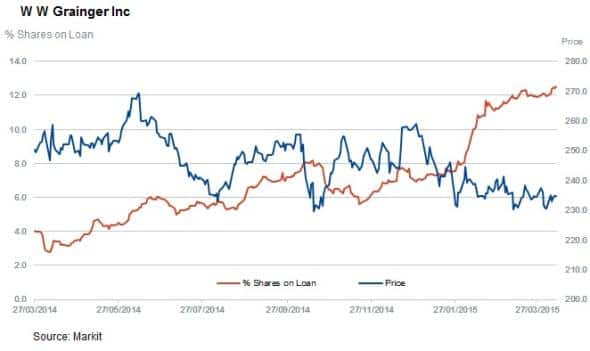

The 54 industrial names which have seen the worst analyst revisions over the last three months have had seen short sellers increase their positions by 15% on average since the start of the year; nearly five times the average rise in shorting activity seen by constituents of the US Total Cap universe.

While many of the names are tied to energy capital spending, such as Dover Corp and Hornbeck Offshore, there are signs that short sellers are positioning themselves for weakness in the wider economy. This is evidenced by the 76% jump in demand to borrow shares of tool distributor WW Grainger since the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Equities-Commodities-turmoil-set-to-impact-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Equities-Commodities-turmoil-set-to-impact-earnings.html&text=Commodities+turmoil+set+to+impact+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Equities-Commodities-turmoil-set-to-impact-earnings.html","enabled":true},{"name":"email","url":"?subject=Commodities turmoil set to impact earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Equities-Commodities-turmoil-set-to-impact-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Commodities+turmoil+set+to+impact+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Equities-Commodities-turmoil-set-to-impact-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}