Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 12, 2015

Spanish economy records strong start to third quarter

The Spanish economy is proving to be one of the leading lights in the eurozone recovery story this year, with the upturn acting as a magnet for investment flows. Growth surged during the second quarter, and PMI survey data suggest the growth spurt has continued into the third quarter. Exchange-traded funds have seen a resumption of inflows in August as investors seek to benefit from increased exposure to the recovery.

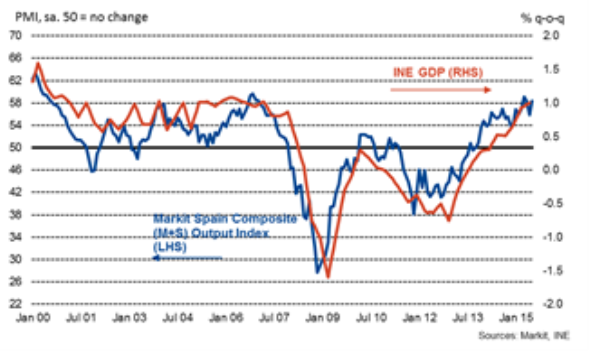

The recently announced 1.0% second quarter rise in gross domestic product (+3.1% year-on-year) was in line with the indications of strong growth from the PMI data during the three months to June, with the composite PMI averaging its highest since the first quarter of 2007. Furthermore, the July PMI data signalled an acceleration in the rate of growth since June on the back of a sharp rise in new work.

Spanish GDP v PMI

The PMI data cover the manufacturing and service sectors, and it was the latter that drove the overall expansion in July. Services activity rose at the fastest pace in three months on the back of improving economic conditions. On the other hand, growth of manufacturing production eased to the weakest since September 2014 amid the weakest rise in new orders in 17 months.

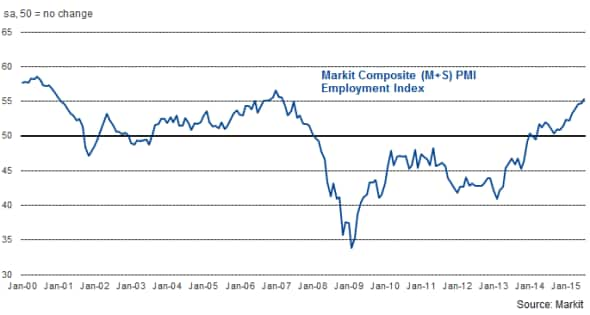

Employment growth accelerates further

Despite a weaker rise in output at manufacturers, the rate of job creation in the sector picked up in July, suggesting that the slowdowns in growth of output and new orders may have been only temporary. This, alongside a faster increase in services staffing levels, led to the strongest rise in overall employment since March 2007.

Composite PMI Employment Index

In fact, the overall rate of job creation has now accelerated in each of the past five months, in a sign of how increasingly willing companies have been to take on extra staff as client demand improves. The positive PMI data on the labour market have been supported by official numbers, with employment up over 400,000 in the second quarter alone and the unemployment rate at its lowest since the third quarter of 2011.

That said, at 22.4% the rate of unemployment remains elevated and there are concerns that rises in employment are often through the use of temporary contracts, which are more easily terminated should the current improvements in business conditions falter.

Change in employment by type of contract

Short-term outlook brightens

The strength of business sentiment among service providers suggests that they are optimistic that the current improvements in economic conditions will continue in the coming months at least. Optimism strengthened in July, with more than half of all firms responding to the PMI survey forecasting higher activity over the coming year.

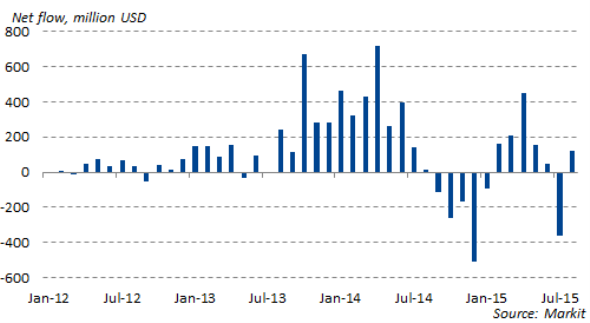

Investor sentiment also looks to be improving, according to Markit data on exchange-traded products. Funds exposed to Spain have recorded net inflows so far in August. If this continues for the rest of the month then it will mark the sixth time in the past seven months that a net inflow into these funds has been recorded.

Funds exposed to Spain see net inflows in August

The only fall during this period was in July, when the Greek crisis came to a head. Weekly data show a strong outflow of money around the time of the Greek referendum and subsequent negotiations with creditors.

Large outflows as Greek crisis came to a head

These data highlight not only that investor sentiment is generally favourable, but also that there are risks going forward. The key risk seems to be political uncertainty, both in the eurozone and domestically as the general election draws closer. The election must be held before the end of the year and there is the possibility that no single party will be able to form an overall majority. This political uncertainty has the potential to blow the recovery off course. For now though, the outlook appears bright and we'd expect to see a further strong performance in the economy during the third quarter of the year.

PMI data for August will be released at the start of September - with manufacturing on the 1st and services on the 3rd - providing the next update on the health of the economy in the third quarter.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-economics-spanish-economy-records-strong-start-to-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-economics-spanish-economy-records-strong-start-to-third-quarter.html&text=Spanish+economy+records+strong+start+to+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-economics-spanish-economy-records-strong-start-to-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Spanish economy records strong start to third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-economics-spanish-economy-records-strong-start-to-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spanish+economy+records+strong+start+to+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-economics-spanish-economy-records-strong-start-to-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}