Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 12, 2016

Week Ahead Economic Overview

US inflation and industrial production numbers are likely to add to the policy debate at the Fed, while the Bank of Japan will be scrutinising first quarter GDP results, after it decided to hold off from introducing more stimulus at its April meeting. Updated labour market, inflation and retail sales data are meanwhile out in the UK and the eurozone awaits the release of consumer price figures.

The Federal Reserve will continue watching the economic data flow in the US carefully in the weeks leading up to the next monetary policy meeting on 15th June. Both GDP and non-farm payroll results disappointed, and business survey data pointed to ongoing weak economic growth at the start of the second quarter. The release of consumer price and industrial production numbers will provide analysts and policy makers with more information on whether the US economy's first quarter malaise has spread into the second quarter.

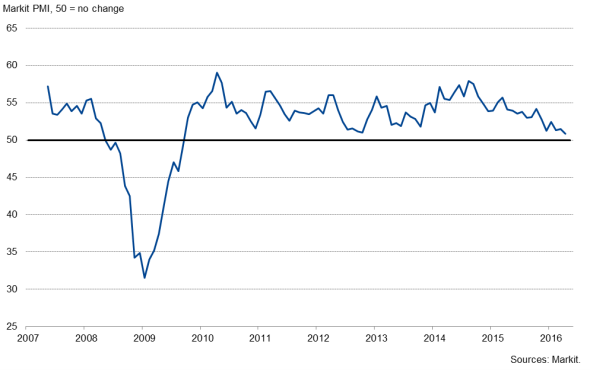

Recent economic data have pointed to the US manufacturing engine running out of steam. Markit's US Manufacturing PMI fell to its lowest level in over six-and-a-half years in April, with output stagnating and companies reluctant to take on additional staff. Official data are showing a similar trend. Industrial production fell in six out of the past seven months and, despite markets expecting a marginal 0.2% rise in April, it looks as if the sector is struggling under the weight of business uncertainty in relation to both the economic and political outlook. Ongoing weakness in the official data would add to the case of delaying the next rate hike until later in the year.

Updated consumer price numbers are also likely to add to the policy debate. The rate of inflation stood at 0.9% in March, remaining well below the Fed's target of 2%. In a statement following April's monetary policy meeting the Fed said it would "carefully monitor actual and expected progress toward its inflation goal" as it weighed when next to raise rates. Markets are expecting a slight uptick to 1.0%.

Markit US Manufacturing PMI

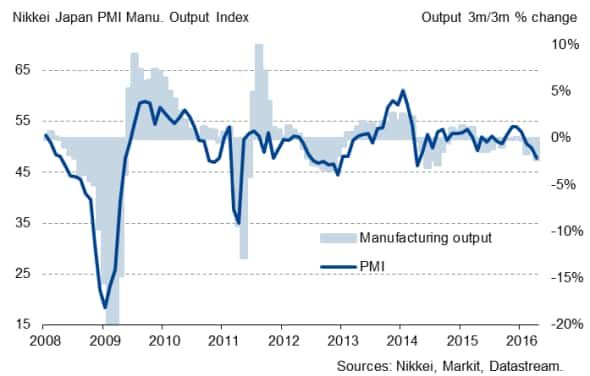

Over in Japan, policy makers will be eagerly awaiting preliminary first quarter GDP results, after the Bank of Japan decided to hold off from further stimulus when it met in April. Economists polled by Thomson Reuters expect a stabilisation of the Japanese economy, after GDP fell in the closing quarter of last year. Any growth will be marginal, however, and a return to recession cannot be ruled out. Latest Nikkei PMI results point to a renewed downturn at the start of the second quarter.

A day before Japan's GDP data are issued, industrial production numbers for March are published. A preliminary estimate showed industrial output surging 3.6%, but the monthly data are highly volatile and the business survey results have signalled the steepest decline in the sector's performance for over three years in April.

Japanese manufacturing Output and the PMI

First quarter GDP results are also out in Russia and are likely to show that the economy continued to shrink in the first three months of 2016, although at a slower pace than at the end of last year. The Russian Central Bank expects a decline of 2% y/y for the first quarter and the IMF predicts Russia's GDP to contract by 1.8% over 2016 as a whole. Recent PMI results signalled a slight pick-up in economic activity in April.

The Bank of England will meanwhile keep an eye on updated labour market results in the UK. Although the unemployment rate has been running at its lowest in a decade in recent months, the actual number of unemployed rose for the first time since July 2015 in February and recent PMI results signalled that hiring hit a 2"-year low in April. Moreover, signs of a slowing economy and uncertainty around Britain's EU referendum appear to have resulted in a shift in emphasis from permanent to temporary hiring among UK employers. The labour market may therefore be set to cool further in coming months.

UK unemployment rate

Latest UK retail sales numbers will meanwhile provide analysts with information on how uncertainty around the EU referendum is affecting consumers. Moreover, updated inflation numbers are released by the Office for National Statistics on Tuesday, after the CPI measure rose to 0.5%, it's highest level since December 2014. Nevertheless, the Bank of England expects inflation to stay below 1.0% in 2016.

Markets will also be awaiting inflation numbers for the eurozone, released by Eurostat on Wednesday. Following April's monetary policy meeting, ECB boss Draghi warned that eurozone inflation could turn negative again this year and it looks likely that Wednesday's numbers will confirm this assumption, with markets pencilling in a 0.2% drop in consumer prices.

Monday 16 May

Wholesale price inflation numbers are published in India.

Preliminary first quarter GDP results are released in Russia.

The results of the latest NY Empire State Manufacturing Index are issued.

Tuesday 17 May

Industrial production figures are issued by the Japanese Ministry of Economy, Trade and Industry.

Eurostat releases latest trade data for the currency union.

The UK sees the publication of latest inflation numbers.

Manufacturing sales figures are updated in Canada.

Building permits and housing starts numbers are released in the US alongside earnings, inflation and industrial production updates.

Wednesday 18 May

In Australia, wage inflation numbers are published.

Japan sees the release of preliminary first quarter GDP results.

House price information are updated in China.

Meanwhile, industrial production figures are issued in Russia.

Inflation data are out in Nigeria and South Africa, with the latter also seeing the publication of retail sales numbers.

In the eurozone, consumer price numbers are updated by Eurostat.

The Office for National Statistics issues latest labour market data, while Markit releases its latest UK Household Finance Index.

Mortgage application figures are out in the US.

Thursday 19 May

Australia sees the release of unemployment figures.

Machinery orders and capital flows data are out in Japan.

The South African Reserve Bank announces its latest monetary policy decision.

Eurostat issues construction output figures while the ECB releases an update on its monthly balance of payments

ILO unemployment numbers are published in France.

Meanwhile, retail sales figures are updated in the UK.

In Canada, wholesale trade data are issued.

Initial jobless claims numbers are updated in the US.

Friday 20 May

In Russia, producer price numbers are updated.

Current account data are published in the eurozone.

Meanwhile, Germany sees the release of producer price figures.

The latest UK House Price Sentiment Index is issued by Knight Frank and Markit. Moreover, the Office for National Statistics releases an article providing the final GDP current price and chained volume measure annual estimates for the period 1997-2014.

Inflation and retail sales numbers are out in Canada.

The OECD releases a statistics update on GDP growth.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}