Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 13, 2015

US high yield falls; Ukraine credit stabilises

The US bond yields continues to diverge from its European peer s while US ETF investors trim their exposure to the riskier end of the bond market.

- ETF investors have taken $2.35bn out of US high yield funds in March

- The difference between ten year US treasuries and German bunds reaches 1.9%

- Ukraine's credit indicates potential bond losses as CDS trades indicate a 95% chance of default

US high yield investors flee

Valeant, a large pharmaceutical firm, expects to price $9.6bn worth of junk bonds today; set to be one of the biggest offerings of high yield debt on record.

While primary supply and demand remains strong, ETF investors have been taking money off the table. Despite 2015 seeing a positive start with US high yield ETFs receiving net inflows of $1.67bn in January and $4.35bn in February, March has seen a reverse in the trend with net outflows of $2.35bn.

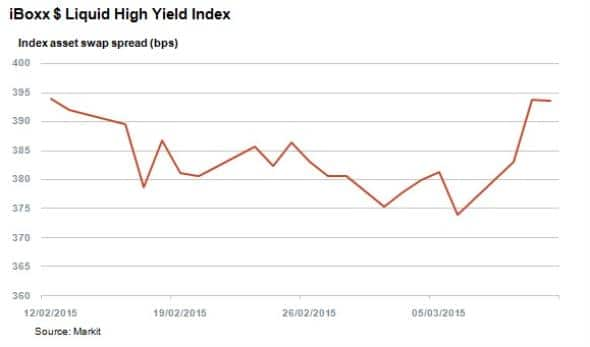

This trend has also been reflected in the widening spreads of US high yield as represented by the iBoxx $ Liquid High Yield Index. Its spread over swaps has increased from 375bps at the start of March to 393bps at present. The weakening in credit risk and fall in prices coincides with oil prices hitting six week lows, which is significant as oil companies are prominent in the high yield space.

US and German yields widen further

Weak retail data in the US wasn't enough to halt the growing gap in transatlantic borrowing costs.

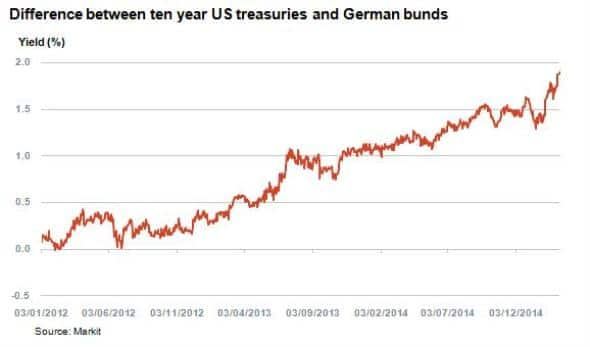

Since the start of 2012, the difference between ten year US Treasuries and equivalent German bund yields has risen from zero to nearly 2%. The difference highlights the diverging growth trajectories of the two regions, which have led to different stances on monetary policy with the eurozone is easing and the US tightening.

US macro data, such as retail sales, will play a key part regarding when the US decides to tighten and increase rates. US ten year yields dropped 7bps on the back of the deteriorating retail data at the start of the week, to 2.13% as market participants pushed back forecasts of an interest rate hike. However this wasn't enough to reduce the yield gap compared to ten year German bunds, which experienced an 11bps fall this week as the ECB's QE programme sparked a buying frenzy.

Ukraine credit stabilises

Ukraine's insolvency woes have curtailed for the time being as the IMF approved a new bailout package worth around $17.5bn. Capital controls and an interest rate hike from 19.5% to 30% have also helped alleviate concerns around a currency in free fall.

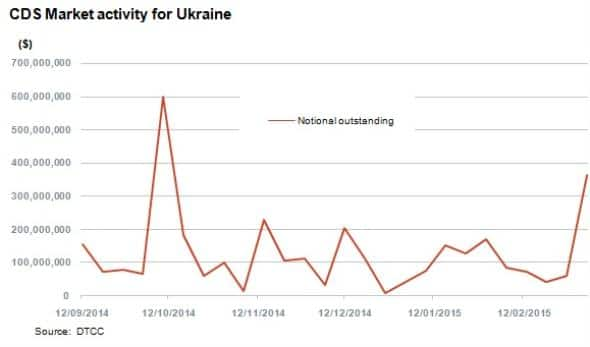

Activity in credit markets picked up with the national amount outstanding up to $365m, levels not seen since October last year, as investors sought protection. Ukraine's sovereign 5-yr CDS spread, which trades upfront, was 59% as of yesterday's close, down from 61% on February 24th; signalling some stabilisation, but little real improvement.

Bonds denominated in US dollars showed some improvement but still trade within a close band in the mid 40's, irrespective of maturity. This is a sign that the market is expecting some sort of debt-restructuring deal and although Ukraine hasn't technically defaulted yet, 1-yr CDS spreads are implying a 95% chance over the next year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-credit-us-high-yield-falls-ukraine-credit-stabilises.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-credit-us-high-yield-falls-ukraine-credit-stabilises.html&text=US+high+yield+falls%3b+Ukraine+credit+stabilises","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-credit-us-high-yield-falls-ukraine-credit-stabilises.html","enabled":true},{"name":"email","url":"?subject=US high yield falls; Ukraine credit stabilises&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-credit-us-high-yield-falls-ukraine-credit-stabilises.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+high+yield+falls%3b+Ukraine+credit+stabilises http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-credit-us-high-yield-falls-ukraine-credit-stabilises.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}