Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 13, 2015

Most shorted ahead of earnings

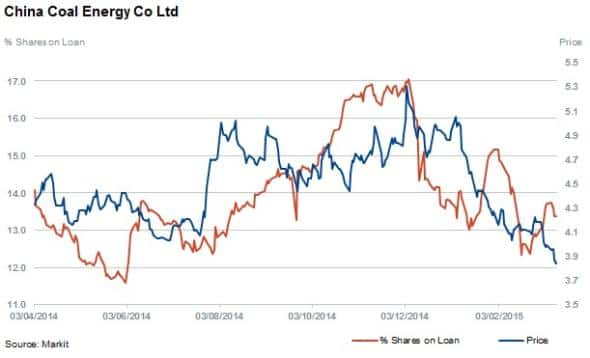

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Oil and energy stocks still feeling the pressure of low energy prices and short selling activity

- Russian exposure catalyses short interest in property group Immofinanz

- Australian retailer Myer Holdings is the most short sold in Apac with 19.7% shares on loan

North America

Pacific Rubiales Energy is the most shorted stock in North America this week ahead of earnings. The Canadian listed and self-proclaimed "leading Latin American focused explorer and producer" of oil has seen shares outstanding on loan increase by 170% in the last six months to 18.3%.

Despite Pacific being a low cost producer with reported sustainable cash operating costs of ~$28boe (barrel of oil equivalent), against a current WTI price of oil of $47 dollars per barrel, short sellers have continued to increase bets against the firm as the shares have declined by 82% in the past six months.

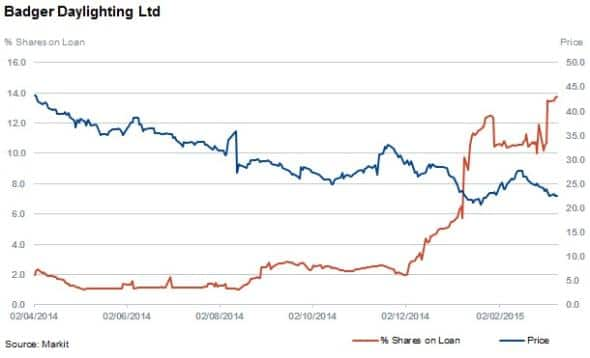

In the top five most short sold is Badger Daylighting; the proportion of the company's shares out on loan has increased by 30% in the last month to 13.5%. The firm provides non-destructive excavation services to civil engineering projects with a large exposure to the oil industry. As North American shale oil production peaks and expansion projects are put on hold, the service industry has begun to contract due to sustained lower oil prices.

Second most short sold in North America is KB Home which continues to be heavily shorted as the proportion of its shares out on loan has increased by 10% in the last three months from 17.4%. Shares in the homebuilder are up 8.1% with short sellers holding their ground.

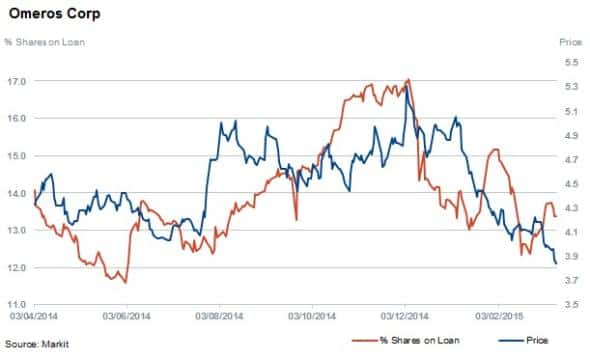

Rounding out the top three is Biotech firm Omeros which saw a significant 19% jump in short interest the last week in conjunction with a 44% increase in its share price. Shares out on loan stand at 13.9% and the Seattle based company hopes to develop and commercialise small-molecule protein therapeutics.

Western Europe

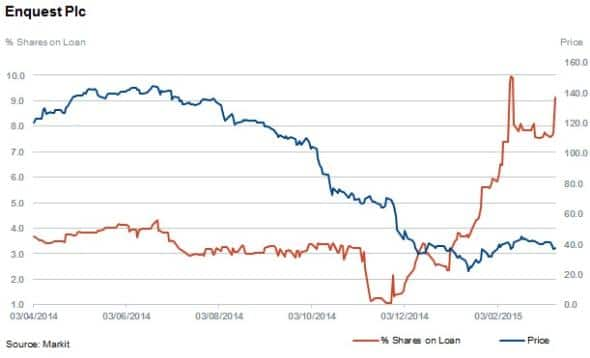

In the UK, short sellers have circled in on EnQuest, an oil and gas development and production company based in the North Sea. The firm is currently developing the large Kraken project and has over the last 12 months seen shares out on loan increase more than double to 9.1% while its share price has dived by 70%.

The group recently disclosed that it has hedged part of production for 2015, cut capital expenditure, and improved debt covenants with bankers in an effort to trim its operating costs by a tenth. This announcement saw short sellers retreat slightly as shares outstanding on loan decreased by 14% over the last month.

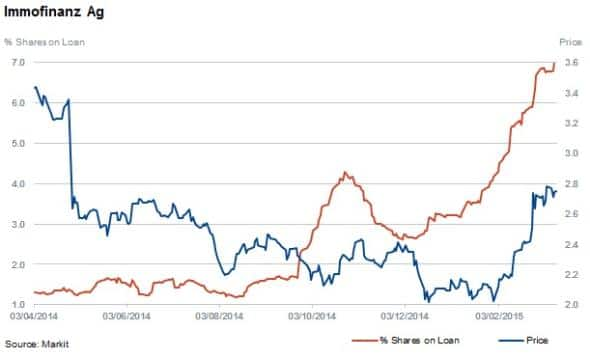

Property group Immofinanz, based in Vienna, has attracted short sellers as evidenced by shares out on loan increasing by 73% since February 2015 ahead of earnings. Short sellers have continued to increase their positions while the share price rallied by 36% over the same time period.

A third of Immofinanz's business is exposed to Russia and the Ukraine crisis has been cited as a negative factor by management affecting the share price and short interest. The shares however have rallied and the group announced this week a further share repurchase programme to be carried out in 2015, similar to that of 2014.

The fourth most shorted European company announcing earning next week is Milan listed Maire techimont. The company provides engineering and contracting services to the oil & gas, petrochemicals and fertilizer industries. The firm has seen short interest climb to 6.2% with the share price increasing 22% year to date.

Asia Pacific

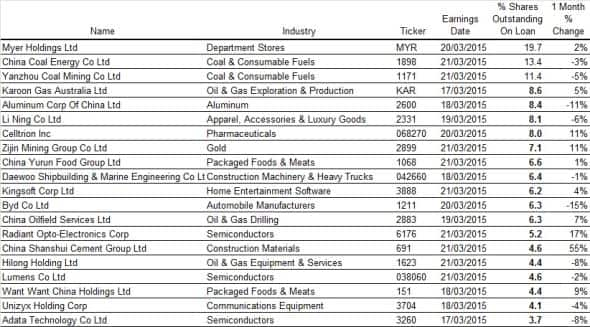

Most shorted in Apac this week is Myer Holdings, Australia's largest department store group. The company's shares out on loan have increased steadily over the last six months to 19.7% while its share price has decreased by 17%. The group has seen sales and earnings stagnate since 2010 which resulted in the chairmen recently issuing a newsletter to shareholders informing them of new incoming ceo.

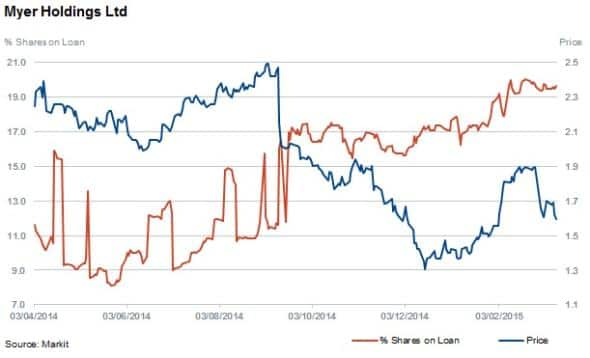

Second most shorted in Apac is China Coal Energy which has sent short sellers covering in recent months with shares outstanding on loan and the share price both decreasing by 20%. Sales forecasts for the producer and trader of coal have been lowered for the year ending December 2014 ahead of earnings, as coal prices worldwide sustain multi year lows.

Relte Stephen Schutte, Analyst at Markit

Posted 13 March 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}