Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 12, 2017

Buoyant French survey data provide encouraging contrast to gloomier GDP figures

France's new President, Emmanuel Macron, will inherit an economy that is enjoying its best growth spell for at least six years, with survey data revealing a broad-based array of positive indicators.

Anecdotal evidence from the surveys suggests that some of the upturn has been attributable to the prospect of a more business-friendly administration. The data will need to be watched for signs of such optimism and confidence being sustained as Macron seeks to form a working government that can successfully enact his proposed reforms.

In this note we provide more insight into signals from surveys and how they relate to official economic data.

Economic growth revival?

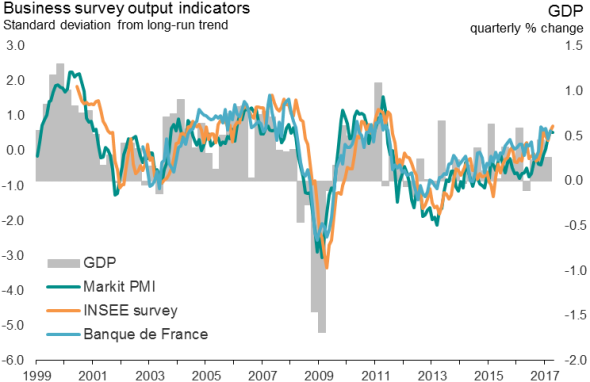

Surveys v quarterly GDP growth rate

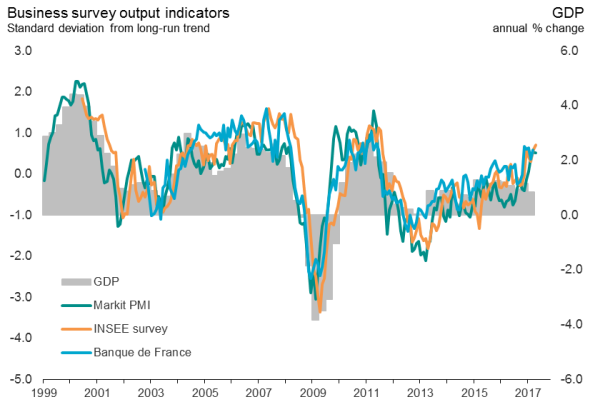

Surveys v annual GDP growth rate

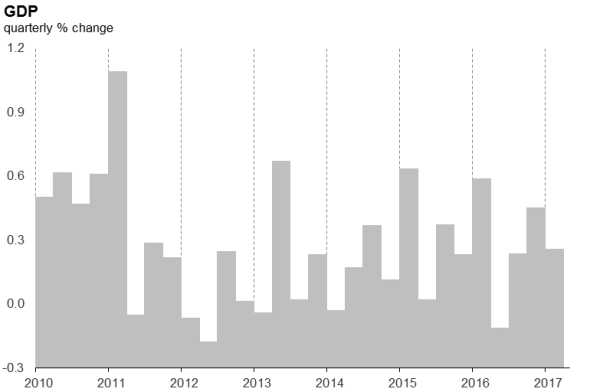

Economic growth accelerating

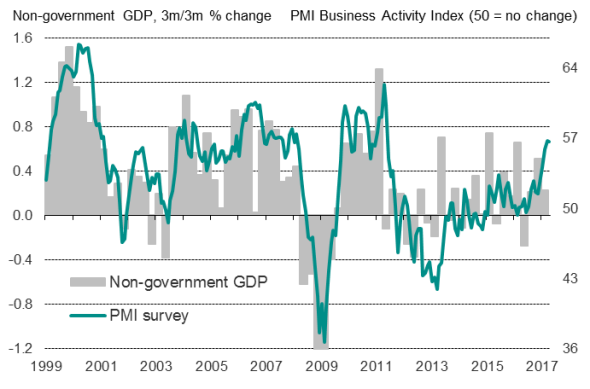

A variety of survey data are pointing to stronger economic growth so far this year, contrasting with official data. Growth of gross domestic product slowed to 0.3% in the first quarter of 2017, according to official statistics body INSEE, down from 0.5% in the fourth quarter of 2016. That was below the signal from the PMI and other business surveys. For example, at 55.6, the average PMI output index reading for the first three months of 2017 was indicative of 0.5% growth, based on simple historical comparisons.

A number of factors may explain the GDP and survey data divergence:

First, GDP data have been volatile in recent years. Charting the quarterly changes in the data highlight how difficult it is to identify any trend in the official statistics.

Comparable data on output from the manufacturing and service economies from IHS Markit, INSEE and the Banque de France have all diverged from the volatile official GDP data in recent years to a greater extent than prior to the global financial crisis. It is therefore important not to read too much into the slowing of GDP growth signalled in the first quarter.

Second, there's an important element of timing. The initial GDP estimates are typically also based only on partial data for the quarter, and notably tend to incorporate little information for the final month of the quarter. The PMI, in contrast, covers all three months, and March 2017 saw an especially strong PMI reading in France.

Here's where the picture become more encouraging. The French composite PMI readings for March and April are consistent with GDP expanding by 0.6%, according to historical comparisons. This suggests that the stage is set for a solid GDP reading for the second quarter, assuming momentum is at least maintained into May.

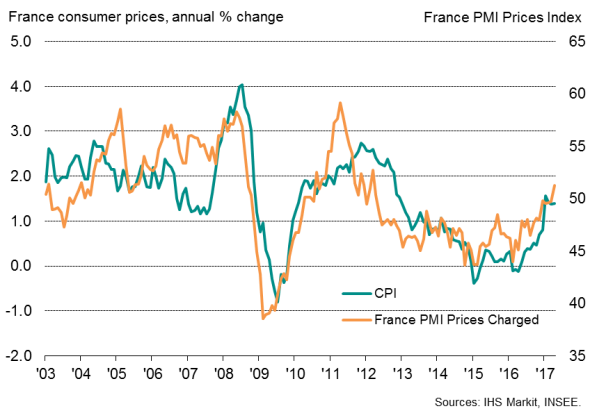

Prices rise for first time in five years

A further sign of the returning health of the French economy appeared in April, namely the first rise in average prices charged by companies seen for five years. Prices charged at the factory gate for manufactured goods rose at the fastest rate since mid-2011, but it was a near-steadying of prices levied by services sector companies that was perhaps more important.

While manufacturing prices tend to mainly reflect global commodity price trends (and the exchange rate), service sector prices are generally more influenced by the strength of domestic demand, both among businesses and households. Rates levied by French service sector firms have been falling continually since April 2012 as weak domestic demand has promoted on-going discounting. But April saw the smallest, only marginal, decline in service sector charges over this period, hinting at an improvement in home market demand.

Business activity

Inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052017-Economics-Buoyant-French-survey-data-provide-encouraging-contrast-to-gloomier-GDP-figures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052017-Economics-Buoyant-French-survey-data-provide-encouraging-contrast-to-gloomier-GDP-figures.html&text=Buoyant+French+survey+data+provide+encouraging+contrast+to+gloomier+GDP+figures","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052017-Economics-Buoyant-French-survey-data-provide-encouraging-contrast-to-gloomier-GDP-figures.html","enabled":true},{"name":"email","url":"?subject=Buoyant French survey data provide encouraging contrast to gloomier GDP figures&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052017-Economics-Buoyant-French-survey-data-provide-encouraging-contrast-to-gloomier-GDP-figures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Buoyant+French+survey+data+provide+encouraging+contrast+to+gloomier+GDP+figures http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052017-Economics-Buoyant-French-survey-data-provide-encouraging-contrast-to-gloomier-GDP-figures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}