Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 12, 2016

Irish economy continues to grow following Brexit vote, but longer-term uncertainty remains

Due to the strong economic and historical links between the two countries, Ireland is widely seen as the economy most vulnerable to the shock of Brexit outside the UK itself. Latest Investec and Ulster Bank PMI data from IHS Markit show that growth has been maintained in recent months, but at a more moderate pace and with some particular weakness evident in manufacturing.

Meanwhile, consumer spending also looks to have continued on an upward trajectory despite an initial hit to confidence following the surprise vote result. With the UK government set to wait until sometime in 2017 to trigger Article 50, the immediate impacts of the vote will likely dissipate over the rest of this year, but longer-term uncertainty remains.

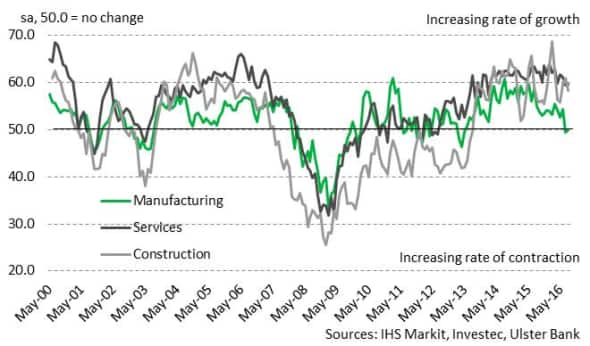

Manufacturing output stabilises

PMI data are available for the manufacturing, services and construction sectors in Ireland and provide the earliest signals as to how the economy has performed following the surprise UK vote. The area most obviously affected by the result of the EU referendum was manufacturing, where production decreased in Ireland in July and new orders stagnated. It was therefore reassuring to see a return to growth of new work in August and a stabilisation of output.

New export orders fell for the second successive month, however, as the weakness of sterling against the euro made it harder for Irish firms to compete with their UK counterparts. There were also reports of demand from UK clients drying up.

After having eased to a near two-and-a-half year low in July, the rate of expansion in services business activity quickened fractionally in August. However, new orders rose at the weakest pace since early-2014 in a sign that companies may be operating in a more difficult environment for securing new work.

Construction, meanwhile, continued to record strong rises in activity and new business in August as the sector's recovery was sustained. A special one-off question added to the August survey indicated that most customers expect Brexit to have no impact on activity over the coming year.

PMI Output Indices

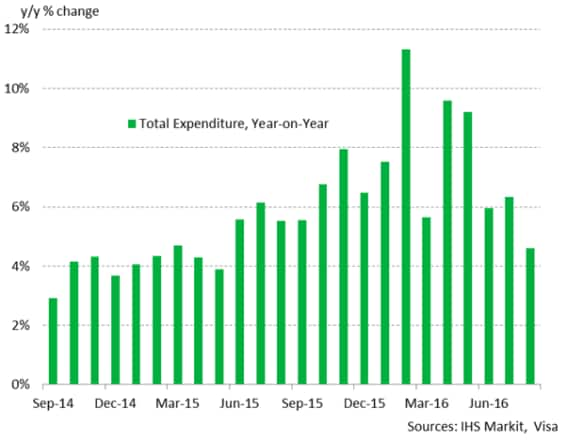

Household spending rises further

Another timely economic indicator is Visa's Irish Consumer Spending Index (CSI), which was updated today with data for August. This showed that household spending was up 4.6% year-on-year, the slowest rate of increase since May 2015 but solid nonetheless. Particular strength was noted in e-commerce while spending on the high street rose only marginally.

Overall growth in spending was recorded in spite of a drop in consumer confidence in response to the result of the UK's referendum in July, suggesting that any dip in sentiment may be short lived and confidence may have rebounded in August.

Visa's Irish Consumer Spending Index

Rates of job creation pick up

Latest PMI data on employment suggest that companies are not expecting a sustained negative impact of the Brexit vote in the coming months as firms across each of the monitored sectors took on staff at a faster pace than in July, when collective hiring eased to the slowest since August 2013. The overall rate of job creation was the fastest in three months, signalling improved confidence among businesses regarding near-term workloads.

All-Sector PMI Employment Index

PMI price indices also moved back towards their pre-referendum levels in August. In July, input costs rose at the slowest pace in close to a year-and-a-half as the sharp fall in sterling following the referendum made items imported from the UK cheaper, but the rate of inflation picked up in August.

While the Irish economy looks set to avoid an outright downturn over the rest of the year, the uncertainty around the details of the UK's renegotiation with the EU will likely subdue the pace of growth going forward.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-economics-irish-economy-continues-to-grow-following-brexit-vote-but-longer-term-uncertainty-remains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-economics-irish-economy-continues-to-grow-following-brexit-vote-but-longer-term-uncertainty-remains.html&text=Irish+economy+continues+to+grow+following+Brexit+vote%2c+but+longer-term+uncertainty+remains","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-economics-irish-economy-continues-to-grow-following-brexit-vote-but-longer-term-uncertainty-remains.html","enabled":true},{"name":"email","url":"?subject=Irish economy continues to grow following Brexit vote, but longer-term uncertainty remains&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-economics-irish-economy-continues-to-grow-following-brexit-vote-but-longer-term-uncertainty-remains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Irish+economy+continues+to+grow+following+Brexit+vote%2c+but+longer-term+uncertainty+remains http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-economics-irish-economy-continues-to-grow-following-brexit-vote-but-longer-term-uncertainty-remains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}