Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 12, 2015

Shifting odds for UK bookmakers

Ladbrokes recently announced the acquisition of competitor Coral in a deal that has seen short sellers readjust their odds in the fiercely competitive UK bookmaker market.

- Shorts have trimmed positions in Ladbrokes after Coral deal came to light

- Despite recent covering, Ladbrokes is still the most short sold high street bookmaker

- Betfair stock has attracted short sellers despite an impressive rise year to date

Online odds in favour

Ladbrokes and Coral are set to merge, forming the largest high-street bookmaker in the UK - Ladbrokes Coral. The deal will sees underlying earnings of the combined entity nearing "400m. This will lift Ladbrokes ahead of William Hill to be largest high street book maker in the UK.

Stagnating revenues and poor stock performance have motivated industry consolidation. Shares in Ladbrokes initially jumped 14% to a 52 week high as news of the deal broke, but the stock has since lost ground and is trading 23% lower.

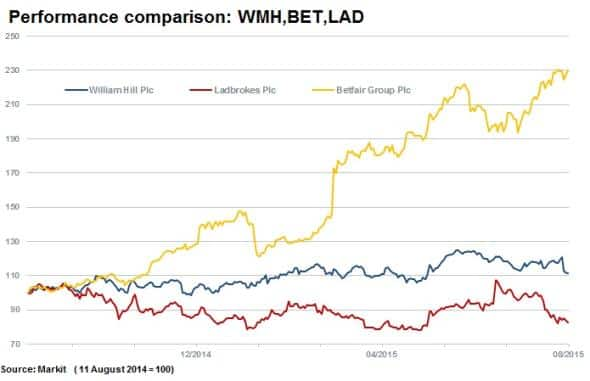

Ladbrokes' growth has stalled in recent years, facing online competition from the likes of Betfair, which reported this year that 93% of all revenue growth emanated from mobile devices, an area in which Ladbrokes has lagged. Ladbrokes' stock is down 17% in the last 12 months while Betfair is up by 130%.

The fund the Coral deal Ladbrokes is issuing new shares and in the process also firming up relationship with Playtech, an online marketing partner which is taking up 23% of the equity placement. New Ladbrokes shareholders (ex-Coral shareholders) were previously thought to undertake a public listing during the year to exit the business. The additionally liquidity provided by new shareholders possibly selling could put additional pressure on the share price in the short term.

Additionally, Ladbroke's new ceo has guided for an operating improvement only in 2017, after the group posted a 44% drop in pre-tax profits for the first half of 2015.

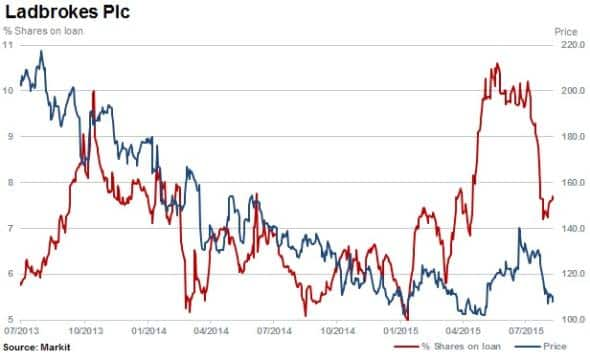

Short sellers have played the odds well on Ladbrokes and have been rewarded. The stock is down 44% over the last two years. Some short sellers have been placated by the merger coming to light as a fifth of positions have been covered since the deal was announced. The proportion of Ladbrokes shares out on loan has fallen to 7.2% from highs of 10% in June.

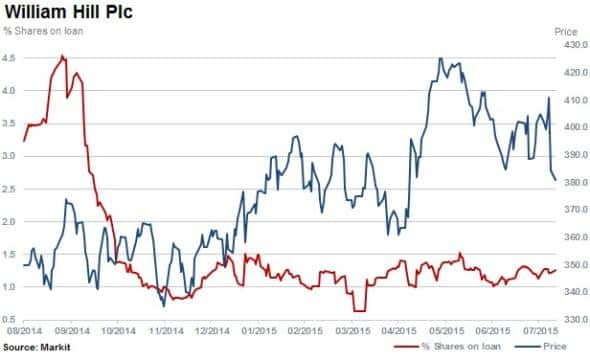

This covering follows a similar trend seen in industry leader William Hill, whose demand to borrow dipped below 1.5% of shares outstanding last October.

Short sellers refocus on Betfair

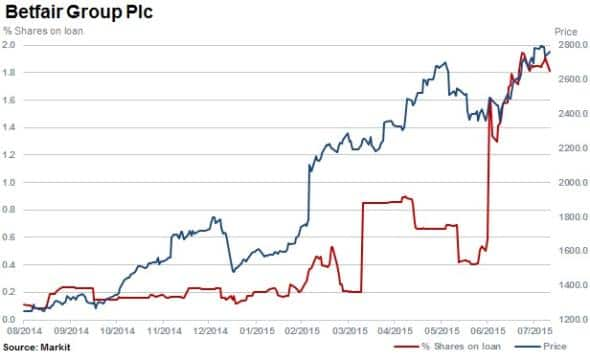

This covering contrasts with what the shorting activity seen in Betfair over the last few weeks. The online betting marketplace has seen a sharp rise in short interest in the last two months, rising to 1.8% of shares outstanding; the highest level seen in over two years.

The bookmaking industry is expected to continue to consolidate, with traditional players rationalising brick and mortar outlets. With online service offerings converging across the industry, sustained long term growth, as seen from Betfair, could come under pressure.

Betfair's stock is up over 130% in a year and trading near 30 times forward earnings; almost twice as high of slower growing peers.

This success has attracted short sellers, who may be questioning the continued rise of the online bookmaker, particularly in the face of increased competition.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-equities-shifting-odds-for-uk-bookmakers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-equities-shifting-odds-for-uk-bookmakers.html&text=Shifting+odds+for+UK+bookmakers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-equities-shifting-odds-for-uk-bookmakers.html","enabled":true},{"name":"email","url":"?subject=Shifting odds for UK bookmakers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-equities-shifting-odds-for-uk-bookmakers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shifting+odds+for+UK+bookmakers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-equities-shifting-odds-for-uk-bookmakers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}